Payroll Specialist Resume Examples and Templates

This page provides you with Payroll Specialist resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Payroll Specialist resume.

What do Hiring Managers look for in a Payroll Specialist Resume

- Payroll Expertise: Strong knowledge of payroll processes, tax regulations, deductions, and compliance.

- Attention to Detail: Meticulousness in accurately processing payroll data, including hours worked, benefits, and deductions.

- Data Analysis Skills: Proficiency in data analysis to identify discrepancies, resolve payroll issues, and ensure accuracy.

- Communication Skills: Effective communication with employees regarding payroll inquiries and changes.

- Time Management: Efficient time management to meet payroll processing deadlines and ensure timely payments.

How to Write a Payroll Specialist Resume?

To write a professional Payroll Specialist resume, follow these steps:

- Select the right Payroll Specialist resume template.

- Write a professional summary at the top explaining your Payroll Specialist’s experience and achievements.

- Follow the STAR method while writing your Payroll Specialist resume’s work experience. Show what you were responsible for and what you achieved as a Payroll Specialist.

- List your top Payroll Specialist skills in a separate skills section.

How to Write Your Payroll Specialist Resume Header?

Write the perfect Payroll Specialist resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Payroll position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Payroll Specialist resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Payroll Specialist Resume Example - Header Section

Cason 9507 Morris Street Somerset, NJ 08873 Marital Status: Married, email: cooldude2022@gmail.com

Good Payroll Specialist Resume Example - Header Section

Cason Reilly, Somerset, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Payroll Specialist email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Payroll Specialist Resume Summary?

Use this template to write the best Payroll Specialist resume summary: Payroll Specialist with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Payroll Specialist Resume Experience Section?

Here’s how you can write a job winning Payroll Specialist resume experience section:

- Write your Payroll Specialist work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Payroll Specialist work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Payroll Specialist).

- Use action verbs in your bullet points.

