Loan Manager Resume Examples and Templates

This page provides you with Loan Manager resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Loan Manager resume.

How to Write a Loan Manager Resume?

To write a professional Loan Manager resume, follow these steps:

- Select the right Loan Manager resume template.

- Write a professional summary at the top explaining your Loan Manager’s experience and achievements.

- Follow the STAR method while writing your Loan Manager resume’s work experience. Show what you were responsible for and what you achieved as a Loan Manager.

- List your top Loan Manager skills in a separate skills section.

How to Write Your Loan Manager Resume Header?

Write the perfect Loan Manager resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Loan Manager to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Loan Manager resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Loan Manager Resume Example - Header Section

Belinda 7598 Old Manor St. Saugus, MA 01906 Marital Status: Married, email: cooldude2022@gmail.com

Good Loan Manager Resume Example - Header Section

Belinda Thompson, Saugus, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Loan Manager email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Loan Manager Resume Summary?

Use this template to write the best Loan Manager resume summary: Loan Manager with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

Example Summary for a Loan Officer Resume

A highly motivated and results-driven Loan Officer with 12 years of experience in the mortgage industry. Seeking to utilize my skills in credit analysis, communication, and relationship building to help borrowers achieve their homeownership dreams.

Mortgage Loan Officer Resume Summary Example

Experienced Loan Officer with a successful track record of providing exceptional customer service, analyzing financial information, and recommending loan solutions to clients. Seeking to leverage my skills and experience to contribute to the success of a financial institution.

How to Write a Loan Manager Resume Experience Section?

Here’s how you can write a job winning Loan Manager resume experience section:

- Write your Loan Manager work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Loan Manager work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Loan Manager).

- Use action verbs in your bullet points.

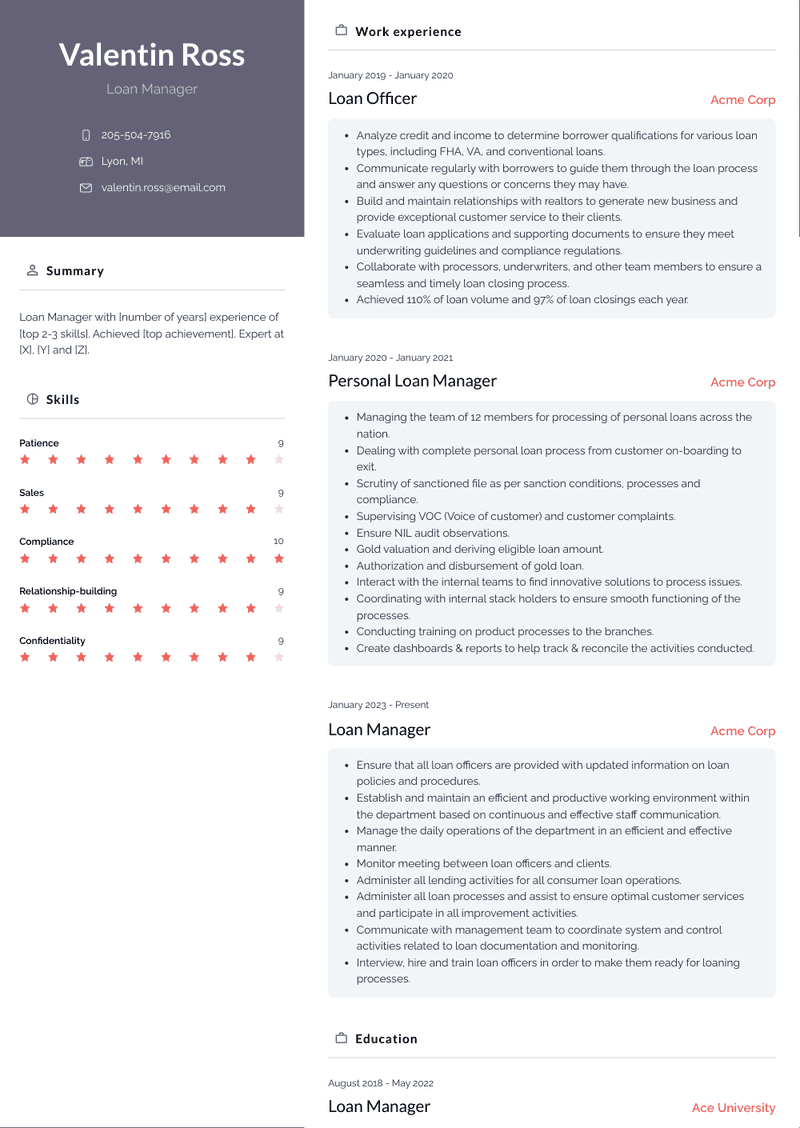

Loan Manager Resume Example

Loan Manager

- Ensure that all loan officers are provided with updated information on loan policies and procedures.

