3+ Underwriting Assistant Resume Examples and Templates

This page provides you with Underwriting Assistant resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Underwriting Assistant resume.

What do Hiring Managers look for in an Underwriting Assistant Resume

- Attention to Detail: Meticulous attention to detail in reviewing and analyzing insurance applications and related documents.

- Analytical Skills: Strong analytical abilities to assess risk factors, gather and evaluate data, and make informed underwriting decisions.

- Communication Skills: Effective written and verbal communication for interacting with underwriters, clients, and stakeholders.

- Organizational Skills: Proficiency in managing and organizing underwriting documents, records, and policies.

- Adaptability: Willingness to adapt to changing underwriting guidelines, regulations, and industry trends.

How to Write an Underwriting Assistant Resume?

To write a professional Underwriting Assistant resume, follow these steps:

- Select the right Underwriting Assistant resume template.

- Write a professional summary at the top explaining your Underwriting Assistant’s experience and achievements.

- Follow the STAR method while writing your Underwriting Assistant resume’s work experience. Show what you were responsible for and what you achieved as an Underwriting Assistant.

- List your top Underwriting Assistant skills in a separate skills section.

How to Write Your Underwriting Assistant Resume Header?

Write the perfect Underwriting Assistant resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Underwriting Assistant position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Underwriting Assistant resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Underwriting Assistant Resume Example - Header Section

Lillian 19 Adams Street Lorain, OH 44052 Marital Status: Married, email: cooldude2022@gmail.com

Good Underwriting Assistant Resume Example - Header Section

Lillian Flynn, Lorain, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Underwriting Assistant email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Underwriting Assistant Resume Summary?

Use this template to write the best Underwriting Assistant resume summary: Underwriting Assistant with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Underwriting Assistant Resume Experience Section?

Here’s how you can write a job winning Underwriting Assistant resume experience section:

- Write your Underwriting Assistant work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Underwriting Assistant work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Underwriting Assistant).

- Use action verbs in your bullet points.

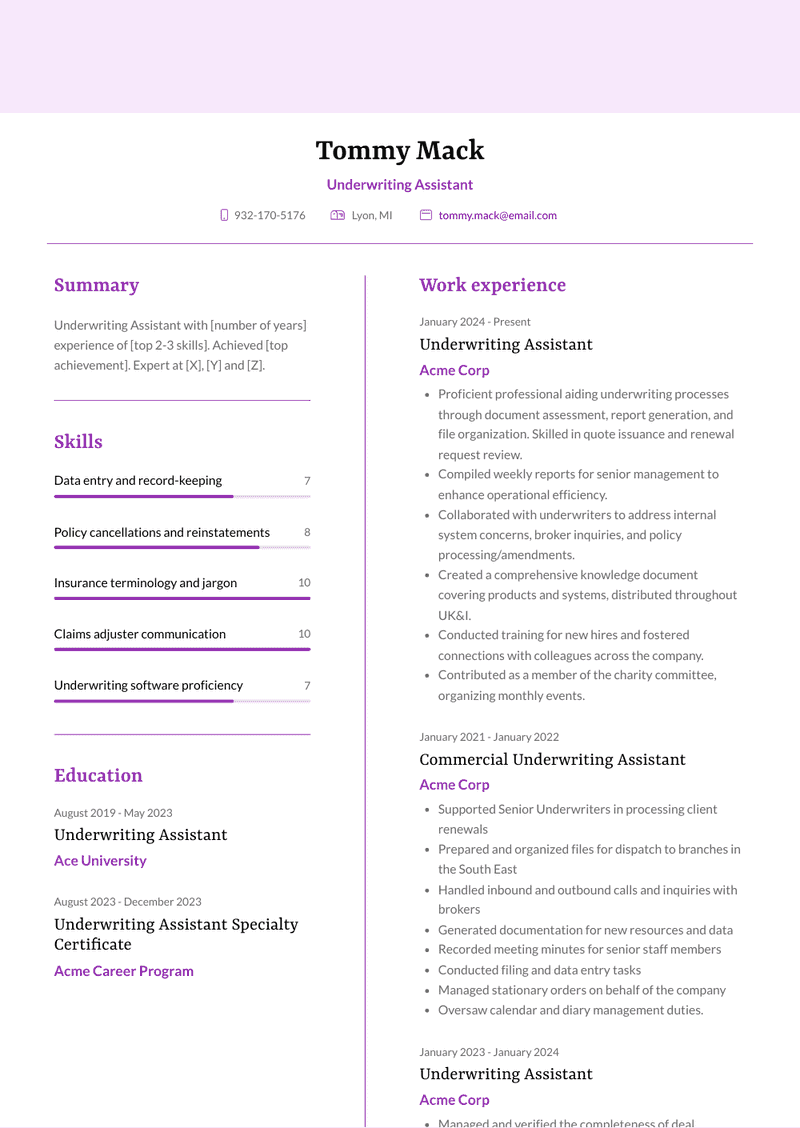

Underwriting Assistant Resume Example

Underwriting Assistant

- Proficient professional aiding underwriting processes through document assessment, report generation, and file organization. Skilled in quote issuance and renewal request review.

- Compiled weekly reports for senior management to enhance operational efficiency.

- Collaborated with underwriters to address internal system concerns, broker inquiries, and policy processing/amendments.

- Created a comprehensive knowledge document covering products and systems, distributed throughout UK&I.

- Conducted training for new hires and fostered connections with colleagues across the company.

- Contributed as a member of the charity committee, organizing monthly events.