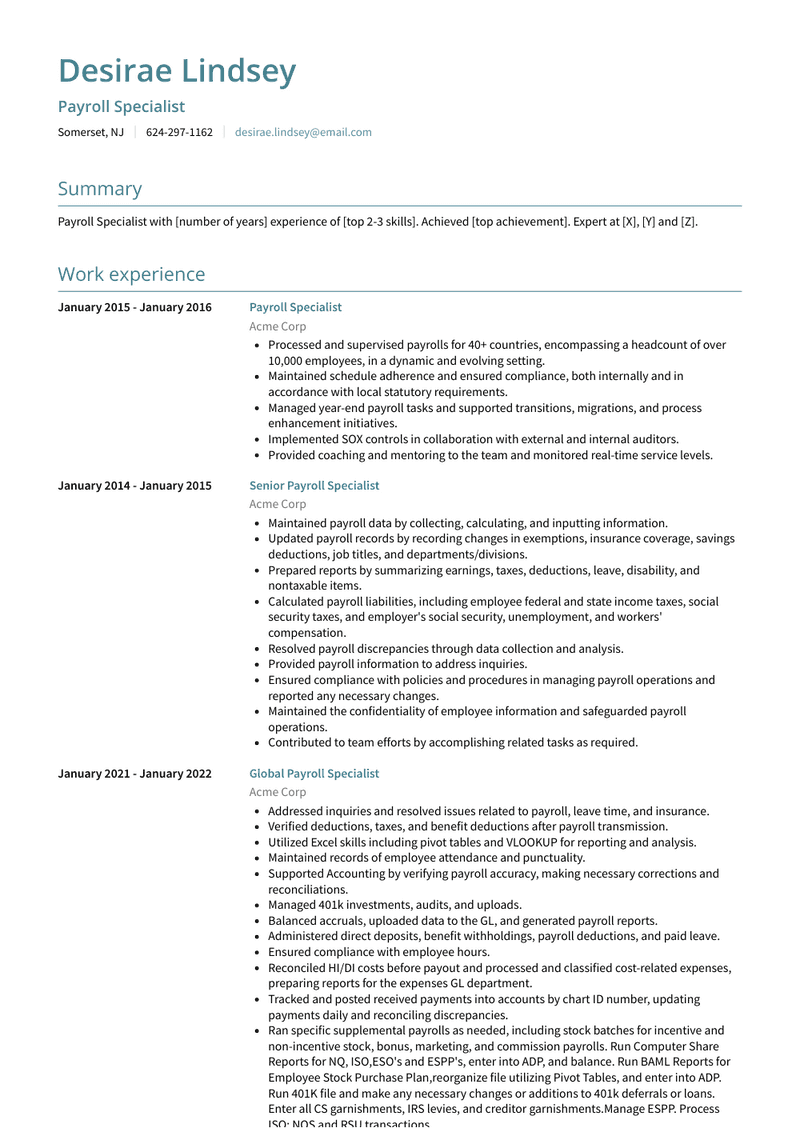

Senior Payroll Specialist Resume Example

Senior Payroll Specialist

- Managed monthly payroll processing for a workforce of over 200 employees.

- Delivered daily customer service via online calls, emails, and the Tulip interface in both English and Hungarian.

- Handled the preparation of employee certificates for purposes such as bank loans.

- Performed end-to-end payroll tasks for multiple clients.

- Assisted with the onboarding of new colleagues and provided training on the Payroll Software.

Payroll Specialist Resume Example

Payroll Specialist

- Conducted end-to-end payroll processes for 78 clients, including small and micro businesses.

- Oversaw the management of cafeteria, timesheet, and e-payslip software.

- Occasionally provided assistance to colleagues with English and Excel.

- Collaborated within a team of 8 specialists.

Global Payroll Specialist Resume Example

Global Payroll Specialist

- Addressed inquiries and resolved issues related to payroll, leave time, and insurance.

- Verified deductions, taxes, and benefit deductions after payroll transmission.

- Utilized Excel skills including pivot tables and VLOOKUP for reporting and analysis.

- Maintained records of employee attendance and punctuality.

- Supported Accounting by verifying payroll accuracy, making necessary corrections and reconciliations.

- Managed 401k investments, audits, and uploads.

- Balanced accruals, uploaded data to the GL, and generated payroll reports.

- Administered direct deposits, benefit withholdings, payroll deductions, and paid leave.

- Ensured compliance with employee hours.

- Reconciled HI/DI costs before payout and processed and classified cost-related expenses, preparing reports for the expenses GL department.

- Tracked and posted received payments into accounts by chart ID number, updating payments daily and reconciling discrepancies.

- Ran specific supplemental payrolls as needed, including stock batches for incentive and non-incentive stock, bonus, marketing, and commission payrolls. Run Computer Share Reports for NQ, ISO,ESO's and ESPP's, enter into ADP, and balance. Run BAML Reports for Employee Stock Purchase Plan,reorganize file utilizing Pivot Tables, and enter into ADP. Run 401K file and make any necessary changes or additions to 401k deferrals or loans. Enter all CS garnishments, IRS levies, and creditor garnishments.Manage ESPP. Process ISO; NQS and RSU transactions.

Payroll Specialist Resume Example

Payroll Specialist

- Managed bi-weekly payroll processing for 1000 employees, including retroactive adjustments for pay increases.

- Oversaw petty cash and prepared and filed payroll taxes on various schedules (bi-weekly, monthly, quarterly, yearly).

- Handled general ledger accruals and adjustments.

- Successfully transitioned the payroll system from manual time card processing to time and attendance.

- Processed bi-weekly payroll for 1000 employees.

- Prepared and filed taxes on both bi-weekly and quarterly schedules.

- Posted manual adjustments to the general ledger.

- Maintained employee master files and input relevant data.

Payroll Specialist Resume Example

Payroll Specialist

- Processed accurate and punctual payroll for all designated accounts, encompassing reconciliation and compliance tasks.

- Shared expertise and knowledge with peers in UltiPro, extending beyond standard payroll functions to enhance the customer experience.

- Provided assistance to colleagues by offering guidance and solutions to address issues, minimizing the volume of support cases and support-related calls.

- Established myself as a Subject Matter Expert (SME) and mentor within the core payroll/HRIS system.

- Volunteered and contributed to special projects that leveraged my previous experience and activation skill set.

Payroll Specialist Resume Example

Payroll Specialist

- Procured stationary supplies for the HR department.

- Ensured the maintenance of precise employee records.

- Conducted employee background checks.

- Provided explanations of employment terms and conditions to staff and senior managers.

- Developed and managed human resources programs and policies, encompassing staffing, compensation, benefits, immigration, employee relations, training, and health and safety.

