3+ Mortgage Underwriter Resume Examples and Templates

This page provides you with Mortgage Underwriter resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Mortgage Underwriter resume.

What do Hiring Managers look for in a Mortgage Underwriter Resume

- Mortgage Knowledge: Extensive knowledge of mortgage lending regulations, guidelines, and underwriting standards.

- Analytical Skills: Strong analytical abilities to evaluate borrowers' financial information, credit history, and loan applications.

- Attention to Detail: Meticulous attention to detail to ensure accuracy in underwriting decisions and documentation.

- Communication Skills: Effective written and verbal communication for interacting with loan officers, borrowers, and stakeholders.

- Risk Assessment: Aptitude for assessing loan risks and making informed underwriting decisions to mitigate them.

How to Write a Mortgage Underwriter Resume?

To write a professional Mortgage Underwriter resume, follow these steps:

- Select the right Mortgage Underwriter resume template.

- Write a professional summary at the top explaining your Mortgage Underwriter’s experience and achievements.

- Follow the STAR method while writing your Mortgage Underwriter resume’s work experience. Show what you were responsible for and what you achieved as a Mortgage Underwriter.

- List your top Mortgage Underwriter skills in a separate skills section.

How to Write Your Mortgage Underwriter Resume Header?

Write the perfect Mortgage Underwriter resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Mortgage Underwriter position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Mortgage Underwriter resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Mortgage Underwriter Resume Example - Header Section

Arturo Miller 682 Fifth St. South Plainfield, NJ 07080 Marital Status: Married, email: cooldude2022@gmail.com

Good Mortgage Underwriter Resume Example - Header Section

Arturo Miller Miller, Plainfield, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Mortgage Underwriter email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Mortgage Underwriter Resume Summary?

Use this template to write the best Mortgage Underwriter resume summary: Mortgage Underwriter with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Mortgage Underwriter Resume Experience Section?

Here’s how you can write a job winning Mortgage Underwriter resume experience section:

- Write your Mortgage Underwriter work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Mortgage Underwriter work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Mortgage Underwriter).

- Use action verbs in your bullet points.

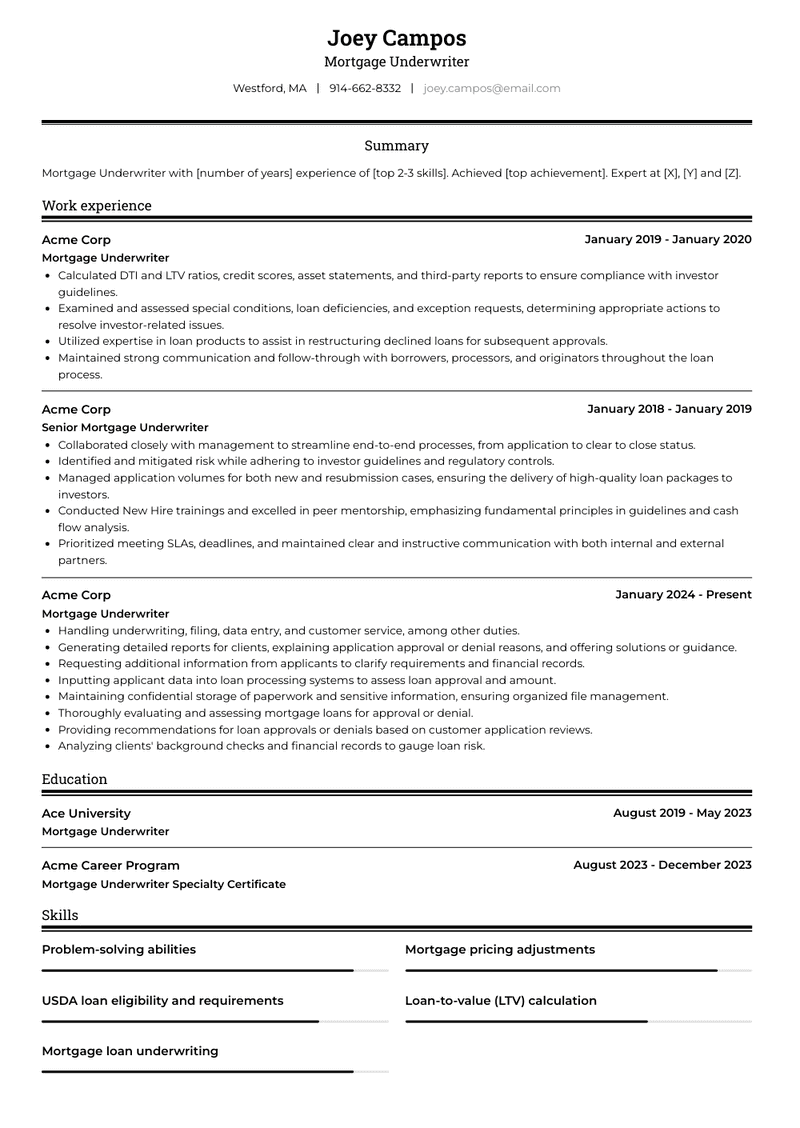

Mortgage Underwriter Resume Example

Mortgage Underwriter

- Handling underwriting, filing, data entry, and customer service, among other duties.

