Teller Supervisor Resume Examples and Templates

This page provides you with Teller Supervisor resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Teller Supervisor resume.

What do Hiring Managers look for in a Teller Supervisor Resume

- Leadership Skills: Ability to lead and motivate a team of tellers, providing guidance, support, and direction to ensure efficient and effective operations.

- Customer Service Orientation: Commitment to delivering excellent customer service, resolving inquiries and concerns promptly, and fostering positive relationships with clients.

- Cash Handling Expertise: Proficiency in managing cash transactions, balancing cash drawers, and ensuring accuracy and compliance with banking regulations.

- Problem-Solving Abilities: Capability to address complex customer issues, resolve disputes, and handle escalated situations with professionalism and diplomacy.

- Attention to Detail: Meticulousness in reviewing transactions, verifying account information, and maintaining accurate records and documentation.

How to Write a Teller Supervisor Resume?

To write a professional Teller Supervisor resume, follow these steps:

- Select the right Teller Supervisor resume template.

- Write a professional summary at the top explaining your Teller Supervisor’s experience and achievements.

- Follow the STAR method while writing your Teller Supervisor resume’s work experience. Show what you were responsible for and what you achieved as a Teller Supervisor.

- List your top Teller Supervisor skills in a separate skills section.

How to Write Your Teller Supervisor Resume Header?

Write the perfect Teller Supervisor resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Teller Supervisor position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Teller Supervisor resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Teller Supervisor Resume Example - Header Section

Mylee 9 W. Wakehurst St. Mount Vernon, NY 10550 Marital Status: Married, email: cooldude2022@gmail.com

Good Teller Supervisor Resume Example - Header Section

Mylee Walters, Mount Vernon, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Teller Supervisor email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Teller Supervisor Resume Summary?

Use this template to write the best Teller Supervisor resume summary: Teller Supervisor with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Teller Supervisor Resume Experience Section?

Here’s how you can write a job winning Teller Supervisor resume experience section:

- Write your Teller Supervisor work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Teller Supervisor work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Teller Supervisor).

- Use action verbs in your bullet points.

