Loan Specialist Resume Examples and Templates

This page provides you with Loan Specialist resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Loan Specialist resume.

What do Hiring Managers look for in a Loan Specialist Resume

- Loan Processing Expertise: Strong knowledge of loan application processes, underwriting guidelines, and loan documentation.

- Attention to Detail: Meticulousness in reviewing loan applications, verifying information, and ensuring accuracy in documentation.

- Communication Skills: Effective communication with borrowers, lenders, and other stakeholders throughout the loan process.

- Analytical Abilities: Proficiency in financial analysis, credit assessment, and risk evaluation.

- Regulatory Compliance: Knowledge of lending regulations, compliance requirements, and adherence to lending standards.

How to Write a Loan Specialist Resume?

To write a professional Loan Specialist resume, follow these steps:

- Select the right Loan Specialist resume template.

- Write a professional summary at the top explaining your Loan Specialist’s experience and achievements.

- Follow the STAR method while writing your Loan Specialist resume’s work experience. Show what you were responsible for and what you achieved as a Loan Specialist.

- List your top Loan Specialist skills in a separate skills section.

How to Write Your Loan Specialist Resume Header?

Write the perfect Loan Specialist resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Loan Specialist position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Loan Specialist resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Loan Specialist Resume Example - Header Section

Eve 9 W. Wakehurst St. Mount Vernon, NY 10550 Marital Status: Married, email: cooldude2022@gmail.com

Good Loan Specialist Resume Example - Header Section

Eve Beltran, Mount Vernon, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Loan Specialist email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Loan Specialist Resume Summary?

Use this template to write the best Loan Specialist resume summary: Loan Specialist with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Loan Specialist Resume Experience Section?

Here’s how you can write a job winning Loan Specialist resume experience section:

- Write your Loan Specialist work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Loan Specialist work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Loan Specialist).

- Use action verbs in your bullet points.

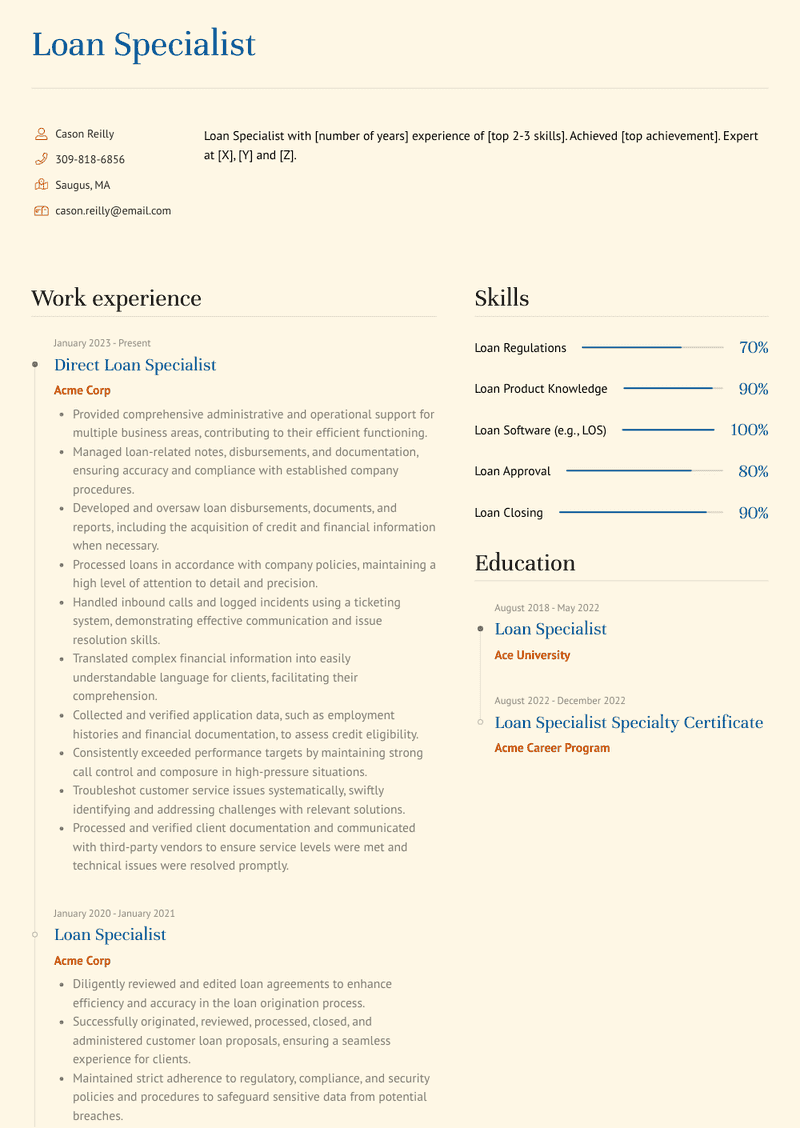

Direct Loan Specialist Resume Example

Direct Loan Specialist

- Provided comprehensive administrative and operational support for multiple business areas, contributing to their efficient functioning.

- Managed loan-related notes, disbursements, and documentation, ensuring accuracy and compliance with established company procedures.

- Developed and oversaw loan disbursements, documents, and reports, including the acquisition of credit and financial information when necessary.

