Senior Tax Associate Resume Examples and Templates

This page provides you with Senior Tax Associate resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Senior Tax Associate resume.

What do Hiring Managers look for in a Senior Tax Associate Resume

- Managing and overseeing tax preparation and filing processes for clients.

- Analyzing complex tax issues and providing expert guidance to clients.

- Ensuring compliance with tax laws, regulations, and reporting requirements.

- Reviewing and verifying tax returns for accuracy and completeness.

- Supervising and mentoring junior tax associates to enhance their skills and knowledge.

- Staying updated on tax law changes and industry developments to provide informed advice to clients.

How to Write a Senior Tax Associate Resume?

To write a professional Senior Tax Associate resume, follow these steps:

- Select the right Senior Tax Associate resume template.

- Write a professional summary at the top explaining your Senior Tax Associate’s experience and achievements.

- Follow the STAR method while writing your Senior Tax Associate resume’s work experience. Show what you were responsible for and what you achieved as a Senior Tax Associate.

- List your top Senior Tax Associate skills in a separate skills section.

How to Write Your Senior Tax Associate Resume Header?

Write the perfect Senior Tax Associate resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Tax Associate position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Senior Tax Associate resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Senior Tax Associate Resume Example - Header Section

Gina 7598 Old Manor St. Saugus, MA 01906 Marital Status: Married, email: cooldude2022@gmail.com

Good Senior Tax Associate Resume Example - Header Section

Gina Zimmerman, Saugus, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Senior Tax Associate email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Senior Tax Associate Resume Summary?

Use this template to write the best Senior Tax Associate resume summary: Senior Tax Associate with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Senior Tax Associate Resume Experience Section?

Here’s how you can write a job winning Senior Tax Associate resume experience section:

- Write your Senior Tax Associate work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Senior Tax Associate work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Senior Tax Associate).

- Use action verbs in your bullet points.

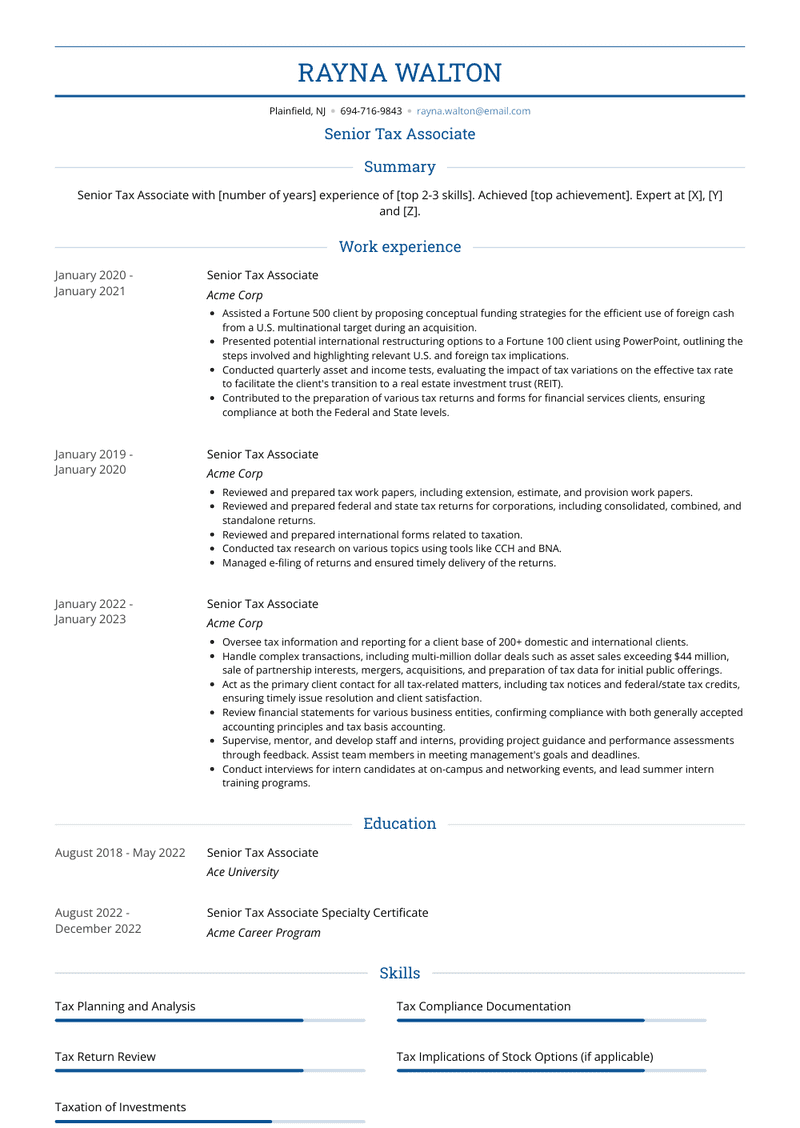

Senior Tax Associate Resume Example

Senior Tax Associate

- Review and oversee the work of less experienced associates (work buddies) to minimize errors in tax return preparation.

- Verify the accuracy and appropriateness of tax returns, calculations, and attachments before submission to managing managers.

- Provide guidance and clarification on tax concepts.

- Develop effective strategies to minimize taxes by maximizing valid deductions and exemptions.

- Assist with the e-filing of tax returns.

- Prepare individual tax returns and tax equalization reports for manager review and approval.