Underwriting Assistant Resume Example

Underwriting Assistant

- Managed and verified the completeness of deal documentation and data, overseeing deal folders

- Recorded and maintained data in the portfolio management system, ensuring completeness for reporting deadlines

- Entered Exposure data into the Exposure tool

- Participated in client meetings and documented meeting minutes

Underwriting Assistant Resume Example

Underwriting Assistant

- Conducted policy underwriting for various insurance types (Fire, Health, PA, CPM, & Motor) within the underwriting hub.

- Provided services to existing clients, including claim processing and policy endorsements.

- Managed cover note control and coordinated with the Accounts department for BRS and other inquiries.

- Addressed agent, franchisee, and client inquiries and resolved issues.

- Handled franchisees and agents of the company, including quotation generation, negotiations, and prompt handling of endorsements and claims.

Commercial Underwriting Assistant Resume Example

Commercial Underwriting Assistant

- Supported Senior Underwriters in processing client renewals

- Prepared and organized files for dispatch to branches in the South East

- Handled inbound and outbound calls and inquiries with brokers

- Generated documentation for new resources and data

- Recorded meeting minutes for senior staff members

- Conducted filing and data entry tasks

- Managed stationary orders on behalf of the company

- Oversaw calendar and diary management duties.

Top Underwriting Assistant Resume Skills for 2023

- Insurance underwriting principles

- Policy issuance and documentation

- Risk assessment and analysis

- Underwriting guidelines and criteria

- Underwriting software proficiency

- Policy rating and pricing

- Policy endorsement processing

- Customer and agent communication

- New business submissions

- Renewal policy reviews

- Policy cancellations and reinstatements

- Loss control and risk management

- Underwriting file maintenance

- Policy audits and compliance

- Data entry and record-keeping

- Policy coverage analysis

- Insurance policy forms and endorsements

- Policy premium calculations

- Reinsurance principles

- Claims processing and investigation

- Loss ratio analysis

- Regulatory compliance (e.g., insurance laws)

- Insurance fraud detection

- Insurance software systems (e.g., underwriting tools)

- Quote generation and analysis

- Claims coordination with underwriting

- Claims adjuster communication

- Insurance terminology and jargon

- Insurance industry trends and updates

- Presentation and communication skills

- Data analysis and interpretation

- Problem-solving abilities

- Time management and organization

- Adaptability and flexibility

- Decision-making skills

- Attention to detail

- Collaboration with cross-functional teams

- Customer service excellence

- Insurance policy research

- Insurance company guidelines and procedures

- Policy issuance quality control

- Insurance risk assessment tools

- Insurance policy documentation software

- Claims settlement processes

- Customer and agent training and support

- Insurance coverage verification

- Claims coding and classification

- Policyholder billing and collections

- Insurance policy endorsements management

- Insurance policy review and analysis

How Long Should my Underwriting Assistant Resume be?

Your Underwriting Assistant resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Underwriting Assistant, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Underwriting Assistant Resume

-

What does an Underwriting Assistant do?

- An Underwriting Assistant provides support to underwriters in the insurance industry by gathering and analyzing data, processing insurance applications, preparing documentation, and assisting with risk assessment. They play a crucial role in ensuring the accuracy and efficiency of the underwriting process.

-

What qualifications are important for an Underwriting Assistant position?

- Qualifications typically include a high school diploma or equivalent, although some employers may prefer candidates with an associate's or bachelor's degree in business, finance, or a related field. Strong analytical skills, attention to detail, proficiency in computer software, and knowledge of insurance principles are essential.

-

What kind of experience should an Underwriting Assistant highlight on their resume?

- Experience in administrative support, data entry, or insurance-related roles is beneficial for an Underwriting Assistant. Highlighting proficiency in processing insurance applications, conducting policy reviews, and assisting with risk assessments can demonstrate relevant experience.

-

How important is it for an Underwriting Assistant to demonstrate attention to detail on their resume?

- Attention to detail is vital for an Underwriting Assistant as they are responsible for accurately processing insurance applications and ensuring that policies comply with underwriting guidelines. Highlighting experience in reviewing documents, verifying information, and identifying discrepancies can demonstrate strong attention to detail.

-

Should an Underwriting Assistant include their experience with insurance software on their resume?

- Yes, mentioning experience with insurance software such as policy management systems, underwriting platforms, or Microsoft Excel can demonstrate the Assistant's ability to efficiently manage data, generate reports, and navigate insurance databases.

-

What soft skills are important for an Underwriting Assistant to highlight on their resume?

- Soft skills such as communication, teamwork, problem-solving, organization, and time management are crucial for an Underwriting Assistant. These skills contribute to effectively communicating with clients, collaborating with underwriters, and managing multiple tasks efficiently.

-

Is it necessary for an Underwriting Assistant to mention their experience with customer service on their resume?

- Yes, mentioning experience with customer service tasks such as answering inquiries, resolving issues, and providing assistance to clients can demonstrate the Assistant's ability to deliver excellent customer service and support the underwriting process.

-

How should an Underwriting Assistant tailor their resume for different insurance lines or underwriting specialties?

- An Underwriting Assistant should highlight experience and skills relevant to the specific insurance lines or underwriting specialties they have worked with, whether it's property and casualty, life and health, commercial insurance, or specialty lines. Emphasizing familiarity with industry-specific terminology, regulations, and underwriting criteria can be beneficial.

-

Should an Underwriting Assistant include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework related to business, finance, or insurance is important. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can an Underwriting Assistant make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful underwriting support projects, any relevant certifications or awards, or extracurricular involvement can enhance the overall presentation of the resume.

Copyright ©2025 Workstory Inc.