3+ Trader Resume Examples and Templates

This page provides you with Trader resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Trader resume.

How to Write a Trader Resume?

To write a professional Trader resume, follow these steps:

- Select the right Trader resume template.

- Write a professional summary at the top explaining your Trader’s experience and achievements.

- Follow the STAR method while writing your Trader resume’s work experience. Show what you were responsible for and what you achieved as a Trader.

- List your top Trader skills in a separate skills section.

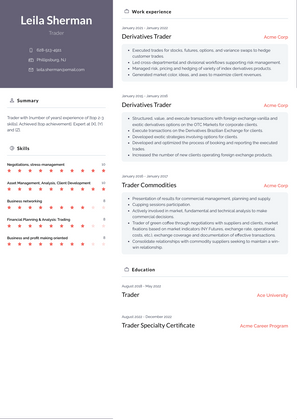

How to Write Your Trader Resume Header?

Write the perfect Trader resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Trader to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Trader resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Trader Resume Example - Header Section

Mylee 167 Hamilton Drive Phillipsburg, NJ 08865 Marital Status: Married, email: cooldude2022@gmail.com

Good Trader Resume Example - Header Section

Mylee Walters, Phillipsburg, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Trader email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Trader Resume Summary?

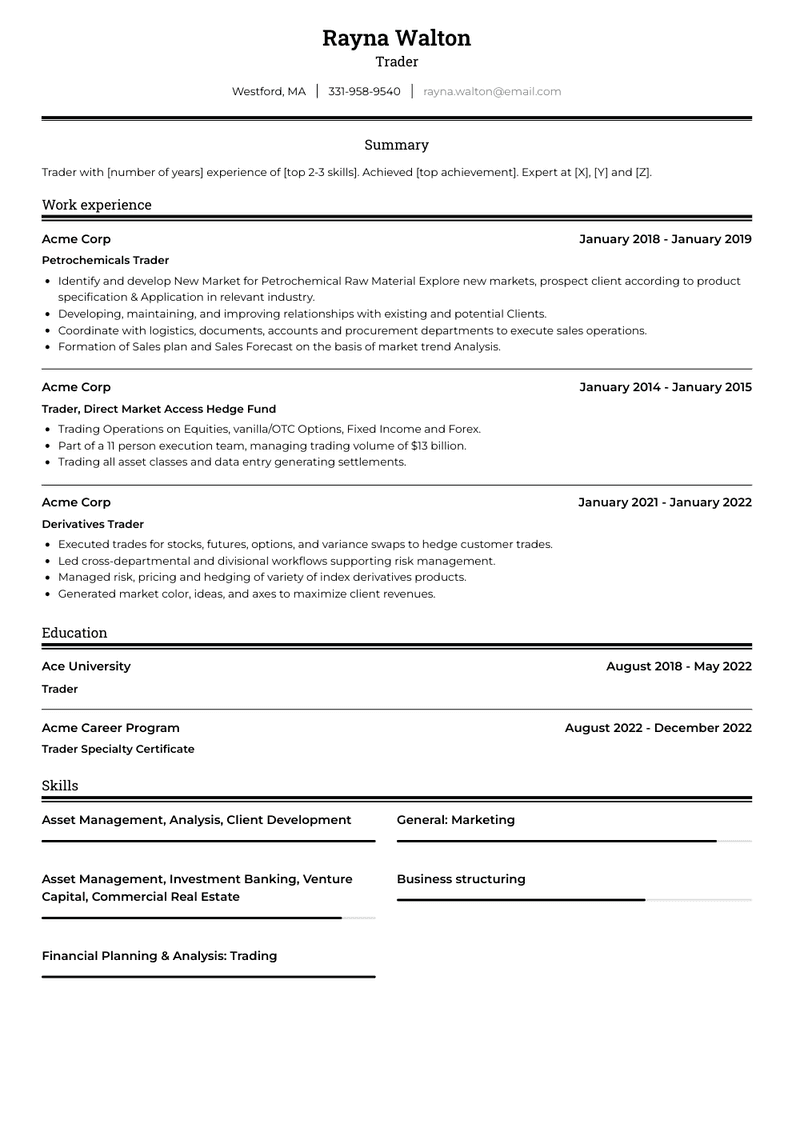

Use this template to write the best Trader resume summary: Trader with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Trader Resume Experience Section?

