Investment Banking Analyst Resume Examples and Templates

This page provides you with Investment Banking Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Investment Banking Analyst resume.

What do Hiring Managers look for in an Investment Banking Analyst Resume

- Financial Acumen: Strong understanding of financial concepts, financial modeling, and valuation methods.

- Analytical Skills: Proficiency in data analysis and the ability to assess investment opportunities and risks.

- Attention to Detail: Meticulousness in preparing financial reports, pitch materials, and investment presentations.

- Communication Skills: Effective communication with clients, colleagues, and stakeholders to convey investment recommendations.

- Teamwork: Capability to work collaboratively within a team on complex financial transactions and projects.

How to Write an Investment Banking Analyst Resume?

To write a professional Investment Banking Analyst resume, follow these steps:

- Select the right Investment Banking Analyst resume template.

- Write a professional summary at the top explaining your Investment Banking Analyst’s experience and achievements.

- Follow the STAR method while writing your Investment Banking Analyst resume’s work experience. Show what you were responsible for and what you achieved as an Investment Banking Analyst.

- List your top Investment Banking Analyst skills in a separate skills section.

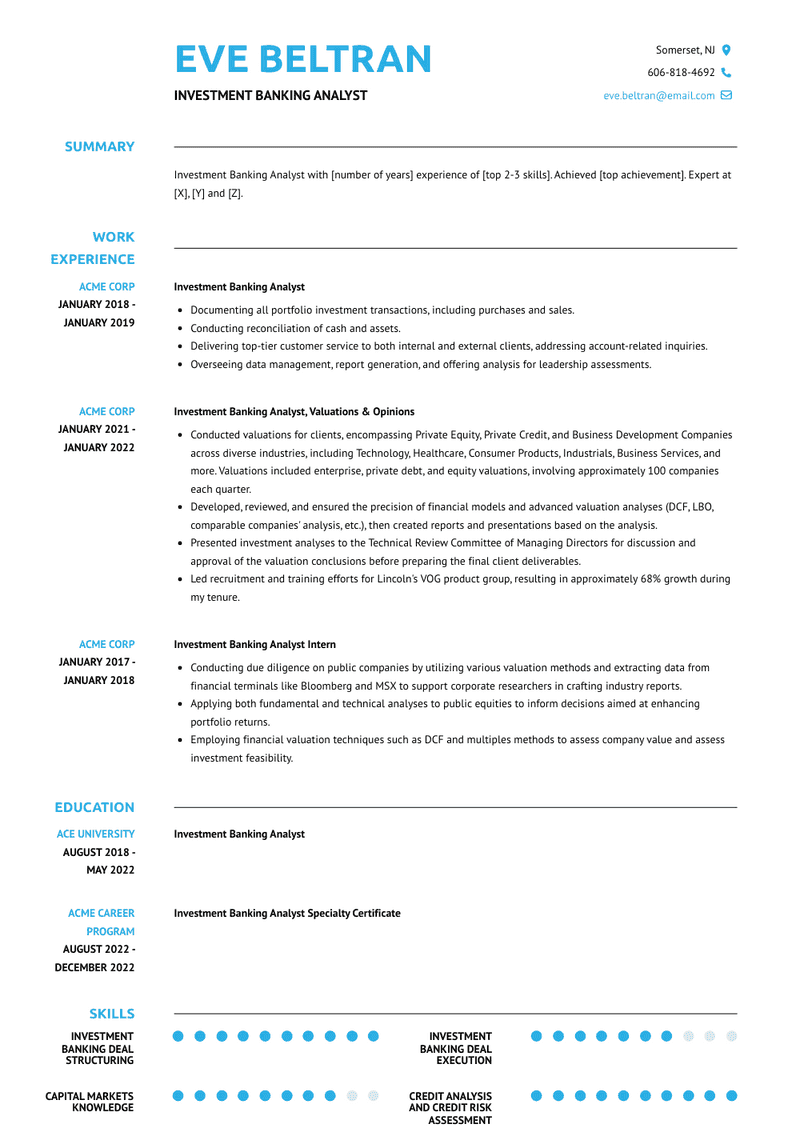

How to Write Your Investment Banking Analyst Resume Header?

Write the perfect Investment Banking Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Investment Banking Analyst position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Investment Banking Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Investment Banking Analyst Resume Example - Header Section

Eve 682 Fifth St. South Plainfield, NJ 07080 Marital Status: Married, email: cooldude2022@gmail.com

Good Investment Banking Analyst Resume Example - Header Section

Eve Beltran, Plainfield, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Investment Banking Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Investment Banking Analyst Resume Summary?

Use this template to write the best Investment Banking Analyst resume summary: Investment Banking Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write an Investment Banking Analyst Resume Experience Section?

Here’s how you can write a job winning Investment Banking Analyst resume experience section:

- Write your Investment Banking Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Investment Banking Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Investment Banking Analyst).

