Relationship Banker Resume Examples and Templates

This page provides you with Relationship Banker resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Relationship Banker resume.

What do Hiring Managers look for in a Relationship Banker Resume

- Customer Service Skills: Exceptional customer service and interpersonal skills to build and maintain strong relationships with banking clients.

- Financial Knowledge: Understanding of banking products and services, including deposit accounts, loans, and investment options.

- Sales and Cross-Selling Skills: Ability to identify and meet clients' financial needs by recommending and cross-selling appropriate products and services.

- Communication Abilities: Clear and effective communication for addressing client inquiries, providing financial advice, and resolving issues.

- Financial Planning: Capability to assist clients in financial planning and achieving their financial goals.

How to Write a Relationship Banker Resume?

To write a professional Relationship Banker resume, follow these steps:

- Select the right Relationship Banker resume template.

- Write a professional summary at the top explaining your Relationship Banker’s experience and achievements.

- Follow the STAR method while writing your Relationship Banker resume’s work experience. Show what you were responsible for and what you achieved as a Relationship Banker.

- List your top Relationship Banker skills in a separate skills section.

How to Write Your Relationship Banker Resume Header?

Write the perfect Relationship Banker resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Relationship Banking position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Relationship Banker resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Relationship Banker Resume Example - Header Section

Joey 35 Marshall Drive Chardon, OH 44024 Marital Status: Married, email: cooldude2022@gmail.com

Good Relationship Banker Resume Example - Header Section

Joey Campos, Chardon, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Relationship Banker email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Relationship Banker Resume Summary?

Use this template to write the best Relationship Banker resume summary: Relationship Banker with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Relationship Banker Resume Experience Section?

Here’s how you can write a job winning Relationship Banker resume experience section:

- Write your Relationship Banker work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Relationship Banker work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Relationship Banker).

- Use action verbs in your bullet points.

