Senior Claims Adjuster Resume Examples and Templates

This page provides you with Senior Claims Adjuster resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Senior Claims Adjuster resume.

What do Hiring Managers look for in a Senior Claims Adjuster Resume

- Analytical Skills: Ability to analyze insurance policies, investigate claims, and assess damages to determine coverage and settlement amounts accurately.

- Negotiation Skills: Proficiency in negotiating settlements with claimants, attorneys, and other parties involved, aiming to reach fair and equitable resolutions while minimizing costs.

- Attention to Detail: Meticulousness in reviewing claim documents, reports, and evidence to identify discrepancies, inconsistencies, and potential fraud.

- Customer Service: Excellent interpersonal skills and a customer-focused approach when communicating with policyholders, providing updates, answering inquiries, and addressing concerns promptly and professionally.

- Technical Knowledge: Comprehensive understanding of insurance regulations, industry standards, and claims processing procedures, ensuring compliance and efficiency in claim handling.

How to Write a Senior Claims Adjuster Resume?

To write a professional Senior Claims Adjuster resume, follow these steps:

- Select the right Senior Claims Adjuster resume template.

- Write a professional summary at the top explaining your Senior Claims Adjuster’s experience and achievements.

- Follow the STAR method while writing your Senior Claims Adjuster resume’s work experience. Show what you were responsible for and what you achieved as a Senior Claims Adjuster.

- List your top Senior Claims Adjuster skills in a separate skills section.

How to Write Your Senior Claims Adjuster Resume Header?

Write the perfect Senior Claims Adjuster resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Senior Claims Adjuster position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Senior Claims Adjuster resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Senior Claims Adjuster Resume Example - Header Section

Lillian 7600 W. Bay Meadows Avenue Rochester, NY 14606 Marital Status: Married, email: cooldude2022@gmail.com

Good Senior Claims Adjuster Resume Example - Header Section

Lillian Flynn, Rochester, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Senior Claims Adjuster email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Senior Claims Adjuster Resume Summary?

Use this template to write the best Senior Claims Adjuster resume summary: Senior Claims Adjuster with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Senior Claims Adjuster Resume Experience Section?

Here’s how you can write a job winning Senior Claims Adjuster resume experience section:

- Write your Senior Claims Adjuster work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Senior Claims Adjuster work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Senior Claims Adjuster).

- Use action verbs in your bullet points.

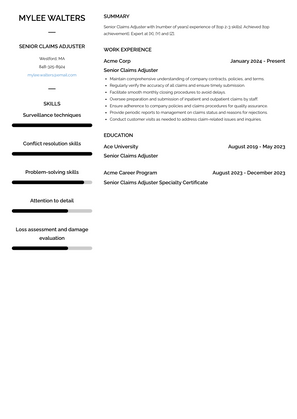

Senior Claims Adjuster Resume Example

Senior Claims Adjuster

- Maintain comprehensive understanding of company contracts, policies, and terms.

- Regularly verify the accuracy of all claims and ensure timely submission.

- Facilitate smooth monthly closing procedures to avoid delays.

- Oversee preparation and submission of inpatient and outpatient claims by staff.

- Ensure adherence to company policies and claims procedures for quality assurance.

- Provide periodic reports to management on claims status and reasons for rejections.

- Conduct customer visits as needed to address claim-related issues and inquiries.

Top Senior Claims Adjuster Resume Skills for 2023

- Insurance policy interpretation

- Claims investigation techniques

- Risk assessment and evaluation

- Loss assessment and damage evaluation

- Documentation review and analysis

- Evidence collection and preservation

- Interviewing skills

- Interrogation techniques

- Surveillance techniques

- Accident scene investigation

- Property damage assessment

- Vehicle appraisal and evaluation

- Medical records review

- Injury evaluation and assessment

- Liability determination

- Coverage analysis

- Subrogation assessment

- Negotiation skills

- Settlement negotiation

- Mediation and arbitration

- Legal knowledge related to insurance claims

- Fraud detection and prevention

- Compliance with insurance regulations

- Understanding of insurance laws and policies

- Policyholder advocacy

- Customer service skills

- Communication skills (verbal and written)

- Time management

- Organization skills

- Computer proficiency (e.g., Microsoft Office, claims management software)

- Data analysis and interpretation

- Reporting skills

- Document management

- Decision-making skills

- Problem-solving skills

- Attention to detail

- Critical thinking skills

- Analytical skills

- Conflict resolution skills

- Emotional intelligence

- Adaptability to changing situations

- Stress management

- Teamwork and collaboration

- Continuous learning and professional development

- Ethics in claims handling

- Cross-functional collaboration with other departments (e.g., legal, underwriting)

- Performance evaluation and feedback

- Budget management (if applicable)

- Leadership skills (for mentoring junior adjusters)

- Quality assurance and improvement

How Long Should my Senior Claims Adjuster Resume be?

Your Senior Claims Adjuster resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Senior Claims Adjuster, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.