Retail Banker Resume Examples and Templates

This page provides you with Retail Banker resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Retail Banker resume.

What do Hiring Managers look for in a Retail Banker Resume

- Customer Service Skills: Ability to provide excellent customer service, including assisting customers with their banking needs, answering inquiries, and resolving issues.

- Financial Acumen: Understanding of banking products and services, such as savings accounts, loans, and credit cards, to effectively advise customers and promote appropriate products.

- Attention to Detail: Precision in processing transactions, maintaining accurate records, and adhering to regulatory requirements.

- Salesmanship: Capability to identify opportunities to cross-sell banking products and services based on customer needs and preferences.

- Communication Skills: Clear and effective communication with customers, colleagues, and management to convey information, discuss banking options, and collaborate on achieving branch goals.

How to Write a Retail Banker Resume?

To write a professional Retail Banker resume, follow these steps:

- Select the right Retail Banker resume template.

- Write a professional summary at the top explaining your Retail Banker’s experience and achievements.

- Follow the STAR method while writing your Retail Banker resume’s work experience. Show what you were responsible for and what you achieved as a Retail Banker.

- List your top Retail Banker skills in a separate skills section.

How to Write Your Retail Banker Resume Header?

Write the perfect Retail Banker resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Retail Banking position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Retail Banker resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Retail Banker Resume Example - Header Section

Leila 35 Marshall Drive Chardon, OH 44024 Marital Status: Married, email: cooldude2022@gmail.com

Good Retail Banker Resume Example - Header Section

Leila Sherman, Chardon, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Retail Banker email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Retail Banker Resume Summary?

Use this template to write the best Retail Banker resume summary: Retail Banker with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Retail Banker Resume Experience Section?

Here’s how you can write a job winning Retail Banker resume experience section:

- Write your Retail Banker work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Retail Banker work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Retail Banker).

- Use action verbs in your bullet points.