- Use action verbs in your bullet points.

Investment Banking Analyst Resume Example

Investment Banking Analyst

- Calculate Initial and Variation Margin using SIMM, GRID, and AANA methods.

- Engage in non-centrally cleared derivatives trading.

- Handle trade documentation like ISDAs and Sleeve agreements.

- Manage collateral documentation, including Collateral Schedules, CSAs, and CSDs.

- Collaborate regularly with clients, sales, and legal teams to identify the most suitable remediation approach for each client, ensuring compliance before regulatory deadlines.

- Conduct in-depth analysis of clients' accounts and trading documentation to assess the need for monitoring or revising trade documentation.

Investment Banking Analyst Resume Example

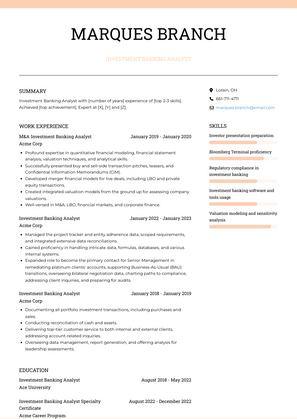

Investment Banking Analyst

- Managed the project tracker and entity adherence data, scoped requirements, and integrated extensive data reconciliations.

- Gained proficiency in handling intricate data, formulas, databases, and various internal systems.

- Expanded role to become the primary contact for Senior Management in remediating platinum clients' accounts, supporting Business-As-Usual (BAU) transitions, overseeing bilateral negotiation data, charting paths to compliance, addressing client inquiries, and preparing for audits.

Investment Banking Analyst, Valuations & Opinions Resume Example

Investment Banking Analyst, Valuations & Opinions

- Conducted valuations for clients, encompassing Private Equity, Private Credit, and Business Development Companies across diverse industries, including Technology, Healthcare, Consumer Products, Industrials, Business Services, and more. Valuations included enterprise, private debt, and equity valuations, involving approximately 100 companies each quarter.

- Developed, reviewed, and ensured the precision of financial models and advanced valuation analyses (DCF, LBO, comparable companies' analysis, etc.), then created reports and presentations based on the analysis.

- Presented investment analyses to the Technical Review Committee of Managing Directors for discussion and approval of the valuation conclusions before preparing the final client deliverables.

- Led recruitment and training efforts for Lincoln's VOG product group, resulting in approximately 68% growth during my tenure.

Investment Banking Analyst Resume Example

Investment Banking Analyst

- Successfully closed a syndicated loan financing AMX's acquisition of PCFT in Acquisition Finance.

- Managed and coordinated projects in collaboration with local/foreign advisors and other banks.

- Conducted market research to identify potential leads and business opportunities, including financial analysis of companies, assessing financial health, leverage, and liquidity.

- Constructed financial models to project P&L, liquidity, and lending viability.

- Took a leadership role in Corporate lending deals, starting from the initial stages. This included developing business analysis, creating financial models, leading internal negotiations, presenting to the credit risk department, and negotiating final documentation with companies.

M&A Investment Banking Analyst Resume Example

M&A Investment Banking Analyst

- Profound expertise in quantitative financial modeling, financial statement analysis, valuation techniques, and analytical skills.

- Successfully presented buy and sell-side transaction pitches, teasers, and Confidential Information Memorandums (CIM).

- Developed merger financial models for live deals, including LBO and private equity transactions.

- Created integrated valuation models from the ground up for assessing company valuations.

- Well-versed in M&A, LBO, financial markets, and corporate finance.

Investment Banking Analyst Resume Example

Investment Banking Analyst

- Documenting all portfolio investment transactions, including purchases and sales.

- Conducting reconciliation of cash and assets.

- Delivering top-tier customer service to both internal and external clients, addressing account-related inquiries.

- Overseeing data management, report generation, and offering analysis for leadership assessments.

Investment Banking Analyst Intern Resume Example

Investment Banking Analyst Intern

- Conducting due diligence on public companies by utilizing various valuation methods and extracting data from financial terminals like Bloomberg and MSX to support corporate researchers in crafting industry reports.

- Applying both fundamental and technical analyses to public equities to inform decisions aimed at enhancing portfolio returns.

- Employing financial valuation techniques such as DCF and multiples methods to assess company value and assess investment feasibility.