Payroll Specialist Resume Example

Payroll Specialist

- Gathered essential data for the monthly payroll.

- Updated payroll system with information on new hires and terminations.

- Managed the Pension and life insurance processes.

- Prepared and distributed monthly payroll and payslips.

- Generated and compiled monthly HR reports.

- Oversaw final settlements for employees who resigned.

- Handled changes in employee status (title, level, promotion, and transfer) within the system.

- Issued HR Letters.

- Addressed employee inquiries and requests.

Payroll Specialist Resume Example

Payroll Specialist

- Generated precise and comprehensive payrolls for a sizable multi-state and multi-company payroll, involving data entry across multiple systems.

- Calculated wages and deductions for immediate pay states.

- Conducted internal and external reporting, including 401(k) and tax wire submissions.

- Audited timekeeping records to ensure compliance.

- Documented and managed garnishments for bankruptcies, student loans, and child support orders.

Payroll Specialist Resume Example

Payroll Specialist

- Processed and supervised payrolls for 40+ countries, encompassing a headcount of over 10,000 employees, in a dynamic and evolving setting.

- Maintained schedule adherence and ensured compliance, both internally and in accordance with local statutory requirements.

- Managed year-end payroll tasks and supported transitions, migrations, and process enhancement initiatives.

- Implemented SOX controls in collaboration with external and internal auditors.

- Provided coaching and mentoring to the team and monitored real-time service levels.

Senior Payroll Specialist Resume Example

Senior Payroll Specialist

- Maintained payroll data by collecting, calculating, and inputting information.

- Updated payroll records by recording changes in exemptions, insurance coverage, savings deductions, job titles, and departments/divisions.

- Prepared reports by summarizing earnings, taxes, deductions, leave, disability, and nontaxable items.

- Calculated payroll liabilities, including employee federal and state income taxes, social security taxes, and employer's social security, unemployment, and workers' compensation.

- Resolved payroll discrepancies through data collection and analysis.

- Provided payroll information to address inquiries.

- Ensured compliance with policies and procedures in managing payroll operations and reported any necessary changes.

- Maintained the confidentiality of employee information and safeguarded payroll operations.

- Contributed to team efforts by accomplishing related tasks as required.

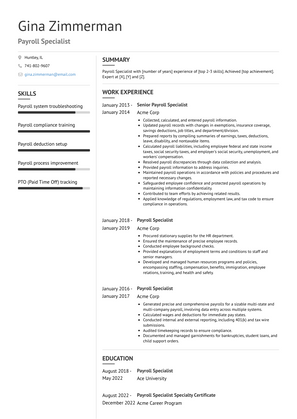

Senior Payroll Specialist Resume Example

Senior Payroll Specialist

- Collected, calculated, and entered payroll information.

- Updated payroll records with changes in exemptions, insurance coverage, savings deductions, job titles, and department/division.

- Prepared reports by compiling summaries of earnings, taxes, deductions, leave, disability, and nontaxable items.

- Calculated payroll liabilities, including employee federal and state income taxes, social security taxes, and employer's social security, unemployment, and workers' compensation.

- Resolved payroll discrepancies through data collection and analysis.

- Provided payroll information to address inquiries.

- Maintained payroll operations in accordance with policies and procedures and reported necessary changes.

- Safeguarded employee confidence and protected payroll operations by maintaining information confidentiality.

- Contributed to team efforts by achieving related results.

- Applied knowledge of regulations, employment law, and tax code to ensure compliance in operations.

Top Payroll Specialist Resume Skills for 2023

- Payroll processing

- Payroll tax compliance

- Payroll software proficiency (e.g., ADP, Paychex)

- Wage and hour laws knowledge

- Benefits administration

- Time and attendance management

- Tax withholding calculations

- Payroll deduction setup

- Payroll reconciliation

- Payroll auditing and compliance

- Garnishments and deductions processing

- Employee benefits enrollment

- Payroll reporting and analytics

- Multi-state payroll processing

- Payroll audits and assessments

- Payroll accounting principles

- Payroll forecasting and budgeting

- Payroll tax filings (federal, state, local)

- 401(k) and retirement plan administration

- FLSA (Fair Labor Standards Act) compliance

- PTO (Paid Time Off) tracking

- Overtime pay calculations

- Worker's compensation management

- Employment verification and records

- New hire onboarding and payroll setup

- Payroll year-end processing

- Electronic payroll payments (e.g., direct deposit)