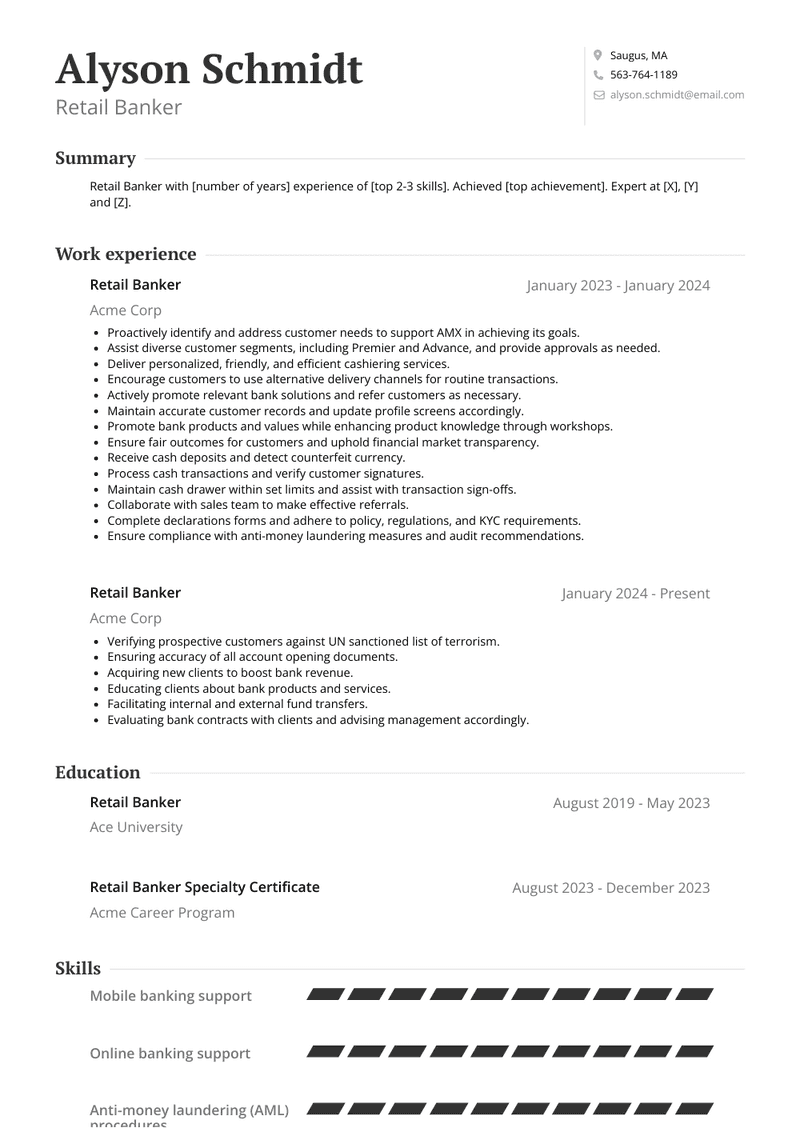

Retail Banker Resume Example

Retail Banker

- Verifying prospective customers against UN sanctioned list of terrorism.

- Ensuring accuracy of all account opening documents.

- Acquiring new clients to boost bank revenue.

- Educating clients about bank products and services.

- Facilitating internal and external fund transfers.

- Evaluating bank contracts with clients and advising management accordingly.

Retail Banker Resume Example

Retail Banker

- Proactively identify and address customer needs to support AMX in achieving its goals.

- Assist diverse customer segments, including Premier and Advance, and provide approvals as needed.

- Deliver personalized, friendly, and efficient cashiering services.

- Encourage customers to use alternative delivery channels for routine transactions.

- Actively promote relevant bank solutions and refer customers as necessary.

- Maintain accurate customer records and update profile screens accordingly.

- Promote bank products and values while enhancing product knowledge through workshops.

- Ensure fair outcomes for customers and uphold financial market transparency.

- Receive cash deposits and detect counterfeit currency.

- Process cash transactions and verify customer signatures.

- Maintain cash drawer within set limits and assist with transaction sign-offs.

- Collaborate with sales team to make effective referrals.

- Complete declarations forms and adhere to policy, regulations, and KYC requirements.

- Ensure compliance with anti-money laundering measures and audit recommendations.

Top Retail Banker Resume Skills for 2023

- Customer relationship management

- Account opening and closing procedures

- Deposit account products knowledge (e.g., savings accounts, checking accounts)

- Loan products knowledge (e.g., personal loans, auto loans)

- Credit card products knowledge

- Mortgage products knowledge

- Investment products knowledge (e.g., certificates of deposit, mutual funds)

- Retirement account products knowledge (e.g., IRAs, 401(k)s)

- Financial needs assessment

- Financial goal setting assistance

- Credit analysis

- Loan origination and processing

- Loan underwriting procedures

- Loan documentation review

- Regulatory compliance in banking (e.g., BSA, Dodd-Frank Act)

- Anti-money laundering (AML) procedures

- Customer identification program (CIP) compliance

- Know Your Customer (KYC) procedures

- Fraud prevention techniques

- Cash handling and vault management

- Currency transaction reporting (CTR) procedures

- Check processing procedures

- Electronic fund transfer (EFT) procedures

- Online banking support

- Mobile banking support

- ATM troubleshooting and maintenance

- Debit card issuance and support

- Credit card application processing

- Account reconciliation

- Account maintenance and updates

- Transaction dispute resolution

- Overdraft protection programs knowledge

- Fee structure explanation

- Interest rate calculation

- Financial literacy education

- Retirement planning assistance

- Estate planning assistance

- Investment portfolio review

- Referral program utilization

- Sales techniques for banking products

- Cross-selling and upselling strategies

- Customer service skills

- Communication skills

- Active listening skills

- Problem-solving skills

- Decision-making skills

- Time management skills

How Long Should my Retail Banker Resume be?

Your Retail Banker resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Retail Banker, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.