Fixed Asset Accountant Resume Examples and Templates

This page provides you with Fixed Asset Accountant resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Fixed Asset Accountant resume.

What do Hiring Managers look for in a Fixed Asset Accountant Resume

- Accounting Expertise: Proficiency in accounting principles, especially related to fixed assets and depreciation.

- Attention to Detail: Strong focus on accuracy in tracking, recording, and reconciling fixed assets.

- Analytical Skills: Ability to analyze and report on fixed asset data, including depreciation schedules.

- Financial Reporting: Skill in preparing financial statements and reports related to fixed assets.

- Compliance Knowledge: Understanding of relevant accounting regulations and standards (e.g., GAAP, IFRS).

How to Write a Fixed Asset Accountant Resume?

To write a professional Fixed Asset Accountant resume, follow these steps:

- Select the right Fixed Asset Accountant resume template.

- Write a professional summary at the top explaining your Fixed Asset Accountant’s experience and achievements.

- Follow the STAR method while writing your Fixed Asset Accountant resume’s work experience. Show what you were responsible for and what you achieved as a Fixed Asset Accountant.

- List your top Fixed Asset Accountant skills in a separate skills section.

How to Write Your Fixed Asset Accountant Resume Header?

Write the perfect Fixed Asset Accountant resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Fixed Asset Accountant position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Fixed Asset Accountant resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Fixed Asset Accountant Resume Example - Header Section

Taylor 682 Fifth St. South Plainfield, NJ 07080 Marital Status: Married, email: cooldude2022@gmail.com

Good Fixed Asset Accountant Resume Example - Header Section

Taylor Malone, Plainfield, NJ, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Fixed Asset Accountant email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Fixed Asset Accountant Resume Summary?

Use this template to write the best Fixed Asset Accountant resume summary: Fixed Asset Accountant with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Fixed Asset Accountant Resume Experience Section?

Here’s how you can write a job winning Fixed Asset Accountant resume experience section:

- Write your Fixed Asset Accountant work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Fixed Asset Accountant work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Fixed Asset Accountant).

- Use action verbs in your bullet points.

