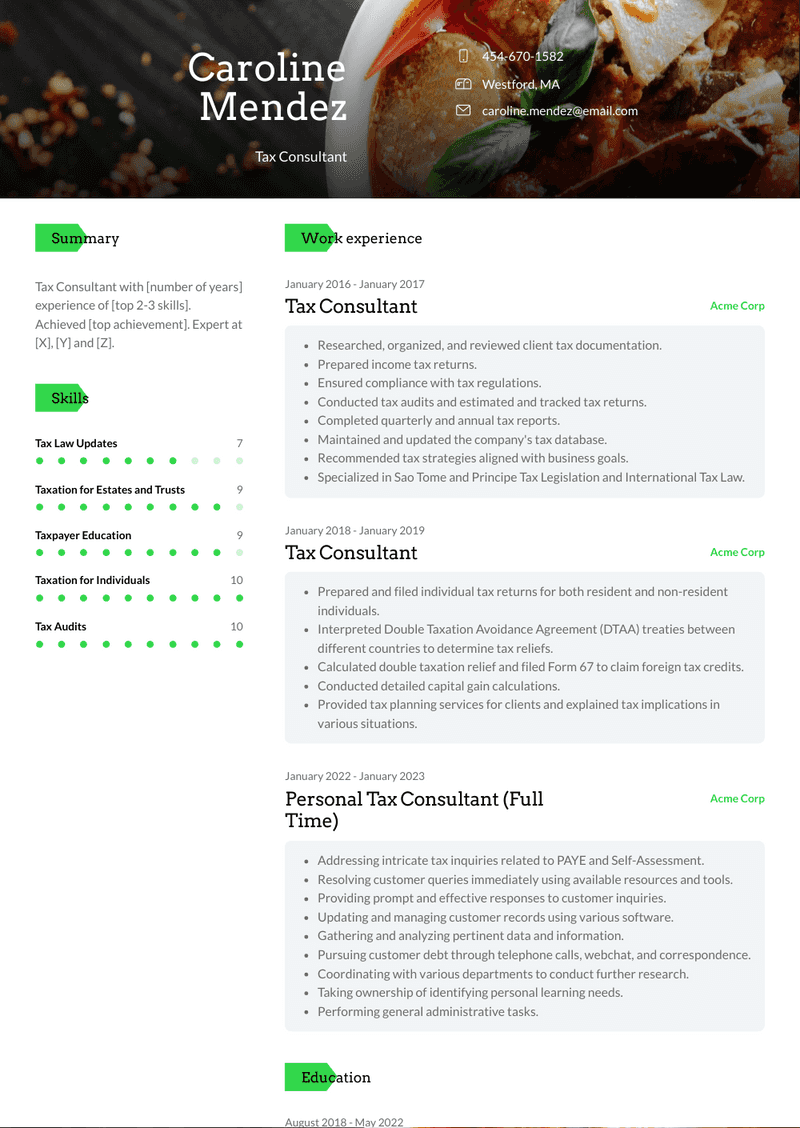

Tax Consultant Resume Examples and Templates

This page provides you with Tax Consultant resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Tax Consultant resume.

What do Hiring Managers look for in a Tax Consultant Resume

- Tax Expertise: In-depth knowledge of tax laws, regulations, and compliance requirements.

- Analytical Skills: Strong analytical abilities to review financial documents, identify tax-saving opportunities, and optimize tax strategies.

- Attention to Detail: Meticulousness in preparing and reviewing tax returns and ensuring accuracy in tax calculations.

- Client Communication: Effective communication and interpersonal skills to interact with clients, provide tax advice, and address tax-related inquiries.

- Ethical Conduct: Adherence to ethical standards and integrity in tax consulting to maintain compliance and trust with clients and authorities.

How to Write a Tax Consultant Resume?

To write a professional Tax Consultant resume, follow these steps:

- Select the right Tax Consultant resume template.

- Write a professional summary at the top explaining your Tax Consultant’s experience and achievements.

- Follow the STAR method while writing your Tax Consultant resume’s work experience. Show what you were responsible for and what you achieved as a Tax Consultant.