- Establish and maintain an efficient and productive working environment within the department based on continuous and effective staff communication.

- Manage the daily operations of the department in an efficient and effective manner.

- Monitor meeting between loan officers and clients.

- Administer all lending activities for all consumer loan operations.

- Administer all loan processes and assist to ensure optimal customer services and participate in all improvement activities.

- Communicate with management team to coordinate system and control activities related to loan documentation and monitoring.

- Interview, hire and train loan officers in order to make them ready for loaning processes.

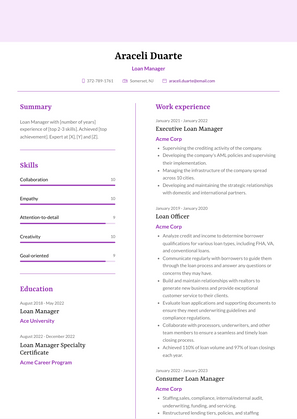

Consumer Loan Manager Resume Example

Consumer Loan Manager

- Staffing,sales, compliance, internal/external audit, underwriting, funding, and servicing.

- Restructured lending tiers, policies, and staffing resulting in an indirect volume increase of 120% per month.

- Implemented an outbound calling onboarding program to deepen member relationships.

- Identified issues between front-end and back-end systems, researched problems, and communicated with appropriate areas for correction.

- Coordinated underwriting, funding, and servicing of $450MM loan portfolio.

- Implemented two loan origination systems including the the development of auto approval matrices and core system integration.

- Implemented and maintained portfolio analytic software detailing reports for internal and external audit.

Executive Loan Manager Resume Example

Executive Loan Manager

- Supervising the crediting activity of the company.

- Developing the company's AML policies and supervising their implementation.

- Managing the infrastructure of the company spread across 10 cities.

- Developing and maintaining the strategic relationships with domestic and international partners.

Personal Loan Manager Resume Example

Personal Loan Manager

- Managing the team of 12 members for processing of personal loans across the nation.

- Dealing with complete personal loan process from customer on-boarding to exit.

- Scrutiny of sanctioned file as per sanction conditions, processes and compliance.

- Supervising VOC (Voice of customer) and customer complaints.

- Ensure NIL audit observations.

- Gold valuation and deriving eligible loan amount.

- Authorization and disbursement of gold loan.

- Interact with the internal teams to find innovative solutions to process issues.

- Coordinating with internal stack holders to ensure smooth functioning of the processes.

- Conducting training on product processes to the branches.

- Create dashboards & reports to help track & reconcile the activities conducted.

Loan Officer Resume Example

Loan Officer

- Analyze credit and income to determine borrower qualifications for various loan types, including FHA, VA, and conventional loans.

- Communicate regularly with borrowers to guide them through the loan process and answer any questions or concerns they may have.

- Build and maintain relationships with realtors to generate new business and provide exceptional customer service to their clients.

- Evaluate loan applications and supporting documents to ensure they meet underwriting guidelines and compliance regulations.

- Collaborate with processors, underwriters, and other team members to ensure a seamless and timely loan closing process.

- Achieved 110% of loan volume and 97% of loan closings each year.

Top Loan Manager Resume Skills for 2023

- Analysis

- Sales

- Customer service

- Communication

- Relationship-building

- Attention-to-detail

- Compliance

- Risk management

- Financial literacy

- Organization

- Problem-solving

- Multi-tasking

- Time management

- Follow-up

- Negotiation

- Networking

- Collaboration

- Persistence

- Flexibility

- Adaptability

- Creativity

- Leadership

- Empathy

- Patience

- Confidentiality

- Integrity

- Accuracy

- Efficiency

- Resourcefulness

- Sales forecasting

- Analytical thinking

- Solution-oriented

- Goal-oriented

- Consultation

- Closing skills

- Presentation skills

- Marketing

- Sales strategies

- Client assessment

- Documentation expertise

How Long Should my Loan Manager Resume be?