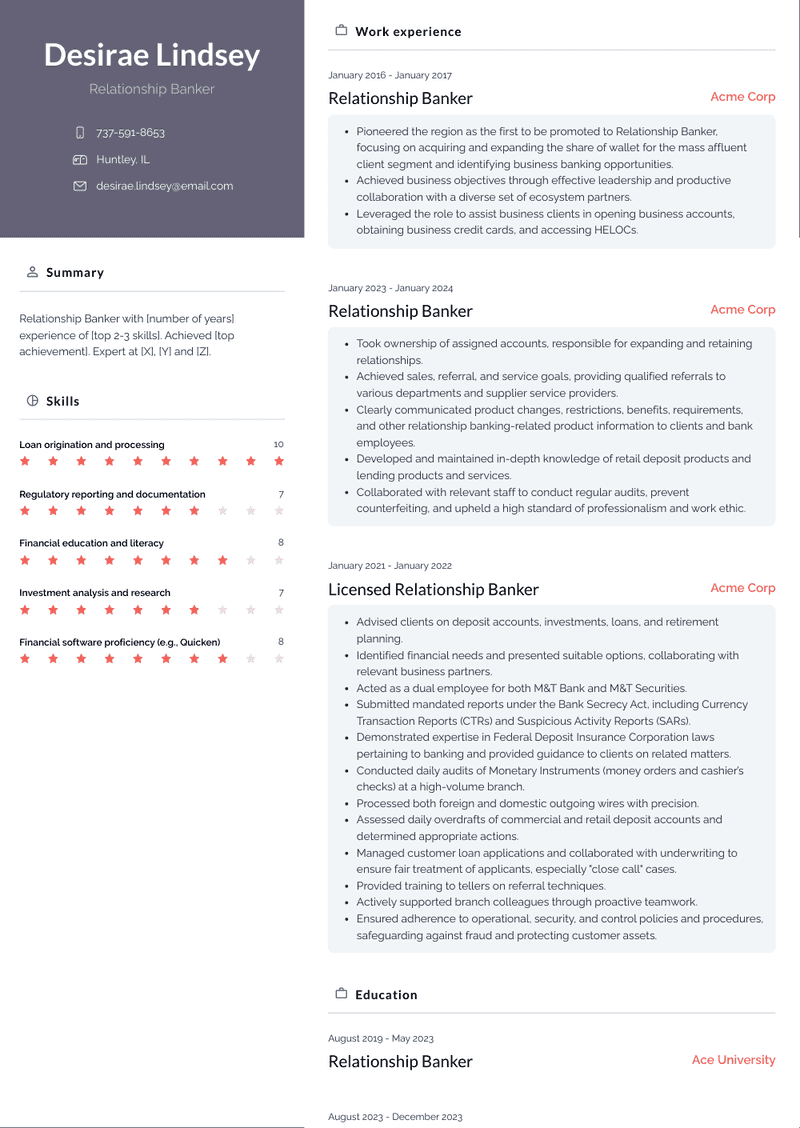

Relationship Banker Resume Example

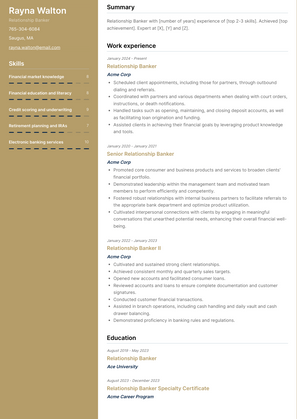

Relationship Banker

- Scheduled client appointments, including those for partners, through outbound dialing and referrals.

- Coordinated with partners and various departments when dealing with court orders, instructions, or death notifications.

- Handled tasks such as opening, maintaining, and closing deposit accounts, as well as facilitating loan origination and funding.

- Assisted clients in achieving their financial goals by leveraging product knowledge and tools.

Relationship Banker Resume Example

Relationship Banker

- Took ownership of assigned accounts, responsible for expanding and retaining relationships.

- Achieved sales, referral, and service goals, providing qualified referrals to various departments and supplier service providers.

- Clearly communicated product changes, restrictions, benefits, requirements, and other relationship banking-related product information to clients and bank employees.

- Developed and maintained in-depth knowledge of retail deposit products and lending products and services.

- Collaborated with relevant staff to conduct regular audits, prevent counterfeiting, and upheld a high standard of professionalism and work ethic.

Relationship Banker II Resume Example

Relationship Banker II

- Cultivated and sustained strong client relationships.

- Achieved consistent monthly and quarterly sales targets.

- Opened new accounts and facilitated consumer loans.

- Reviewed accounts and loans to ensure complete documentation and customer signatures.

- Conducted customer financial transactions.

- Assisted in branch operations, including cash handling and daily vault and cash drawer balancing.

- Demonstrated proficiency in banking rules and regulations.

Licensed Relationship Banker Resume Example

Licensed Relationship Banker

- Advised clients on deposit accounts, investments, loans, and retirement planning.

- Identified financial needs and presented suitable options, collaborating with relevant business partners.

- Acted as a dual employee for both M&T Bank and M&T Securities.

- Submitted mandated reports under the Bank Secrecy Act, including Currency Transaction Reports (CTRs) and Suspicious Activity Reports (SARs).

- Demonstrated expertise in Federal Deposit Insurance Corporation laws pertaining to banking and provided guidance to clients on related matters.

- Conducted daily audits of Monetary Instruments (money orders and cashier’s checks) at a high-volume branch.

- Processed both foreign and domestic outgoing wires with precision.

- Assessed daily overdrafts of commercial and retail deposit accounts and determined appropriate actions.

- Managed customer loan applications and collaborated with underwriting to ensure fair treatment of applicants, especially "close call" cases.

- Provided training to tellers on referral techniques.

- Actively supported branch colleagues through proactive teamwork.

- Ensured adherence to operational, security, and control policies and procedures, safeguarding against fraud and protecting customer assets.

Senior Relationship Banker Resume Example

Senior Relationship Banker

- Promoted core consumer and business products and services to broaden clients' financial portfolio.

- Demonstrated leadership within the management team and motivated team members to perform efficiently and competently.

- Fostered robust relationships with internal business partners to facilitate referrals to the appropriate bank department and optimize product utilization.

- Cultivated interpersonal connections with clients by engaging in meaningful conversations that unearthed potential needs, enhancing their overall financial well-being.

Relationship Banker Resume Example

Relationship Banker

- Deliver exceptional customer service and consistently meet sales and referral targets.

- Assist with dual control vault duties and support audit controls.

- Interact with customers in the lobby, offering guidance on conducting transactions through self-service technologies.

- Contribute to branch sales performance to achieve business growth objectives.

- Fulfill all assigned duties as required.

Senior Relationship Banker Resume Example

Senior Relationship Banker

- Managed a portfolio of high-value consumer and business banking relationships, focusing on sales, business development, and account management.

- Cultivated consultative client relationships to gather feedback, understand specific needs, and ensure long-term retention and portfolio growth.