- List your top Tax Consultant skills in a separate skills section.

How to Write Your Tax Consultant Resume Header?

Write the perfect Tax Consultant resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Consultant position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Tax Consultant resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Tax Consultant Resume Example - Header Section

Mylee 7704 Clay St. Huntley, IL 60142 Marital Status: Married, email: cooldude2022@gmail.com

Good Tax Consultant Resume Example - Header Section

Mylee Walters, Huntley, IL, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Tax Consultant email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Tax Consultant Resume Summary?

Use this template to write the best Tax Consultant resume summary: Tax Consultant with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Tax Consultant Resume Experience Section?

Here’s how you can write a job winning Tax Consultant resume experience section:

- Write your Tax Consultant work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Tax Consultant work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Tax Consultant).

- Use action verbs in your bullet points.

Tax Consultant Resume Example

Tax Consultant

- Filed Income Tax Returns for individuals, firms, and private limited companies.

- Prepared documentation for scrutiny cases.

- Represented clients before Income Tax Officers (ITO).

- Generated opinions on tax-related matters.

- Advised clients on international tax issues and foreign remittances, including in-depth analysis of Double Taxation Avoidance Agreements (DTAA).

- Provided technical input for office newsletters.

Personal Tax Consultant (Full Time) Resume Example

Personal Tax Consultant (Full Time)

- Addressing intricate tax inquiries related to PAYE and Self-Assessment.

- Resolving customer queries immediately using available resources and tools.

- Providing prompt and effective responses to customer inquiries.

- Updating and managing customer records using various software.

- Gathering and analyzing pertinent data and information.

- Pursuing customer debt through telephone calls, webchat, and correspondence.

- Coordinating with various departments to conduct further research.

- Taking ownership of identifying personal learning needs.

- Performing general administrative tasks.

Senior Tax Consultant Resume Example

Senior Tax Consultant

- Providing Tax Compliance Services covering Corporate Income Tax, Value-Added Tax, Foreign Contractor Withholding Tax, Personal Income Tax, and other ad-hoc engagements.

- Offering ad-hoc advisory services, particularly in Organization’s Restructuring Tax Planning, Application of Tax Treaty, Investment Project Tax Planning, Vietnamese Regulations related to potential investment areas and fields for planning purposes, and more.

- Participating in various tax due diligence projects for significant M&A activities across a wide range of industries such as education, hospitality, agricultural processing, and retail.

- Specializing in Hospitality, Manufacturing and Trading, Resource, and Energy industries.

Junior Tax Consultant Resume Example

Junior Tax Consultant

- Prepared and reviewed tax returns.

- Handled the preparation of first, second, and third provisional returns.

- Calculated tax liabilities and completed income tax finalizations.

- Managed payroll tax matters.

- Handled VAT returns, registrations, and provided opinions.

- Identified tax risks across various disciplines for audits.

- Drafted responses to SARS (South African Revenue Service) queries.

- Authored tax opinions and reports.

- Demonstrated ethical and professional conduct in a tax environment.

- Registered taxpayers and finalized income tax, payroll tax, and VAT returns in a private tax practice.

- Drafted memoranda and crafted responses to Alternative Dispute Resolutions.

- Wrote tax opinions related to tax disputes, business models, and investment and estate planning.

- Prepared Voluntary Disclosure Program (VDP) Applications.

- Drafted articles.

Tax Consultant Resume Example

Tax Consultant

- Scheduling meetings.

- Ensuring the diary is kept up to date.

- Managing and maintaining a personal calendar.

- Recording and processing client invoices for financial submissions.

- Calculating VAT, PAYE, and tax returns for clients.

- Preparing cashbooks and Financial Statements.

- Calculating figures for client VAT returns.

- Handling client tax calculations for submissions.

- Capturing financial data using Pastel for clients' income and expenses and retrieving financial records.

- Obtaining SARS statuses and tax clearance for clients, both companies and individuals.

- Managing household and day-to-day errands.