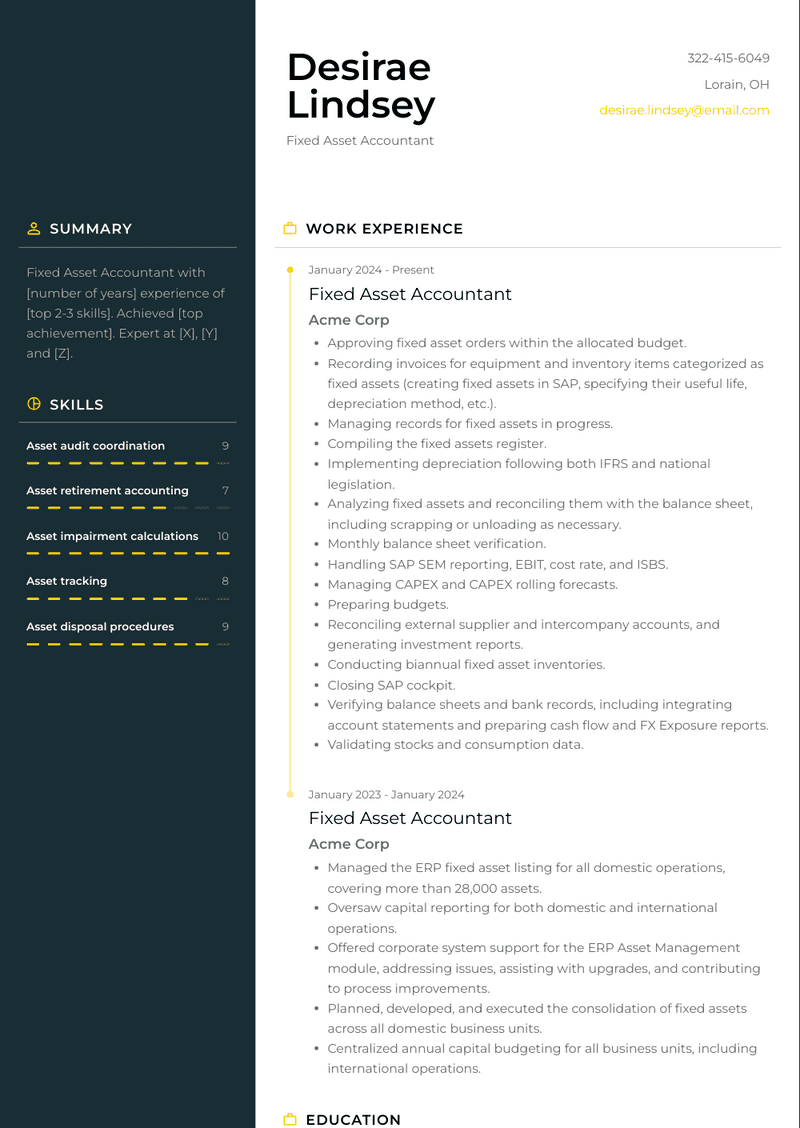

Fixed Asset Accountant Resume Example

Fixed Asset Accountant

- Approving fixed asset orders within the allocated budget.

- Recording invoices for equipment and inventory items categorized as fixed assets (creating fixed assets in SAP, specifying their useful life, depreciation method, etc.).

- Managing records for fixed assets in progress.

- Compiling the fixed assets register.

- Implementing depreciation following both IFRS and national legislation.

- Analyzing fixed assets and reconciling them with the balance sheet, including scrapping or unloading as necessary.

- Monthly balance sheet verification.

- Handling SAP SEM reporting, EBIT, cost rate, and ISBS.

- Managing CAPEX and CAPEX rolling forecasts.

- Preparing budgets.

- Reconciling external supplier and intercompany accounts, and generating investment reports.

- Conducting biannual fixed asset inventories.

- Closing SAP cockpit.

- Verifying balance sheets and bank records, including integrating account statements and preparing cash flow and FX Exposure reports.

- Validating stocks and consumption data.

Fixed Asset Accountant Resume Example

Fixed Asset Accountant

- Managed the ERP fixed asset listing for all domestic operations, covering more than 28,000 assets.

- Oversaw capital reporting for both domestic and international operations.

- Offered corporate system support for the ERP Asset Management module, addressing issues, assisting with upgrades, and contributing to process improvements.

- Planned, developed, and executed the consolidation of fixed assets across all domestic business units.

- Centralized annual capital budgeting for all business units, including international operations.

Top Fixed Asset Accountant Resume Skills for 2023

- Fixed asset accounting

- Asset tracking

- Asset valuation

- Depreciation calculations

- Asset impairment testing

- Capitalization policy adherence

- Asset acquisition accounting

- Asset disposal accounting

- Asset retirement accounting

- Asset ledger maintenance

- Asset reconciliation

- Asset data entry

- Asset tagging

- Asset register management

- Asset audit preparation

- Asset categorization

- Asset coding and numbering

- Asset software proficiency

- IFRS (International Financial Reporting Standards) knowledge

- GAAP (Generally Accepted Accounting Principles) knowledge

- Cost allocation

- Capital expenditure analysis

- Lease accounting (e.g., ASC 842)

- Asset impairment assessments

- Asset impairment calculations

- Asset depreciation methods (e.g., straight-line, MACRS)

- Asset disposal procedures

- Asset retirement procedures

- Asset documentation

- Asset transfer accounting

- Asset maintenance records

- Asset forecasting

- Fixed asset reports generation

- Fixed asset software customization

- Fixed asset system integration

- Fixed asset data analysis

- Asset tagging software

- Barcoding for asset tracking

- Asset audit coordination

- Asset database management

- Asset tagging best practices

- Asset audit trails

- Asset insurance management

- Asset disposal approval processes

- Tax depreciation calculations

- Tax compliance for fixed assets

- Inventory control and reconciliation

- Internal controls for fixed assets

- Capital budgeting

- Financial statement analysis

How Long Should my Fixed Asset Accountant Resume be?

Your Fixed Asset Accountant resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Fixed Asset Accountant, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as a Fixed Asset Accountant on my resume?

To highlight your fixed asset accounting experience, focus on your ability to track, manage, and record fixed assets for the organization. Include examples of how you’ve maintained asset registers, performed asset capitalization, and ensured accurate depreciation calculations. Mention your role in conducting asset audits, preparing asset-related financial reports, and ensuring compliance with accounting standards such as GAAP or IFRS.

What are the key skills to feature on a Fixed Asset Accountant resume?