- Generating detailed reports for clients, explaining application approval or denial reasons, and offering solutions or guidance.

- Requesting additional information from applicants to clarify requirements and financial records.

- Inputting applicant data into loan processing systems to assess loan approval and amount.

- Maintaining confidential storage of paperwork and sensitive information, ensuring organized file management.

- Thoroughly evaluating and assessing mortgage loans for approval or denial.

- Providing recommendations for loan approvals or denials based on customer application reviews.

- Analyzing clients' background checks and financial records to gauge loan risk.

Conventional Mortgage Underwriter II Resume Example

Conventional Mortgage Underwriter II

- Conducted nationwide underwriting of various retail mortgage loans.

- Conducted comprehensive financial reviews, including assets, credit reports, income types, and HTI, DTI, and LTV ratio calculations.

- Documented reasons for loan approval or denial and contributed to underwriting scenarios.

- Ensured timely clearance of conditions to meet closing dates and communicated status updates to processing and sales teams, meeting borrower expectations.

- Maintained a 100% monthly quality rating by adhering to company, FMNA, and FHLMC guidelines.

Senior Mortgage Underwriter Resume Example

Senior Mortgage Underwriter

- Streamlined end-to-end processes for sales, processing, underwriting, and closing/funding departments.

- Identified and mitigated risks, aligning with investor guidelines and regulatory controls, achieving >99.2% quality audit metrics.

- Effectively managed a substantial application pipeline, ensuring high-quality loan package delivery to investors.

- Conducted New Hire trainings and excelled in peer mentorship, emphasizing seller guidelines and cash flow analysis.

- Prioritized meeting SLAs and deadlines, maintaining concise and instructive communication with internal and external partners.

- Conducted complex deal structuring, self-employed income cash flow analysis, and reviewed non-agency and Jumbo loans.

Senior Mortgage Underwriter Resume Example

Senior Mortgage Underwriter

- Drove production in Direct Mortgage Lending, following conforming and portfolio loan guidelines, and adhering to internal and external controls.

- Proficient in AUS systems and well-versed in referred/manual underwriting principles and documentation.

- Effectively managed a substantial pipeline of new and resubmitted purchase and refinance applications.

- Achieved a >75% pull-through rate on Loss Mitigation workout plans (Shortsales, Modifications, Deed-in-Lieu of Foreclosure).

- Consistently recognized with awards for achieving 100% scores in Credit Quality audits over multiple quarters.

- Conducted calculations for complex self-employed income cash flow scenarios.

- Held authority for loans of up to $10M.

- Reviewed Condo projects (agency approved and non-warranty) and Co-Op projects.

Mortgage Underwriter Resume Example

Mortgage Underwriter

- Analyzed Conventional/FHA/VA mortgage loan applications following specific guidelines.

- Assessed various income documentation, including pay stubs, W-2s, written employment verifications, bank statements, tax returns (1040), 1003 forms, and non-employment income documents.

- Calculated borrower's income, encompassing wage earnings, social security income, child support, Veteran Affairs (VA) disability, and IRA/Pension/Retirement income.

- Evaluated Debt-To-Income ratio (DTI), Loan-To-Value ratio (LTV), Combined Loan-To-Value ratio (CLTV), and addressed mortgage underwriting conditions.

- Utilized Automated Underwriting Systems (AUS) such as Fannie Mae and Freddie Mac.

- Processed and closed an average of 20 conventional and government loans daily.

- Conducted internal audits of loan files to identify errors or mistakes.

- Addressed queries and resolved issues within mortgage files.

Mortgage Underwriter Resume Example

Mortgage Underwriter

- Calculated DTI and LTV ratios, credit scores, asset statements, and third-party reports to ensure compliance with investor guidelines.

- Examined and assessed special conditions, loan deficiencies, and exception requests, determining appropriate actions to resolve investor-related issues.

- Utilized expertise in loan products to assist in restructuring declined loans for subsequent approvals.

- Maintained strong communication and follow-through with borrowers, processors, and originators throughout the loan process.

Senior Mortgage Underwriter Resume Example

Senior Mortgage Underwriter

- Collaborated closely with management to streamline end-to-end processes, from application to clear to close status.

- Identified and mitigated risk while adhering to investor guidelines and regulatory controls.

- Managed application volumes for both new and resubmission cases, ensuring the delivery of high-quality loan packages to investors.

- Conducted New Hire trainings and excelled in peer mentorship, emphasizing fundamental principles in guidelines and cash flow analysis.

- Prioritized meeting SLAs, deadlines, and maintained clear and instructive communication with both internal and external partners.

Mortgage Underwriter Resume Example

Mortgage Underwriter

- Kept abreast of guidelines and procedures for Conventional products to stay current and knowledgeable.

- Thrived in a high-paced environment, making precise loan decisions while effectively managing risk.

- Maintained efficient and clear communication, both verbally and in writing, with colleagues and other departments to ensure a seamless experience for our members.

Mortgage Underwriter Resume Example

Mortgage Underwriter

- Conducted loan file audits, analyzing for Credit, Capacity, Capital, Character, and Collateral, ensuring compliance with program and product specifications.

