Risk Analyst Resume Examples and Templates

This page provides you with Risk Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Risk Analyst resume.

What do Hiring Managers look for in a Risk Analyst Resume

- Analytical Skills: Strong analytical and quantitative skills to assess financial data, market trends, and potential risks.

- Risk Assessment: Ability to identify, evaluate, and quantify various types of risks, including credit, market, operational, and compliance risks.

- Data Analysis: Proficiency in data analysis tools and techniques to interpret data and generate insights for risk assessment.

- Problem-Solving Abilities: Capability to develop risk mitigation strategies, recommend risk-reduction measures, and make data-driven decisions.

- Communication Skills: Effective communication, both written and verbal, to present findings, collaborate with stakeholders, and report on risk-related issues.

How to Write a Risk Analyst Resume?

To write a professional Risk Analyst resume, follow these steps:

- Select the right Risk Analyst resume template.

- Write a professional summary at the top explaining your Risk Analyst’s experience and achievements.

- Follow the STAR method while writing your Risk Analyst resume’s work experience. Show what you were responsible for and what you achieved as a Risk Analyst.

- List your top Risk Analyst skills in a separate skills section.

How to Write Your Risk Analyst Resume Header?

Write the perfect Risk Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Risk Analysis position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Risk Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Risk Analyst Resume Example - Header Section

Caitlyn 19 Adams Street Lorain, OH 44052 Marital Status: Married, email: cooldude2022@gmail.com

Good Risk Analyst Resume Example - Header Section

Caitlyn Bray, Lorain, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Risk Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Risk Analyst Resume Summary?

Use this template to write the best Risk Analyst resume summary: Risk Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Risk Analyst Resume Experience Section?

Here’s how you can write a job winning Risk Analyst resume experience section:

- Write your Risk Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Risk Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Risk Analyst).

- Use action verbs in your bullet points.