Here’s how you can write a job winning Trader resume experience section:

- Write your Trader work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Trader work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Trader).

- Use action verbs in your bullet points.

Cryptocurrency trader Resume Example

Cryptocurrency trader

- Market Indicators

- Capital Management

- Technical Analysis

- Technical Models

Junior Trader Resume Example

Junior Trader

- Sales support in the Japanese, Australian, Eastern European regions.

- Collecting market and pricing information from the South African, Australian, and Japanese regions.

- Acquisition of 72 potential customers at important Asian fairs (Tokyo Pack, ProPak Asia, AUSPACK, Packaging Innovations Tokyo) and through cold calls in the African, Australian and Japanese regions.

- Since February 2020 developing from zero the African customer base, individuating over 305k AUD of PP consumption from medium and large accounts only.

Derivatives Trader Resume Example

Derivatives Trader

- Executed trades for stocks, futures, options, and variance swaps to hedge customer trades.

- Led cross-departmental and divisional workflows supporting risk management.

- Managed risk, pricing and hedging of variety of index derivatives products.

- Generated market color, ideas, and axes to maximize client revenues.

Virtual Assets Trader Resume Example

Virtual Assets Trader

- Buying/Selling Non-Fungible Tokens (NFT)

- Virtual Assistant

- Trading Digital Currency

Proprietary Equity Trader Resume Example

Proprietary Equity Trader

- Executes trades, performs risk management, and daily cost/profit analysis.

- Performs portfolio management of various financial derivatives- fixed-income securities and special purpose acquisition companies.

- Market researches of different trading strategies and their implementation in intraday trading routines.

Petrochemicals Trader Resume Example

Petrochemicals Trader

- Identify and develop New Market for Petrochemical Raw Material Explore new markets, prospect client according to product specification & Application in relevant industry.

- Developing, maintaining, and improving relationships with existing and potential Clients.

- Coordinate with logistics, documents, accounts and procurement departments to execute sales operations.

- Formation of Sales plan and Sales Forecast on the basis of market trend Analysis.

Trader Resume Example

Trader

- Executing trades by orders

- Maintaining quality relationships with clients

- Researching and analyzing materials in trading area

Trader Commodities Resume Example

Trader Commodities

- Presentation of results for commercial management, planning and supply.

- Cupping sessions participation.

- Actively involved in market, fundamental and technical analysis to make commercial decisions.

- Trader of green coffee through negotiations with suppliers and clients, market fixations based on market indicators (NY Futures, exchange rate, operational costs, etc.), exchange coverage and documentation of effective transactions.

- Consolidate relationships with commodity suppliers seeking to maintain a win-win relationship.

Derivatives Trader Resume Example

Derivatives Trader

- Structured, value, and execute transactions with foreign exchange vanilla and exotic derivatives options on the OTC Markets for corporate clients.

- Execute transactions on the Derivatives Brazilian Exchange for clients.

- Developed exotic strategies involving options for clients.

- Developed and optimized the process of booking and reporting the executed trades.

- Increased the number of new clients operating foreign exchange products.

Trader, Direct Market Access Hedge Fund Resume Example

Trader, Direct Market Access Hedge Fund

- Trading Operations on Equities, vanilla/OTC Options, Fixed Income and Forex.

- Part of a 11 person execution team, managing trading volume of $13 billion.

- Trading all asset classes and data entry generating settlements.

Top Trader Resume Skills for 2023

- Market analysis

- Technical analysis

- Fundamental analysis

- Quantitative analysis

- Risk management

- Trading strategies development

- Algorithmic trading

- High-frequency trading

- Options trading

- Futures trading

- Foreign exchange (Forex) trading

- Equity trading

- Commodity trading

- Cryptocurrency trading

- Derivatives trading

- Arbitrage

- Portfolio management

- Position sizing

- Stop-loss management

- Trade execution

- Order types (market orders, limit orders, stop orders)

- Order routing

- Trading platform usage

- Trading software (e.g., Bloomberg Terminal, Thinkorswim)

