Payment Processor Resume Examples and Templates

This page provides you with Payment Processor resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Payment Processor resume.

What do Hiring Managers look for in a Payment Processor Resume

- Attention to Detail: Precision in processing financial transactions accurately and efficiently, ensuring that all details are recorded correctly.

- Knowledge of Payment Systems: Understanding of payment processing systems and procedures, including electronic payment methods and banking regulations.

- Data Entry Skills: Proficiency in entering payment information into computer systems with speed and accuracy.

- Security Awareness: Commitment to maintaining the security and confidentiality of financial data and sensitive information.

- Problem-Solving Abilities: Aptitude to address issues such as payment discrepancies, transaction errors, and payment processing delays, and implement solutions to resolve them efficiently.

How to Write a Payment Processor Resume?

To write a professional Payment Processor resume, follow these steps:

- Select the right Payment Processor resume template.

- Write a professional summary at the top explaining your Payment Processor’s experience and achievements.

- Follow the STAR method while writing your Payment Processor resume’s work experience. Show what you were responsible for and what you achieved as a Payment Processor.

- List your top Payment Processor skills in a separate skills section.

How to Write Your Payment Processor Resume Header?

Write the perfect Payment Processor resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Payment Processor job title to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Payment Processor resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Payment Processor Resume Example - Header Section

Eve 35 Marshall Drive Chardon, OH 44024 Marital Status: Married, email: cooldude2022@gmail.com

Good Payment Processor Resume Example - Header Section

Eve Beltran, Chardon, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Payment Processor email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Payment Processor Resume Summary?

Use this template to write the best Payment Processor resume summary: Payment Processor with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Payment Processor Resume Experience Section?

Here’s how you can write a job winning Payment Processor resume experience section:

- Write your Payment Processor work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Payment Processor work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Payment Processor).

- Use action verbs in your bullet points.

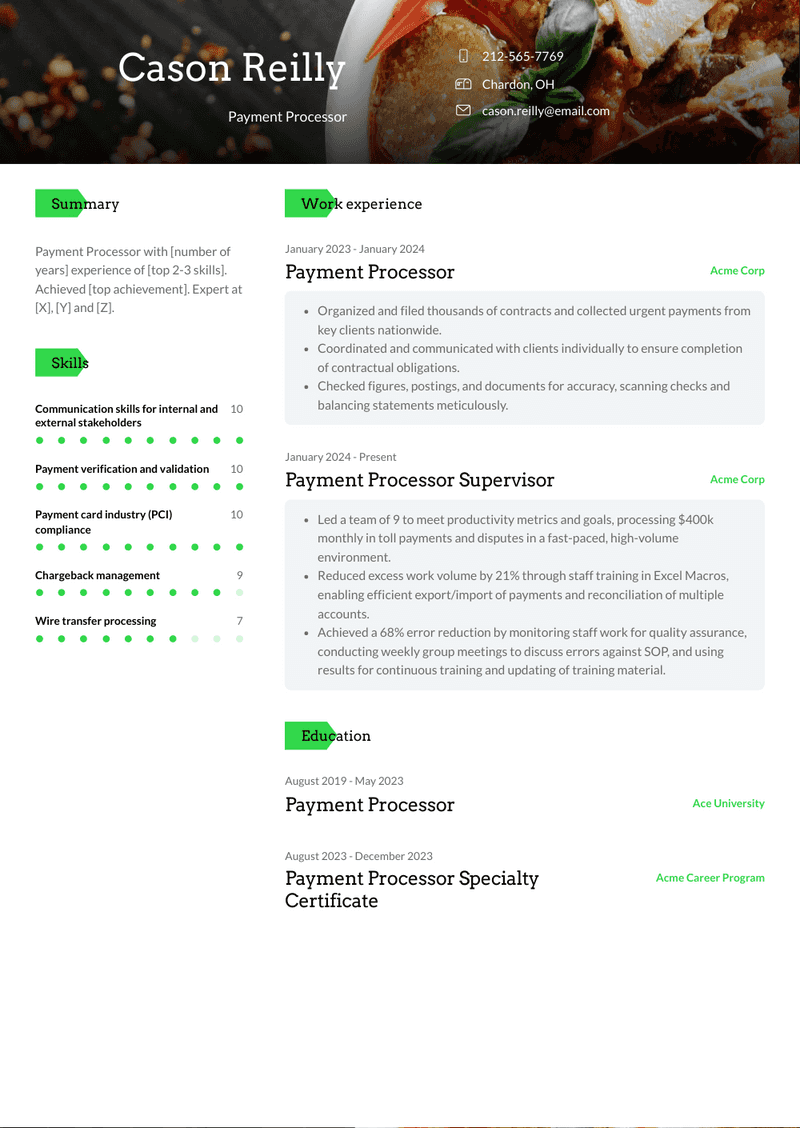

Payment Processor Supervisor Resume Example

Payment Processor Supervisor

- Led a team of 9 to meet productivity metrics and goals, processing $400k monthly in toll payments and disputes in a fast-paced, high-volume environment.

- Reduced excess work volume by 21% through staff training in Excel Macros, enabling efficient export/import of payments and reconciliation of multiple accounts.

- Achieved a 68% error reduction by monitoring staff work for quality assurance, conducting weekly group meetings to discuss errors against SOP, and using results for continuous training and updating of training material.

Payment Processor Resume Example

Payment Processor

- Organized and filed thousands of contracts and collected urgent payments from key clients nationwide.

- Coordinated and communicated with clients individually to ensure completion of contractual obligations.

- Checked figures, postings, and documents for accuracy, scanning checks and balancing statements meticulously.

Top Payment Processor Resume Skills for 2023

- Payment processing systems operation

- Transaction authorization procedures

- Payment card industry (PCI) compliance

- Payment gateway integration

- Point-of-sale (POS) terminal operation

- Online payment processing platforms usage

- Mobile payment processing applications usage

- Payment verification and validation

- Fraud detection and prevention measures

- Chargeback management

- Refund processing

- Payment reconciliation

- Settlement procedures

- Batch processing

- Currency conversion processes

- Electronic funds transfer (EFT) procedures

- Automated clearing house (ACH) processing

- Wire transfer processing

- Direct debit processing

- Payment encryption methods

- Tokenization techniques

- 3D Secure authentication

- Payment card industry data security standard (PCI DSS) compliance

- Payment processing regulations knowledge (e.g., GDPR, PSD2)

- Know Your Customer (KYC) procedures

- Anti-money laundering (AML) procedures

- Customer identification program (CIP) compliance

- Compliance with financial regulations (e.g., OFAC, FinCEN)

- Regulatory reporting requirements

- Data security protocols

- Risk assessment and mitigation strategies

- Transaction monitoring and analysis

- Real-time payment processing

- Settlement timing optimization

- Payment network protocols (e.g., ISO 8583)

- Interchange fee management

- Merchant onboarding procedures

- Payment processor integration with merchant systems

- Customer support for payment-related inquiries

- Payment processing documentation and reporting

- Payment system troubleshooting

- Incident response and resolution

- Change management procedures

- Collaboration with financial institutions and payment networks

- Vendor management for payment processing services

- Continuous learning and professional development in payment processing technologies

- Communication skills for internal and external stakeholders

- Teamwork and collaboration with cross-functional teams

- Problem-solving skills for complex payment processing issues

- Adaptability to evolving payment processing trends and technologies

How Long Should my Payment Processor Resume be?

Your Payment Processor resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Payment Processor, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.