- Maintain a sense of urgency in completing tasks efficiently and effectively.

- Monitor tax deadlines and ensure compliance with regulatory requirements.

- Analyze and review source documents related to stock options, evaluate tax implications, calculate tax liabilities, and file necessary documents.

Senior Tax Associate Resume Example

Senior Tax Associate

- Oversee tax information and reporting for a client base of 200+ domestic and international clients.

- Handle complex transactions, including multi-million dollar deals such as asset sales exceeding $44 million, sale of partnership interests, mergers, acquisitions, and preparation of tax data for initial public offerings.

- Act as the primary client contact for all tax-related matters, including tax notices and federal/state tax credits, ensuring timely issue resolution and client satisfaction.

- Review financial statements for various business entities, confirming compliance with both generally accepted accounting principles and tax basis accounting.

- Supervise, mentor, and develop staff and interns, providing project guidance and performance assessments through feedback. Assist team members in meeting management's goals and deadlines.

- Conduct interviews for intern candidates at on-campus and networking events, and lead summer intern training programs.

Senior Tax Associate Resume Example

Senior Tax Associate

- Provided tax consulting services for operational groups.

- Established alternative investment structures.

- Assisted in M&A activities, including due diligence, structuring, and exit strategies.

- Offered tax advice for both domestic and international matters, covering implementation, structuring, monitoring, and exits.

- Reviewed and amended legal documents to address tax implications.

- Conducted impact assessments related to regulations such as DAC6, ATAD I/II/III.

- Contributed to tax transformation projects as a team member.

Senior Tax Associate Resume Example

Senior Tax Associate

- Assisted a Fortune 500 client by proposing conceptual funding strategies for the efficient use of foreign cash from a U.S. multinational target during an acquisition.

- Presented potential international restructuring options to a Fortune 100 client using PowerPoint, outlining the steps involved and highlighting relevant U.S. and foreign tax implications.

- Conducted quarterly asset and income tests, evaluating the impact of tax variations on the effective tax rate to facilitate the client's transition to a real estate investment trust (REIT).

- Contributed to the preparation of various tax returns and forms for financial services clients, ensuring compliance at both the Federal and State levels.

Senior Tax Associate Resume Example

Senior Tax Associate

- Reviewed and prepared tax work papers, including extension, estimate, and provision work papers.

- Reviewed and prepared federal and state tax returns for corporations, including consolidated, combined, and standalone returns.

- Reviewed and prepared international forms related to taxation.

- Conducted tax research on various topics using tools like CCH and BNA.

- Managed e-filing of returns and ensured timely delivery of the returns.

Seasonal Senior Tax Associate Resume Example

Seasonal Senior Tax Associate

- Managed a team of three Tax Associates and supervised Interns to ensure accuracy and compliance.

- Prepared and reviewed complex tax returns, including those for partnerships, S-corporations, high net worth individuals, gift tax returns, and various other tax forms.

- Employed tax software to project federal and state tax liability for quarterly estimated tax payments.

- Conducted discussions with clients regarding their returns and offered tax planning advice for future years.

- Prepared and reviewed federal income tax proforma and consolidated returns for major clients.

- Conducted extensive tax research projects as needed for various client engagements.

- Provided guidance and research on income tax issues while contributing to the training and development of newly hired tax associates.

Top Senior Tax Associate Resume Skills for 2023

- Tax Law Knowledge

- Income Tax Preparation

- Tax Planning and Analysis

- Tax Compliance and Reporting

- Tax Return Review

- Tax Code Research

- Tax Accounting Methods

- Tax Credits and Deductions

- State and Local Taxation

- Federal Tax Regulations

- Tax Return Filing (e.g., IRS forms)

- Tax Software Proficiency (e.g., TurboTax)

- Taxation of Business Entities

- Taxation of Individuals

- Taxation of Investments

- International Taxation (if applicable)

- Tax Compliance Audits

- Tax Liability Assessment

- Tax Strategies and Minimization

- Tax Documentation and Record Keeping

- Tax Accounting Principles

- Tax Dispute Resolution

- Tax Advisory Services

- Tax Return Amendments

- Tax Preparation Quality Control

- Tax Research Tools (e.g., RIA Checkpoint)

- Tax Compliance Reporting Software

- Tax Compliance Documentation

- Tax Analysis Software (e.g., BNA Income Tax Planner)

- Tax Compliance Deadlines Management

- Tax Advisory for Business Transactions

- Tax Depreciation Calculation

- Tax Deferred Investments

- Tax Compliance for High-Net-Worth Individuals (if applicable)

- Tax Accounting for Deferred Income

- Partnership Taxation (if applicable)

- S Corporation Taxation (if applicable)

- Trust and Estate Taxation (if applicable)

- Taxation for Non-Profit Organizations (if applicable)

- Tax Return E-Filing (if applicable)

- Tax Compliance Reporting for Corporations

- Tax Credits for Renewable Energy (if applicable)

- Knowledge of Tax Code Changes

- Tax Compliance for Real Estate Transactions (if applicable)

- Tax Impact on Investments and Financial Planning

- Tax Research and Analysis for Special Cases

- Tax Compliance for Retirement Accounts (e.g., 401(k))

- Tax Implications of Stock Options (if applicable)

- IRS Auditing Procedures

How Long Should my Senior Tax Associate Resume be?

Your Senior Tax Associate resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Senior Tax Associate, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.