Your Loan Manager resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Loan Manager, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my loan management experience on a Loan Manager resume?

To highlight your loan management experience, focus on your ability to oversee the loan application process, manage client relationships, and ensure compliance with lending regulations. Include examples of how you’ve managed loan portfolios, improved loan approval rates, and worked with underwriters to assess borrower risk. Mention your expertise in financial analysis and your ability to meet lending targets.

What are the key skills to feature on a Loan Manager resume?

Key skills to feature include loan origination, risk assessment, financial analysis, and regulatory compliance. Additionally, highlight your ability to manage client relationships, your expertise with loan management software, and your knowledge of lending policies and procedures. Emphasize your negotiation skills, attention to detail, and your ability to handle complex loan processes.

How do I demonstrate my ability to manage a loan portfolio on my resume?

Demonstrate your ability to manage a loan portfolio by providing examples of the types and volumes of loans you’ve handled, such as personal, mortgage, or business loans. Mention how you’ve monitored loan performance, identified risk factors, and taken corrective actions to mitigate defaults. Highlight your role in ensuring timely loan approvals, maintaining portfolio quality, and achieving growth targets.

Should I include metrics on my Loan Manager resume? If so, what kind?

Yes, including metrics is important to quantify your contributions. For example, you could mention the size of the loan portfolio you’ve managed, the increase in loan approval rates, or the reduction in default rates. Metrics such as improved client satisfaction, increased loan origination, or the percentage of loans closed on time provide tangible evidence of your effectiveness as a Loan Manager.

How can I showcase my experience with regulatory compliance on my resume?

You can showcase your experience by detailing your knowledge of lending regulations such as TILA, RESPA, or HMDA. Provide examples of how you’ve ensured compliance with federal and state laws throughout the loan approval process. Mention any experience you have in conducting audits, preparing reports for regulators, or implementing compliance training for your team to avoid violations and penalties.

What kind of achievements should I highlight as a Loan Manager?

Highlight achievements such as growing the loan portfolio, reducing loan delinquency rates, or achieving high loan approval rates. You could also mention any recognition you received for exceeding sales targets, optimizing loan processes, or improving borrower satisfaction. Achievements that demonstrate your ability to meet business goals while maintaining compliance are particularly valuable.

How do I address a lack of formal loan management experience on a Loan Manager resume?

If you lack formal experience, focus on transferable skills such as financial analysis, customer service, and risk management. Mention any experience you have in handling loan applications, processing financial documents, or working in a lending or banking environment. Highlight your attention to detail, ability to follow lending guidelines, and any relevant coursework or certifications in finance or loan processing.

How important is experience with financial analysis for a Loan Manager role?

Experience with financial analysis is highly important for a Loan Manager, as it ensures your ability to assess borrower risk and make informed lending decisions. Highlight your ability to analyze financial statements, calculate debt-to-income ratios, and assess creditworthiness. Mention any experience in developing loan strategies, minimizing risk, and ensuring profitability through sound financial analysis.

How do I demonstrate my ability to manage client relationships on my resume?

Demonstrate your ability to manage client relationships by describing how you’ve worked with borrowers throughout the loan application process. Mention your role in advising clients on loan products, negotiating terms, and ensuring a positive client experience. Highlight your communication skills, your ability to build trust, and your experience in resolving client concerns or questions efficiently.

Should I include certifications on my Loan Manager resume?

Yes, including certifications can enhance your resume by demonstrating your qualifications and commitment to professional development. Certifications such as Certified Mortgage Banker (CMB), Certified Loan Officer, or training in financial analysis or lending regulations can add significant value to your resume and make you stand out to potential employers.

-

How can I highlight my loan management experience on a Loan Manager resume?

-

What are the key skills to feature on a Loan Manager resume?

-

How do I demonstrate my ability to manage a loan portfolio on my resume?

-

Should I include metrics on my Loan Manager resume? If so, what kind?

-

How can I showcase my experience with regulatory compliance on my resume?

-

What kind of achievements should I highlight as a Loan Manager?

-

How do I address a lack of formal loan management experience on a Loan Manager resume?

-

How important is experience with financial analysis for a Loan Manager role?

-

How do I demonstrate my ability to manage client relationships on my resume?

Copyright ©2025 Workstory Inc.