- Risk assessment

- Volatility analysis

- Correlation analysis

- Economic indicators interpretation

- Financial statement analysis

- Time series analysis

- Chart patterns recognition

- Candlestick patterns recognition

- Trading psychology

- Emotional control

- Discipline

- Patience

- Quick decision-making

- Reaction time

- Adaptability to market conditions

- Stress management

- Backtesting strategies

- Performance evaluation

- Market research

- News analysis

- Market sentiment analysis

- Liquidity analysis

- Trade journaling

- Continuous learning and self-improvement

- Networking with other traders

- Compliance with regulations and laws

How Long Should my Trader Resume be?

Your Trader resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Trader, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as a Trader on my resume?

To highlight your experience as a Trader, focus on your ability to analyze market trends, execute trades, and manage risk effectively. Detail your expertise in specific markets, such as equities, commodities, or foreign exchange, and any significant trading strategies you have successfully employed. Mention your proficiency with trading platforms and analytical tools, and include examples of successful trades or campaigns that have significantly benefited your firm's financial position.

What are the key skills to feature on a Trader's resume?

Key skills to feature on a Trader's resume include market analysis, risk management, quantitative skills, and decision-making under pressure. Additionally, highlight your proficiency in using trading software, your ability to adapt to rapidly changing conditions, and your understanding of financial regulations and compliance issues.

How do I demonstrate my ability to manage risk on my resume?

Demonstrate your ability to manage risk by detailing your experience in developing and implementing risk management strategies that protect assets and optimize financial performance. Mention specific techniques you use, such as stop-loss orders, diversification strategies, or derivatives to hedge positions. Provide examples where your risk management approach prevented significant losses or maximized gains during volatile market periods.

Should I include metrics on my Trader resume? If so, what kind?

Yes, including metrics on your Trader resume can be very beneficial. For example, you could mention the percentage increase in portfolio value you managed, the volume of trades executed, or the profit margin achieved. Metrics that demonstrate your effectiveness in generating revenue and managing financial risk are particularly impactful.

How can I showcase my experience with different trading instruments on my resume?

Showcase your experience with different trading instruments by detailing the range of assets you have traded, such as stocks, bonds, options, or futures. Discuss your knowledge of the characteristics and market behaviors of each type of instrument and how you leverage this knowledge to make profitable decisions.

What kind of achievements should I highlight as a Trader?

Highlight achievements such as consistently exceeding profit targets, significantly reducing risk exposure, or developing a trading strategy that outperformed market benchmarks. You could also mention any industry recognition you have received for your trading skills or contributions to your firm's market position.

How do I address a lack of experience in a particular market on my resume?

If you lack experience in a particular market, focus on transferable skills such as your analytical abilities, understanding of economic indicators, and quick decision-making skills. Mention any related experience or training that demonstrates your ability to learn and succeed in new trading environments.

How important is technological proficiency for a Trader role?

Technological proficiency is extremely important for a Trader, as modern trading heavily relies on software and algorithms. Highlight your experience with electronic trading platforms, algorithmic trading, and data analysis tools. Mention any specific software you are proficient in, which can include Bloomberg, MetaTrader, or custom trading algorithms.

How do I demonstrate my ability to make quick decisions on my resume?

Demonstrate your ability to make quick decisions by providing examples where your prompt action led to significant financial gains or avoided losses. Mention situations where you analyzed fast-moving market data and made trading decisions that capitalized on short-term market trends or reacted to unexpected events.

Should I include certifications on my Trader resume?

Including relevant certifications can enhance your resume by demonstrating your commitment to professional development and expertise in specific areas of trading. Certifications such as the Chartered Financial Analyst (CFA) or Certified Market Technician (CMT) can add value, showing that you have advanced knowledge of financial markets and investment analysis.

-

How do I demonstrate my ability to manage risk on my resume?

-

Should I include metrics on my Trader resume? If so, what kind?

-

How can I showcase my experience with different trading instruments on my resume?

-

How do I address a lack of experience in a particular market on my resume?

-

How important is technological proficiency for a Trader role?

-

How do I demonstrate my ability to make quick decisions on my resume?

Copyright ©2025 Workstory Inc.