- In addition to core responsibilities, performed quality checks for team members and provided constructive feedback to ensure error-free results. Monitored and reported on standards and performance targets.

- Maintained daily MIS records, generated daily and monthly reports, and highlighted individual team member status.

Top Mortgage Underwriter Resume Skills for 2023

- Mortgage loan underwriting

- Mortgage lending regulations (e.g., TRID, RESPA)

- Credit analysis and risk assessment

- Loan-to-value (LTV) calculation

- Debt-to-income (DTI) analysis

- Income verification and analysis

- Asset verification and analysis

- Employment verification

- Appraisal review and analysis

- Title search and examination

- Property valuation

- Collateral assessment

- Loan program knowledge (e.g., FHA, VA, conventional)

- Mortgage product guidelines

- Automated underwriting systems (AUS)

- Loan origination software (LOS)

- Mortgage underwriting software proficiency

- Regulatory compliance (e.g., Dodd-Frank, HMDA)

- Mortgage insurance evaluation

- Fraud detection and prevention

- Mortgage underwriting guidelines

- Loan file documentation and organization

- Mortgage application evaluation

- Risk assessment and mitigation

- Loan approval and denial decisions

- Credit score analysis

- Down payment analysis

- Mortgage interest rate determination

- Mortgage pricing adjustments

- Appraisal standards (e.g., USPAP)

- Real estate market analysis

- Mortgage documentation requirements

- Loan closing and funding

- Mortgage insurance premium calculations

- FHA mortgage insurance requirements

- VA loan eligibility and benefits

- USDA loan eligibility and requirements

- Reverse mortgage underwriting

- Jumbo mortgage underwriting

- Private mortgage insurance (PMI)

- Mortgage compliance audits

- Quality control and quality assurance

- Risk management and assessment

- Presentation and communication skills

- Data analysis and interpretation

- Problem-solving abilities

- Time management and organization

- Adaptability and flexibility

- Decision-making skills

- Attention to detail

How Long Should my Mortgage Underwriter Resume be?

Your Mortgage Underwriter resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Mortgage Underwriter, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Mortgage Underwriter Resume

-

What does a Mortgage Underwriter do?

- A Mortgage Underwriter evaluates loan applications to determine if they meet the lender's guidelines and qualify for approval. They assess the borrower's creditworthiness, income, assets, and property value to mitigate risk and ensure compliance with regulatory standards.

-

What qualifications are important for a Mortgage Underwriter position?

- Qualifications typically include a bachelor's degree in finance, economics, business administration, or a related field. Strong analytical skills, attention to detail, knowledge of mortgage lending regulations, and experience with underwriting software are essential.

-

What kind of experience should a Mortgage Underwriter highlight on their resume?

- Experience in mortgage underwriting, including reviewing loan applications, analyzing financial documents, assessing risk factors, and making lending decisions, is crucial for a Mortgage Underwriter. Highlighting proficiency in using underwriting software, conducting risk assessments, and ensuring compliance with lending guidelines can demonstrate relevant experience.

-

How important is it for a Mortgage Underwriter to demonstrate knowledge of mortgage lending regulations on their resume?

- Knowledge of mortgage lending regulations, such as the Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and Dodd-Frank Act, is important for a Mortgage Underwriter. Highlighting experience in ensuring compliance with these regulations and underwriting guidelines can demonstrate the Underwriter's understanding of legal requirements.

-

Should a Mortgage Underwriter include their experience with credit analysis on their resume?

- Yes, mentioning experience with credit analysis, including reviewing credit reports, evaluating borrower credit history, and assessing credit risk, is important for a Mortgage Underwriter. This demonstrates the Underwriter's role in evaluating borrower creditworthiness and making lending decisions.

-

What soft skills are important for a Mortgage Underwriter to highlight on their resume?

- Soft skills such as attention to detail, critical thinking, decision-making, communication, and time management are crucial for a Mortgage Underwriter. These skills contribute to effectively analyzing loan applications, communicating with borrowers and stakeholders, and meeting underwriting deadlines.

-

Is it necessary for a Mortgage Underwriter to mention their experience with property valuation on their resume?

- Yes, mentioning experience with property valuation, including reviewing property appraisals, assessing property value, and evaluating collateral risk, is important for a Mortgage Underwriter. This demonstrates the Underwriter's role in ensuring that the property meets lending guidelines and mitigating risk for the lender.

-

How should a Mortgage Underwriter tailor their resume for different types of mortgage loans (e.g., conventional, FHA, VA)?

- A Mortgage Underwriter should highlight experience and skills relevant to the specific types of mortgage loans they have underwritten, whether it's conventional loans, FHA loans, VA loans, or others. Emphasizing familiarity with program-specific guidelines, eligibility requirements, and underwriting criteria can be beneficial.

-

Should a Mortgage Underwriter include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework related to finance, economics, or mortgage underwriting is important for a Mortgage Underwriter. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can a Mortgage Underwriter make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful underwriting decisions, any relevant certifications or awards, or extracurricular involvement can enhance the overall presentation of the resume.

Copyright ©2025 Workstory Inc.