- Proficient in balancing sales management and customer service, building strong client relationships to maximize lifetime value.

- Committed to continuous personal and professional development, consistently learning new skills and techniques to boost sales volume and maintain customer satisfaction.

- Possessed comprehensive product knowledge across a range of complex financial offerings, providing clients with in-depth advice based on their individual requirements.

- Successfully trained and coached clients on core banking products, including Checking, Non-Checking, Credit Cards, Auto Transfers, Overdraft Protections, and Loans.

- Analyzed local community demand to optimize sales and business development strategies, making recommendations for future growth and expansion.

- Executed integrated sales, relationship, and credit strategies aligned with branch goals and objectives.

- Implemented risk management protocols, such as the BSA questionnaire for high-risk business account holders, to mitigate fraud threats.

- Maintained regular communication with customers to reevaluate their financial needs and provide appropriate solutions when possible.

- Ensured ongoing safety and security of client and bank assets in compliance with regulatory protocols.

- Collaborated efficiently with merchant, payroll, and commercial business partners to explore opportunities for new client business lending growth.

Relationship Banker Resume Example

Relationship Banker

- Leads the strategic development of client relationships in retail branch operations, fostering cross-functional support for sales, CRM, small business, compliance/audits, product development, and policy management.

- Drives the optimization of departmental goals to achieve operational and financial strategic objectives, presenting at sales, service, and departmental meetings to achieve desired outcomes.

- Establishes vital relationships with community partners, advocacy groups, and financial institution partners.

Relationship Banker Resume Example

Relationship Banker

- Pioneered the region as the first to be promoted to Relationship Banker, focusing on acquiring and expanding the share of wallet for the mass affluent client segment and identifying business banking opportunities.

- Achieved business objectives through effective leadership and productive collaboration with a diverse set of ecosystem partners.

- Leveraged the role to assist business clients in opening business accounts, obtaining business credit cards, and accessing HELOCs.

Licensed Relationship Banker Resume Example

Licensed Relationship Banker

- Oversee sales activities to meet personal and bank-set goals.

- Cultivate new client relationships and conduct outbound outreach efforts to manage a self-developed prospective client pipeline.

- Assist clients and walk-ins in identifying their banking needs.

- Offer information on the bank's services and products, guiding clients in the product selection process.

- Ensure accurate completion of account opening procedures.

- Facilitate financial solutions by referring clients to investment and mortgage partners.

- Provide information to clients about services such as safe deposits, wire transfers, and other offerings.

Relationship Banker Resume Example

Relationship Banker

- Educate clients on Investec products and ensure their comprehension.

- Structure lending deals and present them to the credit department.

- Cultivate trust and build lasting relationships with existing clients.

- Manage client expectations and handle complaints effectively.

- Spearhead lead generation through marketing activities and devise innovative sales strategies.

Top Relationship Banker Resume Skills for 2023

- Customer relationship management

- Financial product knowledge (e.g., loans, savings accounts)

- Banking regulations and compliance

- Retail banking services

- Account opening and closing procedures

- Financial advising and consultation

- Credit analysis and lending

- Investment products and services

- Wealth management principles

- Risk assessment and management

- Financial planning and goal setting

- Cross-selling financial products

- Personal and business banking services

- Mortgage lending and home loans

- Consumer lending (e.g., auto loans, personal loans)

- Small business lending

- Regulatory compliance (e.g., KYC, AML)

- Banking software and systems

- Financial account management

- Loan origination and processing

- Credit scoring and underwriting

- Investment portfolio management

- Retirement planning and IRAs

- Estate planning and trusts

- Insurance products (e.g., life, home, auto)

- Cash handling and vault management

- Electronic banking services

- Financial statement analysis

- Account reconciliation

- Financial goal tracking and reporting

- Customer needs assessment

- Financial education and literacy

- Financial software proficiency (e.g., Quicken)

- Regulatory reporting and documentation

- Presentation and communication skills

- Data analysis and interpretation

- Problem-solving abilities

- Time management and organization

- Adaptability and flexibility

- Decision-making skills

- Attention to detail

- Sales and negotiation skills

- Customer service excellence

- Banking industry trends and updates

- Financial market knowledge

- Investment analysis and research

- Client and stakeholder relations

- Networking and business development

- Compliance audits and risk assessment

How Long Should my Relationship Banker Resume be?

Your Relationship Banker resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Relationship Banker, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.