Tax Consultant Resume Example

Tax Consultant

- Prepared and filed individual tax returns for both resident and non-resident individuals.

- Interpreted Double Taxation Avoidance Agreement (DTAA) treaties between different countries to determine tax reliefs.

- Calculated double taxation relief and filed Form 67 to claim foreign tax credits.

- Conducted detailed capital gain calculations.

- Provided tax planning services for clients and explained tax implications in various situations.

Lead TAX Consultant Resume Example

Lead TAX Consultant

- Coordinated workflow efficiently.

- Developed guidance materials and provided clear direction to staff.

- Supervised the work of less experienced personnel, including task delegation, progress monitoring, timely feedback, and conducting performance reviews.

- Participated in and supervised tax engagements and related activities under the guidance of more experienced professionals.

- Prepared benchmarking studies and transfer pricing documentation.

Tax Consultant Resume Example

Tax Consultant

- Researched, organized, and reviewed client tax documentation.

- Prepared income tax returns.

- Ensured compliance with tax regulations.

- Conducted tax audits and estimated and tracked tax returns.

- Completed quarterly and annual tax reports.

- Maintained and updated the company's tax database.

- Recommended tax strategies aligned with business goals.

- Specialized in Sao Tome and Principe Tax Legislation and International Tax Law.

Tax Consultant Resume Example

Tax Consultant

- Prepared qualifying disclosures to Revenue, including liability quantification.

- Provided assistance and advice on Revenue Audits and Aspect queries.

- Conducted PAYE and subsistence reviews, including implementing exclusion orders for non-resident directors.

- Offered guidance on double tax relief, both under domestic rules and relevant double tax treaties, in accordance with OECD principles, and managed double tax credits under the legislation, including communication with foreign tax authorities.

- Prepared and reviewed tax effect accounting calculations for inclusion as note disclosures in statutory financial statements.

- Produced advice memos covering complex tax matters such as corporate group reorganizations, tax-efficient corporate cash extraction methods, tax residency migration into and out of Ireland, and tax due diligence for share and asset sales from both buyer and seller perspectives.

- Generated detailed capital allowance reports.

- Managed and trained junior staff, including task delegation, work review, and overall approval of work, along with providing feedback and performance reviews for junior team members.

Tax Consultant Resume Example

Tax Consultant

- Advised both national and international clients on the tax aspects of corporate and real estate transactions, emphasizing legal and tax planning perspectives.

- Structured commercial transactions and devised tax-efficient employee incentivization arrangements.

- Drafted and negotiated tax warranties and indemnities for corporate transactions.

- Conducted research and interpretation of national and international financial reporting standards, as well as complex tax and company law legislation.

- Considered international tax principles.

- Provided guidance on tax and legal aspects of management buy-outs, ensuring a seamless transition before and after the sale.

- Trained junior staff members.

- Delivered tax seminars both internally and externally for corporate department personnel and business owners.

Tax Consultant Resume Example

Tax Consultant

- Provided tax structuring advice to national and international clients across diverse industries for real estate and corporate transactions.

- Drafted and negotiated tax warranties and indemnities for corporate transactions.

- Assisted the property and employment law department with tax-related inquiries.

- Conducted research and interpreted national and international financial reporting standards, along with complex tax and company law legislation.

- Demonstrated a solid understanding of double taxation treaties and international tax principles.

- Conducted tax due diligence.

- Trained junior staff members.

- Delivered tax seminars, both internally and externally, to corporate department personnel and business owners.

Top Tax Consultant Resume Skills for 2023

- Taxation Laws and Regulations

- Tax Compliance

- Tax Planning

- Income Tax Preparation

- Tax Deductions and Credits

- Tax Audits

- Tax Filings

- Tax Returns

- Tax Software

- Tax Consultation

- Taxation for Individuals

- Taxation for Businesses

- International Taxation

- State and Local Taxes

- Tax Research

- Tax Accounting

- IRS (Internal Revenue Service) Guidelines

- Tax Liability Assessment

- Tax Reporting

- Tax Dispute Resolution

- Tax Records Management

- Tax Exemptions

- Tax Code Interpretation

- Tax Analysis

- Tax Compliance Audits

- Tax Planning Strategies

- Tax Legislation

- Tax Compliance Monitoring

- Tax Documentation

- Tax Strategy Development

- Tax Compliance Assessments

- Taxation Software (e.g., TurboTax)