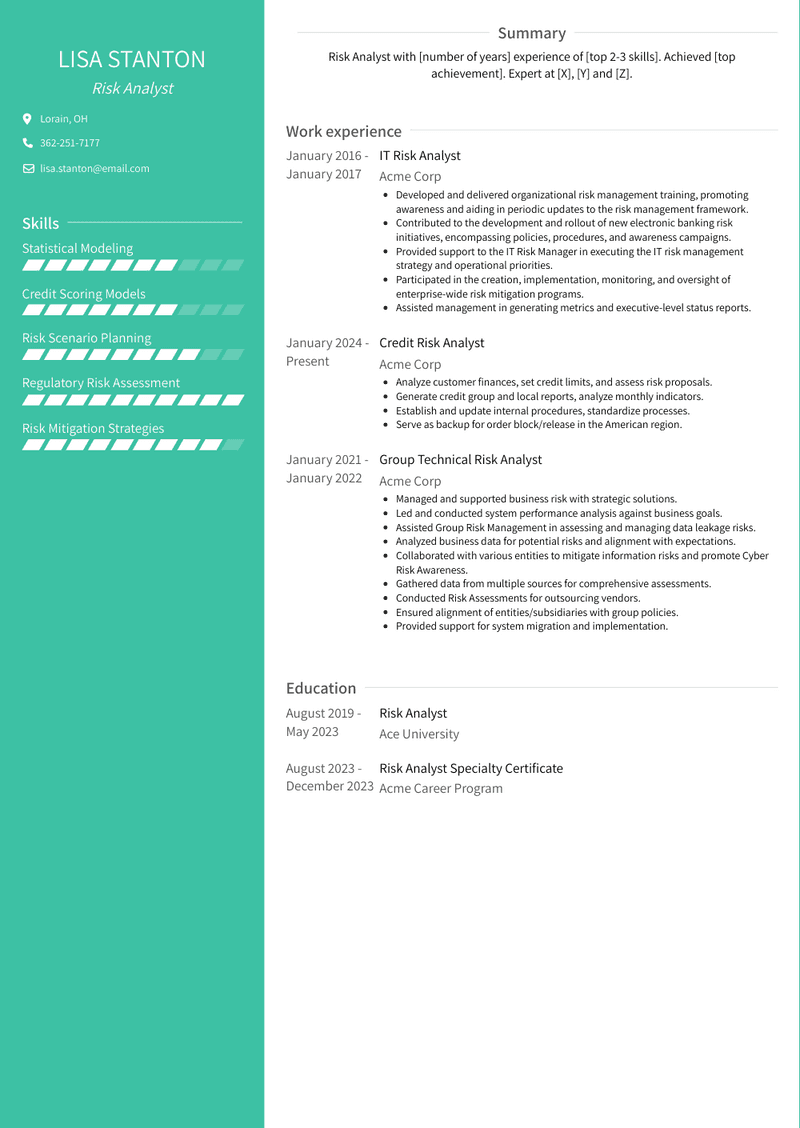

Credit Risk Analyst Resume Example

Credit Risk Analyst

- Analyze customer finances, set credit limits, and assess risk proposals.

- Generate credit group and local reports, analyze monthly indicators.

- Establish and update internal procedures, standardize processes.

- Serve as backup for order block/release in the American region.

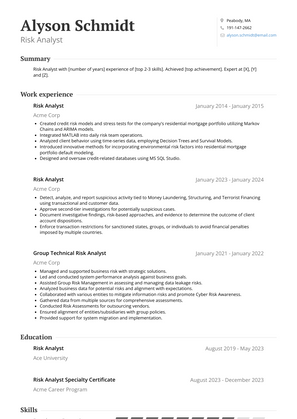

Risk Analyst Resume Example

Risk Analyst

- Detect, analyze, and report suspicious activity tied to Money Laundering, Structuring, and Terrorist Financing using transactional and customer data.

- Approve second-tier investigations for potentially suspicious cases.

- Document investigative findings, risk-based approaches, and evidence to determine the outcome of client account dispositions.

- Enforce transaction restrictions for sanctioned states, groups, or individuals to avoid financial penalties imposed by multiple countries.

Risk Analyst Resume Example

Risk Analyst

- Managed customer, agent/vendor, and internal interactions for primary casualty insurance programs.

- Revised vendor agreements and sales contracts.

- Established risk management policies and procedures.

- Oversaw claims within retention, negotiated significant claims.

- Conducted staff training on insurance and risk management.

- Produced loss analyses and trend reports.

- Achieved a 19% reduction in property and casualty insurance premiums.

- Implemented an emergency response/disaster recovery plan.

- Introduced a driver training program, reducing the loss rate by 12%.

Group Technical Risk Analyst Resume Example

Group Technical Risk Analyst

- Managed and supported business risk with strategic solutions.

- Led and conducted system performance analysis against business goals.

- Assisted Group Risk Management in assessing and managing data leakage risks.

- Analyzed business data for potential risks and alignment with expectations.

- Collaborated with various entities to mitigate information risks and promote Cyber Risk Awareness.

- Gathered data from multiple sources for comprehensive assessments.

- Conducted Risk Assessments for outsourcing vendors.

- Ensured alignment of entities/subsidiaries with group policies.

- Provided support for system migration and implementation.

Risk Analyst Resume Example

Risk Analyst

- Managed the critical incident report database: compiled, analyzed, and reported data. Conducted in-depth data analysis, graphing trends, and ensuring data accuracy.

- Maintained risk management files, including sensitive and confidential information.

- Gathered compliance evidence across departments for performance assessment.

- Identified process improvement and automation opportunities.

- Developed and enhanced multiple Ad hoc reports.

Commercial Credit Risk Analyst II Resume Example

Commercial Credit Risk Analyst II

- Perform administrative duties, aiding management and colleagues.

- Track all Audit findings in Wholesale & Market Risk.

- Collaborate closely with Audit and CRRI.

- Review and report audit findings to Senior Management.

- Engage with Senior Management regularly.

- Support employee engagement initiatives in Wholesale & Market Risk.

- Coordinate town hall events hosted by the Chief Compliance Officer.

- Assist in various projects.

- Manage dashboard reporting for Wholesale Risk.

- Review monthly FTP report for certification.

- Offer support for team members' access requests.

Audit and Operational Risk Analyst Resume Example

Audit and Operational Risk Analyst

- Part of Operational Risk Management under the Divisional Control Officer (DCO) for Regulation, Compliance, and Anti-Financial Crime.

- Responsible for planning, executing, and overseeing risk analysis, control assessments, and risk management reporting.