- Processed loans in accordance with company policies, maintaining a high level of attention to detail and precision.

- Handled inbound calls and logged incidents using a ticketing system, demonstrating effective communication and issue resolution skills.

- Translated complex financial information into easily understandable language for clients, facilitating their comprehension.

- Collected and verified application data, such as employment histories and financial documentation, to assess credit eligibility.

- Consistently exceeded performance targets by maintaining strong call control and composure in high-pressure situations.

- Troubleshot customer service issues systematically, swiftly identifying and addressing challenges with relevant solutions.

- Processed and verified client documentation and communicated with third-party vendors to ensure service levels were met and technical issues were resolved promptly.

Mortgage Loan Specialist Resume Example

Mortgage Loan Specialist

- Developed and nurtured long-term relationships with Developer Staff, Agents, Lawyers, and Valuers to foster consistent business interactions and explore new opportunities.

- Provided expert mortgage loan advice and tailored solutions to meet the unique needs of prospects, addressing inquiries related to housing loan knowledge, Debt-Service Ratio (DSR) calculations, and loan margin to safeguard customers' interests.

- Presented a diverse range of wealth plans to satisfy prospect demands, encompassing savings plans, protection plans, unit trusts, and premier banking support.

- Collaborated with other teams to boost overall performance and achieve targets, actively participating in various training programs and courses offered by the bank to stay updated on the latest financial trends in the country and understand customer risk appetite.

- Monitored and tracked the status of customer loans to ensure timely disbursement and prevent delays.

- Liaised with the credit team to ensure that customer profiles aligned with the bank's current guidelines and standards.

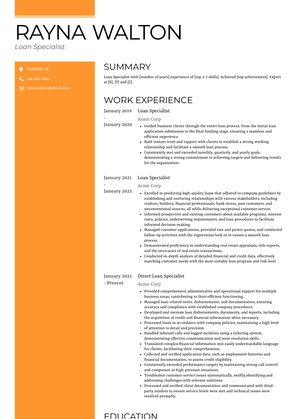

Loan Specialist Resume Example

Loan Specialist

- Excelled in producing high-quality loans that adhered to company guidelines by establishing and nurturing relationships with various stakeholders, including realtors, builders, financial professionals, bank stores, past customers, and unconventional sources, all while delivering exceptional customer service.

- Informed prospective and existing customers about available programs, interest rates, policies, underwriting requirements, and loan procedures to facilitate informed decision-making.

- Managed customer applications, provided rate and points quotes, and conducted follow-up activities with the registration lock-in to ensure a smooth loan process.

- Demonstrated proficiency in understanding real estate appraisals, title reports, and the intricacies of real estate transactions.

- Conducted in-depth analysis of detailed financial and credit data, effectively matching customer needs with the most suitable loan program and risk level.

Loan Specialist Resume Example

Loan Specialist

- Diligently reviewed and edited loan agreements to enhance efficiency and accuracy in the loan origination process.

- Successfully originated, reviewed, processed, closed, and administered customer loan proposals, ensuring a seamless experience for clients.

- Maintained strict adherence to regulatory, compliance, and security policies and procedures to safeguard sensitive data from potential breaches.

- Proactively identified and implemented solutions for customers facing credit issues, demonstrating a commitment to assisting clients in challenging financial situations.

Loan Specialist Resume Example

Loan Specialist

- Guided business clients through the entire loan process, from the initial loan application submission to the final funding stage, ensuring a seamless and efficient experience.

- Built instant trust and rapport with clients to establish a strong working relationship and facilitate a smooth loan process.

- Consistently met and exceeded monthly, quarterly, and yearly goals, demonstrating a strong commitment to achieving targets and delivering results for the organization.

Top Loan Specialist Resume Skills for 2023

- Loan Processing

- Credit Analysis

- Loan Origination

- Loan Underwriting

- Loan Documentation

- Loan Closing

- Loan Servicing

- Mortgage Lending

- Consumer Lending

- Loan Compliance

- Loan Approval

- Loan Portfolio Management

- Loan Review

- Loan Modifications

- Loan Application Review

- Loan Due Diligence

- Loan Disbursement

- Loan Monitoring

- Loan Default Management

- Loan Risk Assessment

- Loan Data Analysis

- Loan Decision Making

- Loan Product Knowledge

- Loan Software (e.g., LOS)

- Loan Regulations

- Loan Processing Tools

- Loan Audits

- Loan Repayment

- Loan Documentation Review

- Loan Quality Assurance

- Loan Customer Service

- Loan Payment Processing

- Loan Interest Calculation

- Loan Rate Lock

- Loan Funding

- Loan Portfolio Analysis

- Loan Application Assistance

- Loan Compliance Audits

- Loan Program Evaluation

- Communication Skills (Loan)

- Problem Solving (Loan)

- Attention to Detail (Loan)

- Time Management (Loan)

- Team Collaboration (Loan)

- Loan Application Tracking

- Loan Processing Efficiency

- Loan Decision Support

- Loan File Management

- Loan Disbursement Procedures

- Loan Product Development

How Long Should my Loan Specialist Resume be?

Your Loan Specialist resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Loan Specialist, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.