Key skills to feature include fixed asset management, asset tracking, depreciation calculations, financial reporting, and experience with accounting software like SAP, Oracle, or QuickBooks. Additionally, highlight your attention to detail, ability to reconcile asset accounts, and knowledge of capital expenditure (CAPEX) processes. Emphasize your organizational skills, accuracy, and familiarity with asset valuation and impairment processes.

How do I demonstrate my ability to manage fixed assets on my resume?

Demonstrate your ability to manage fixed assets by providing examples of how you’ve tracked purchases, maintained asset records, and ensured accurate asset classification. Mention your experience with capitalizing assets, recording acquisitions, and conducting physical asset audits. Highlight your ability to work with asset registers and reconcile fixed asset accounts with the general ledger.

Should I include metrics on my Fixed Asset Accountant resume? If so, what kind?

Yes, including metrics can help quantify your impact. For example, you could mention the number of assets you’ve tracked, the total value of the fixed asset portfolio you’ve managed, or the percentage of accuracy improvements in asset records. Metrics such as reducing discrepancies in asset reporting, optimizing depreciation schedules, or improving asset audit compliance provide tangible evidence of your effectiveness as a Fixed Asset Accountant.

How can I showcase my experience with asset depreciation on my resume?

You can showcase your experience by detailing how you’ve calculated and recorded depreciation using straight-line or other methods (e.g., declining balance). Provide examples of how you’ve ensured accurate depreciation schedules, applied asset life cycles, and adjusted depreciation rates based on asset use or condition. Highlight your ability to manage large volumes of assets while maintaining compliance with relevant accounting standards.

What kind of achievements should I highlight as a Fixed Asset Accountant?

Highlight achievements such as improving fixed asset tracking processes, implementing new asset management systems, or reducing discrepancies in asset records. You could also mention any recognition you’ve received for increasing audit readiness, optimizing depreciation schedules, or successfully conducting large-scale asset audits. Achievements that demonstrate your ability to manage fixed assets accurately and efficiently are particularly valuable.

How do I address a lack of specific fixed asset accounting experience on my resume?

If you lack specific fixed asset accounting experience, focus on transferable skills such as financial reporting, general accounting, and experience with accounting systems. Mention any experience you have in managing large datasets, reconciling accounts, or handling capital expenditure (CAPEX) processes. Highlight your ability to learn quickly, your understanding of accounting principles, and any relevant certifications in accounting or finance.

How important is experience with accounting software for a Fixed Asset Accountant role?

Experience with accounting software is highly important, as it ensures you can efficiently manage fixed assets, record transactions, and generate reports. Highlight your proficiency with software such as SAP, Oracle, Microsoft Dynamics, or QuickBooks. Mention how you’ve used these tools to track assets, calculate depreciation, or reconcile accounts. Familiarity with fixed asset modules within ERP systems is particularly valuable.

How do I demonstrate my ability to prepare financial reports for fixed assets on my resume?

Demonstrate your ability to prepare financial reports by describing how you’ve created fixed asset schedules, depreciation reports, and reconciliation statements. Mention your role in generating asset-related data for financial statements, conducting asset roll-forward schedules, and assisting with annual audits. Highlight your accuracy in reporting and your ability to provide clear and detailed fixed asset summaries to stakeholders.

Should I include certifications on my Fixed Asset Accountant resume?

Yes, including certifications can enhance your resume by demonstrating your qualifications and commitment to professional development. Certifications such as Certified Public Accountant (CPA), Certified Management Accountant (CMA), or specialized certifications in fixed asset accounting or financial reporting can add significant value to your resume and make you stand out to potential employers.

-

What do Hiring Managers look for in a Fixed Asset Accountant Resume

-

How to Write a Professional Fixed Asset Accountant Resume Summary?

-

How to Write a Fixed Asset Accountant Resume Experience Section?

-

How can I highlight my experience as a Fixed Asset Accountant on my resume?

-

What are the key skills to feature on a Fixed Asset Accountant resume?

-

How do I demonstrate my ability to manage fixed assets on my resume?

-

Should I include metrics on my Fixed Asset Accountant resume? If so, what kind?

-

How can I showcase my experience with asset depreciation on my resume?

-

What kind of achievements should I highlight as a Fixed Asset Accountant?

-

How do I address a lack of specific fixed asset accounting experience on my resume?

-

How important is experience with accounting software for a Fixed Asset Accountant role?

-

How do I demonstrate my ability to prepare financial reports for fixed assets on my resume?

-

Should I include certifications on my Fixed Asset Accountant resume?

Copyright ©2025 Workstory Inc.