- Payroll system upgrades and maintenance

- Payroll policy development

- Payroll compliance training

- Payroll software implementation

- Payroll cost analysis

- Payroll vendor management

- Payroll process documentation

- Payroll data security

- Knowledge of payroll laws and regulations (e.g., IRS guidelines)

- Payroll tax reconciliation

- Payroll system integration with HR and accounting systems

- Employee self-service portals (e.g., ADP Workforce Now)

- Payroll department leadership

- Payroll process improvement

- Payroll reporting tools (e.g., Crystal Reports)

- Labor distribution and cost allocation

- Payroll journal entries

- Payroll compliance audits

- Payroll tax penalty avoidance

- Payroll compliance reporting

- Payroll system troubleshooting

- Knowledge of COBRA regulations

- Continuous learning and staying updated on payroll laws and best practices

How Long Should my Payroll Specialist Resume be?

Your Payroll Specialist resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Payroll Specialist, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as a Payroll Specialist on my resume?

Focus on your expertise in processing payroll, managing employee data, and ensuring compliance with tax regulations. Highlight your role in accurately processing payments, resolving payroll discrepancies, and maintaining payroll records.

What are the key skills to feature on a Payroll Specialist's resume?

Emphasize skills in payroll processing, tax compliance, data entry, and proficiency with payroll software such as ADP, Paychex, or QuickBooks. Highlight your attention to detail, problem-solving skills, and ability to handle payroll audits.

How do I demonstrate my ability to process payroll on my resume?

Provide examples of payroll cycles you’ve managed, including the number of employees and the systems used. Highlight your experience in ensuring accurate and timely payment while adhering to company policies and legal requirements.

Should I include metrics on my Payroll Specialist resume? If so, what kind?

Yes, include metrics such as the number of employees processed, accuracy rates, or reductions in payroll errors. These metrics help quantify your impact on improving payroll efficiency and accuracy.

How can I showcase my experience with tax compliance on my resume?

Detail your role in calculating and deducting taxes, filing tax forms, and ensuring compliance with federal, state, and local tax regulations. Highlight your ability to manage year-end reporting, including W-2s and 1099s.

What kind of achievements should I highlight as a Payroll Specialist?

Highlight achievements such as reducing payroll errors, improving process efficiency, or being recognized for accurate payroll processing. Mention any recognition for your role in managing payroll during audits or implementing new payroll systems.

How do I address a lack of experience in a specific payroll system on my resume?

Emphasize your general payroll skills, attention to detail, and ability to learn new systems quickly. Highlight any relevant training, certifications, or projects that demonstrate your readiness to adapt to new payroll software or processes.

How important is confidentiality for a Payroll Specialist role?

Confidentiality is essential for maintaining employee trust and protecting sensitive financial information. Highlight your experience in handling confidential data, ensuring compliance with privacy regulations, and safeguarding payroll records.

How do I demonstrate my ability to handle payroll discrepancies on my resume?

Mention specific examples where you identified and resolved payroll discrepancies, ensured timely corrections, and communicated effectively with employees to address concerns. Highlight your role in preventing recurring issues by improving payroll processes.

Should I include certifications on my Payroll Specialist resume?

Yes, include relevant certifications such as Certified Payroll Professional (CPP) or Fundamental Payroll Certification (FPC). These certifications demonstrate your expertise in payroll management and your commitment to maintaining industry standards.

-

What do Hiring Managers look for in a Payroll Specialist Resume

-

How to Write a Professional Payroll Specialist Resume Summary?

-

How to Write a Payroll Specialist Resume Experience Section?

-

How can I highlight my experience as a Payroll Specialist on my resume?

-

What are the key skills to feature on a Payroll Specialist's resume?

-

How do I demonstrate my ability to process payroll on my resume?

-

Should I include metrics on my Payroll Specialist resume? If so, what kind?

-

How can I showcase my experience with tax compliance on my resume?

-

What kind of achievements should I highlight as a Payroll Specialist?

-

How do I address a lack of experience in a specific payroll system on my resume?

-

How important is confidentiality for a Payroll Specialist role?

-

How do I demonstrate my ability to handle payroll discrepancies on my resume?

-

Should I include certifications on my Payroll Specialist resume?

Copyright ©2025 Workstory Inc.