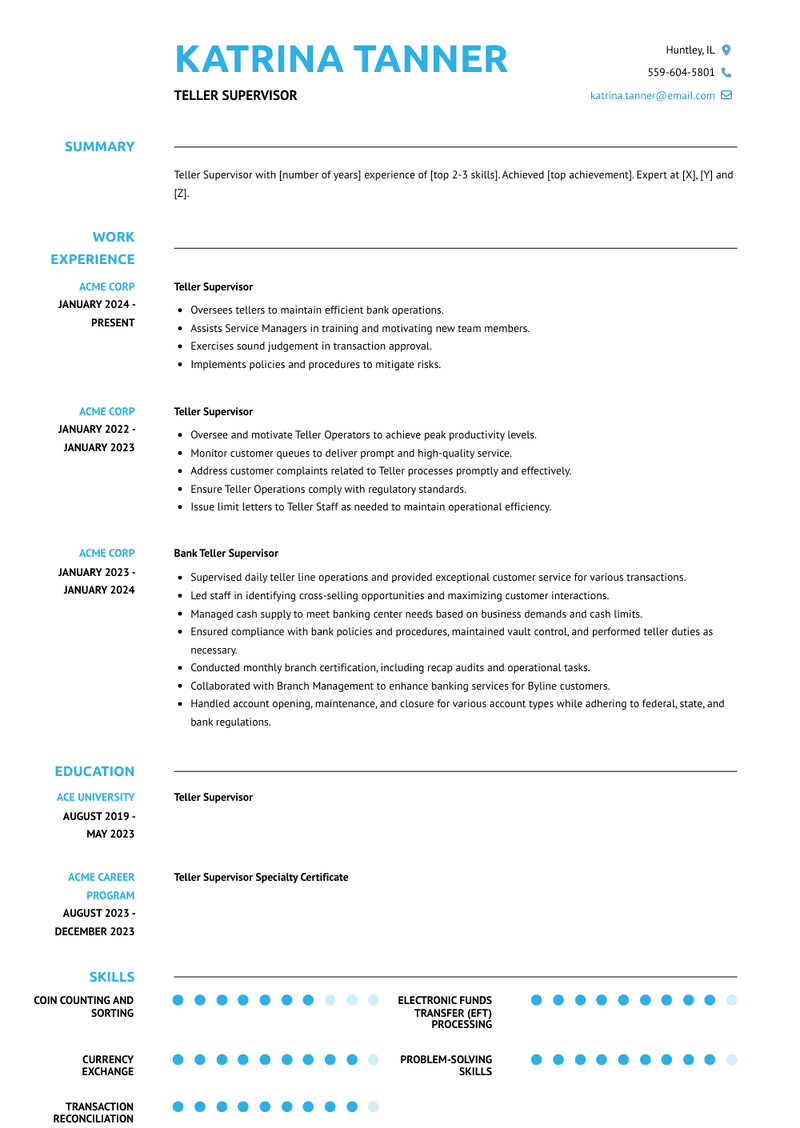

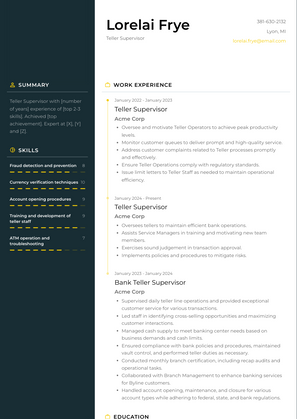

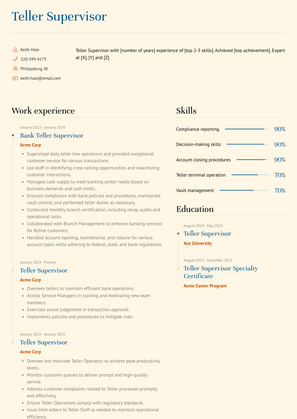

Teller Supervisor Resume Example

Teller Supervisor

- Oversees tellers to maintain efficient bank operations.

- Assists Service Managers in training and motivating new team members.

- Exercises sound judgement in transaction approval.

- Implements policies and procedures to mitigate risks.

Bank Teller Supervisor Resume Example

Bank Teller Supervisor

- Supervised daily teller line operations and provided exceptional customer service for various transactions.

- Led staff in identifying cross-selling opportunities and maximizing customer interactions.

- Managed cash supply to meet banking center needs based on business demands and cash limits.

- Ensured compliance with bank policies and procedures, maintained vault control, and performed teller duties as necessary.

- Conducted monthly branch certification, including recap audits and operational tasks.

- Collaborated with Branch Management to enhance banking services for Byline customers.

- Handled account opening, maintenance, and closure for various account types while adhering to federal, state, and bank regulations.

Teller Supervisor Resume Example

Teller Supervisor

- Oversee and motivate Teller Operators to achieve peak productivity levels.

- Monitor customer queues to deliver prompt and high-quality service.

- Address customer complaints related to Teller processes promptly and effectively.

- Ensure Teller Operations comply with regulatory standards.

- Issue limit letters to Teller Staff as needed to maintain operational efficiency.

Top Teller Supervisor Resume Skills for 2023

- Cash handling procedures

- Coin counting and sorting

- Currency verification techniques

- Check processing procedures

- Deposit verification

- Withdrawal processing

- Cash drawer balancing

- Vault management

- Currency exchange

- Transaction reconciliation

- Check cashing procedures

- Endorsement verification

- Customer account management

- Account verification

- Account opening procedures

- Account closing procedures

- Payment processing

- Transaction authorization

- Fraud detection and prevention

- Compliance with banking regulations

- Bank security protocols

- Cash management software proficiency

- Teller terminal operation

- ATM operation and troubleshooting

- Electronic funds transfer (EFT) processing

- Banking products knowledge (e.g., savings accounts, loans)

- Customer service skills

- Communication skills (verbal and written)

- Interpersonal skills

- Leadership skills

- Team management and supervision

- Training and development of teller staff

- Performance management

- Coaching and mentoring

- Conflict resolution skills

- Problem-solving skills

- Decision-making skills

- Time management

- Organization skills

- Attention to detail

- Adaptability to changing workloads

- Continuous learning and professional development in banking regulations and practices

- Customer satisfaction tracking and improvement

- Complaint resolution skills

- Sales skills (cross-selling banking products)

- Cash ordering and management

- Cash flow management

- Budget management

- Compliance reporting

- Risk management

How Long Should my Teller Supervisor Resume be?

Your Teller Supervisor resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Teller Supervisor, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.