Top Investment Banking Analyst Resume Skills for 2023

- Financial modeling and valuation

- Financial statement analysis

- Excel proficiency (advanced functions and macros)

- Equity research and analysis

- Investment analysis and due diligence

- Business and industry research

- Market research and trend analysis

- Company valuation methods (e.g., DCF, comps)

- Mergers and acquisitions (M&A) analysis

- Initial public offering (IPO) preparation

- Investment pitch book creation

- Capital markets knowledge

- Financial data analysis and interpretation

- Investment risk assessment

- Investment memorandum preparation

- Private placement and capital raising

- Pitching and presenting investment opportunities

- Investment banking software and tools usage

- Bloomberg Terminal proficiency

- Financial modeling software (e.g., Wall Street Prep)

- Leveraged buyout (LBO) analysis

- Financial due diligence and audit support

- Investment committee documentation

- Regulatory compliance in investment banking

- Capital structure analysis

- Debt and equity financing strategies

- Investment research reports writing

- Investment banking pitch development

- Valuation modeling and sensitivity analysis

- Financial statement projection modeling

- Investment banking deal execution

- Investment banking industry knowledge

- Data analysis and visualization tools (e.g., Tableau)

- Equity and debt offering documentation

- Investment banking legal documentation

- Investor presentation preparation

- Investment banking pitch delivery

- Financial market trends analysis

- Financial derivatives knowledge (e.g., options, swaps)

- Investment banking deal structuring

- Investment banking regulatory knowledge (e.g., SEC)

- Investment banking deal negotiation

- Investment banking transaction support

- Investment banking relationship management

- Financial modeling for mergers and acquisitions

- Credit analysis and credit risk assessment

- Investment banking compliance and ethics

- Investment banking project management

- Financial risk management

How Long Should my Investment Banking Analyst Resume be?

Your Investment Banking Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Investment Banking Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as an Investment Banking Analyst on my resume?

Focus on your expertise in financial modeling, valuation, and deal execution. Highlight your role in supporting mergers and acquisitions (M&A), capital raising, and conducting market research to advise clients on financial strategies.

What are the key skills to feature on an Investment Banking Analyst's resume?

Emphasize skills in financial analysis, valuation techniques (e.g., DCF, LBO, comparable company analysis), Excel proficiency, and industry research. Highlight your ability to assist in deal structuring, perform due diligence, and create pitchbooks for clients.

How do I demonstrate my ability to perform financial analysis on my resume?

Provide examples of financial models you've built, including valuations, merger models, or debt structuring. Highlight your experience in analyzing financial statements and making projections that guided investment decisions or supported M&A transactions.

Should I include metrics on my Investment Banking Analyst resume? If so, what kind?

Yes, include metrics such as the value of deals you contributed to, improvements in financial forecasts, or the number of successful transactions you supported. These metrics help quantify your impact in driving deal success.

How can I showcase my experience with mergers and acquisitions (M&A) on my resume?

Detail your role in conducting due diligence, performing company valuations, and preparing deal documents for M&A transactions. Highlight your involvement in supporting negotiations, structuring deals, and closing transactions.

What kind of achievements should I highlight as an Investment Banking Analyst?

Highlight achievements such as contributing to high-profile deals, improving financial models, or being recognized for delivering accurate financial insights. Mention any awards or commendations for your role in successful deals or financial advisory.

How do I address a lack of experience in a specific area of investment banking on my resume?

Emphasize your analytical skills, problem-solving abilities, and adaptability. Highlight any relevant coursework, internships, or personal projects that demonstrate your capability to quickly learn and contribute to investment banking functions.

How important is collaboration for an Investment Banking Analyst role?

Collaboration is essential for working with senior bankers, legal teams, and clients. Highlight your experience in supporting deal teams, coordinating with different departments, and ensuring smooth execution of transactions.

How do I demonstrate my ability to create pitchbooks on my resume?

Mention specific examples where you developed pitchbooks for clients, focusing on financial projections, market research, and valuation summaries. Highlight your role in presenting actionable financial insights and recommendations to clients.

Should I include certifications on my Investment Banking Analyst resume?

Yes, include relevant certifications such as Chartered Financial Analyst (CFA), Financial Modeling & Valuation Analyst (FMVA), or Series 79 license. These certifications demonstrate your expertise in financial analysis and commitment to the investment banking field.

-

What do Hiring Managers look for in an Investment Banking Analyst Resume

-

How to Write a Professional Investment Banking Analyst Resume Summary?

-

How to Write an Investment Banking Analyst Resume Experience Section?

-

Investment Banking Analyst, Valuations & Opinions Resume Example

-

How can I highlight my experience as an Investment Banking Analyst on my resume?

-

What are the key skills to feature on an Investment Banking Analyst's resume?

-

How do I demonstrate my ability to perform financial analysis on my resume?

-

Should I include metrics on my Investment Banking Analyst resume? If so, what kind?

-

How can I showcase my experience with mergers and acquisitions (M&A) on my resume?

-

What kind of achievements should I highlight as an Investment Banking Analyst?

-

How do I address a lack of experience in a specific area of investment banking on my resume?

-

How important is collaboration for an Investment Banking Analyst role?

-

How do I demonstrate my ability to create pitchbooks on my resume?

-

Should I include certifications on my Investment Banking Analyst resume?

Copyright ©2025 Workstory Inc.