- Validate audit findings and self-identified issues, and enhance operational risk management.

- Identify and address risks, define risk-reduction measures, and escalate when necessary. Foster a culture of heightened risk awareness at Deutsche Bank.

- Achievements:

- Developed Conflict of Interests framework, drafted guidelines, and successfully implemented it within COO Compliance functions.

- Collaborated with the Central Records Management team to establish the divisional framework for Records Management, addressing GDPR-related aspects, and formulated the policy accordingly.

- Created presentations and training materials for framework and policy implementation, conducted training sessions, and provided support during the implementation phase.

- Managed the initiation, monitoring, and closure of new audit findings and self-identified issues in Regulation, Compliance, Anti-Financial Crime, including our own DCO function.

- Acted as a substitute for the Risk Type Controller.

Risk Analyst Resume Example

Risk Analyst

- Distressed Hedge Fund with Total AUM exceeding 350M USD.

- Daily updates of portfolio VaR and risk allocation using factor models and Monte Carlo methods.

- Conducted back-testing of hedging strategies for extreme events on critical risk exposures.

IT Risk Analyst Resume Example

IT Risk Analyst

- Developed and delivered organizational risk management training, promoting awareness and aiding in periodic updates to the risk management framework.

- Contributed to the development and rollout of new electronic banking risk initiatives, encompassing policies, procedures, and awareness campaigns.

- Provided support to the IT Risk Manager in executing the IT risk management strategy and operational priorities.

- Participated in the creation, implementation, monitoring, and oversight of enterprise-wide risk mitigation programs.

- Assisted management in generating metrics and executive-level status reports.

Risk Analyst Resume Example

Risk Analyst

- Designed and executed custom scorecards and pre-approval procedures, achieving a 73% auto-approval rate for Lease and Loan portfolio.

- Created and managed reporting tools for residual values, delivering presentations to C-level executives.

- Led a team of consultants in building a residual loss forecasting model, overseeing data gathering, suggesting modeling methods, validating results, and presenting findings.

- Contributed to the design of Data Mart and conducted various ad-hoc data mining tasks.

- Employed VBA for report automation, leading to notable enhancements in efficiency and accuracy.

Risk Analyst Resume Example

Risk Analyst

- Created credit risk models and stress tests for the company's residential mortgage portfolio utilizing Markov Chains and ARIMA models.

- Integrated MATLAB into daily risk team operations.

- Analyzed client behavior using time-series data, employing Decision Trees and Survival Models.

- Introduced innovative methods for incorporating environmental risk factors into residential mortgage portfolio default modeling.

- Designed and oversaw credit-related databases using MS SQL Studio.

Top Risk Analyst Resume Skills for 2023

- Risk Assessment

- Risk Management

- Data Analysis

- Statistical Modeling

- Financial Risk Analysis

- Credit Risk Analysis

- Market Risk Analysis

- Operational Risk Analysis

- Risk Mitigation Strategies

- Risk Reporting

- Risk Identification

- Risk Monitoring

- Risk Evaluation

- Risk Modeling Software (e.g., SAS, R)

- Risk Metrics and KPIs

- Monte Carlo Simulation

- Stress Testing

- Value at Risk (VaR) Calculation

- Credit Scoring Models

- Portfolio Risk Analysis

- Basel III Compliance

- Regulatory Risk Assessment

- Compliance Management

- Financial Forecasting

- Risk Management Frameworks (e.g., COSO)

- Risk Heatmaps

- Scenario Analysis

- Credit Default Models

- Market Risk VaR Models

- Credit Risk Modeling Software (e.g., Moody's Analytics)

- Risk Data Analytics

- Credit Risk Assessment Tools

- Economic Capital Calculation

- Risk Appetite Framework

- Risk Aggregation

- Counterparty Risk Analysis

- Liquidity Risk Analysis

- Risk Reporting Tools (e.g., Tableau)

- Operational Risk Assessment

- Loss Event Analysis

- Risk Policies and Procedures

- Risk Culture Assessment

- Risk Governance

- Enterprise Risk Management (ERM)

- Regulatory Reporting

- Fraud Detection and Prevention

- Risk Scenario Planning

- Risk Communication

- Emerging Risk Assessment

How Long Should my Risk Analyst Resume be?

Your Risk Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Risk Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.