- Tax Policy Analysis

- Taxation for Investments

- Taxation for Retirement Planning

- Taxation for Real Estate

- Taxation for Estates and Trusts

- Taxation for Nonprofits

- Taxation for Corporations

- Communication Skills

- Problem Solving

- Attention to Detail

- Time Management

- Team Collaboration

- Tax Compliance Reporting

- Tax Law Updates

- Tax Return Review

- Tax Documentation Verification

- Taxpayer Education

- Tax Risk Assessment

How Long Should my Tax Consultant Resume be?

Your Tax Consultant resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Tax Consultant, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as a Tax Consultant on my resume?

Focus on your expertise in tax planning, compliance, and advisory services. Highlight your role in preparing tax returns, providing tax-saving strategies, and ensuring clients meet legal tax obligations.

What are the key skills to feature on a Tax Consultant's resume?

Emphasize skills in tax law, tax preparation, financial analysis, and client advisory. Highlight your ability to navigate tax regulations, identify tax-saving opportunities, and resolve complex tax issues for individuals or businesses.

How do I demonstrate my ability to provide tax consulting services on my resume?

Provide examples of tax strategies you’ve implemented, detailing how they reduced tax liabilities or ensured compliance. Highlight your experience in preparing tax returns, conducting tax research, and advising clients on tax-related decisions.

Should I include metrics on my Tax Consultant resume? If so, what kind?

Yes, include metrics such as the amount of tax savings achieved for clients, the number of tax returns filed, or the percentage of audits resolved successfully. These figures help quantify your contributions to tax planning and client satisfaction.

How can I showcase my experience with tax regulations on my resume?

Detail your role in ensuring compliance with federal, state, and local tax regulations. Highlight your experience in conducting tax research, staying updated on tax law changes, and advising clients on how to adapt to new tax legislation.

What kind of achievements should I highlight as a Tax Consultant?

Highlight achievements such as successfully reducing tax liabilities for clients, resolving audits, or implementing tax-saving strategies that resulted in significant cost savings. Mention any recognition or commendations for your expertise in tax planning and consulting.

How do I address a lack of experience in a specific area of tax consulting on my resume?

Emphasize your core tax knowledge and analytical skills, as well as your ability to learn and adapt to complex tax issues. Highlight any relevant coursework, certifications, or training that demonstrate your commitment to expanding your tax expertise.

How important is client communication for a Tax Consultant role?

Client communication is crucial to ensure that clients understand their tax obligations and strategies. Highlight your experience in explaining complex tax laws to clients, advising them on decisions, and maintaining strong client relationships.

How do I demonstrate my ability to resolve tax issues on my resume?

Mention specific examples where you’ve resolved tax disputes, successfully represented clients in audits, or addressed compliance issues. Highlight your role in researching solutions, negotiating with tax authorities, and achieving favorable outcomes for clients.

Should I include certifications on my Tax Consultant resume?

Yes, include relevant certifications such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Chartered Tax Advisor (CTA). These certifications demonstrate your expertise in tax consulting and your commitment to maintaining high professional standards.

-

How can I highlight my experience as a Tax Consultant on my resume?

-

What are the key skills to feature on a Tax Consultant's resume?

-

How do I demonstrate my ability to provide tax consulting services on my resume?

-

Should I include metrics on my Tax Consultant resume? If so, what kind?

-

How can I showcase my experience with tax regulations on my resume?

-

What kind of achievements should I highlight as a Tax Consultant?

-

How do I address a lack of experience in a specific area of tax consulting on my resume?

-

How important is client communication for a Tax Consultant role?

-

How do I demonstrate my ability to resolve tax issues on my resume?

-

Should I include certifications on my Tax Consultant resume?

Copyright ©2025 Workstory Inc.