3+ Equity Analyst Resume Examples and Templates

This page provides you with Equity Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Equity Analyst resume.

How to Write a Equity Analyst Resume?

To write a professional Equity Analyst resume, follow these steps:

- Select the right Equity Analyst resume template.

- Write a professional summary at the top explaining your Equity Analyst’s experience and achievements.

- Follow the STAR method while writing your Equity Analyst resume’s work experience. Show what you were responsible for and what you achieved as an Equity Analyst.

- List your top Equity Analyst skills in a separate skills section.

How to Write Your Equity Analyst Resume Header?

Write the perfect Equity Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Equity Analyst to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Equity Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Equity Analyst Resume Example - Header Section

Marques 7600 W. Bay Meadows Avenue Rochester, NY 14606 Marital Status: Married, email: cooldude2022@gmail.com

Good Equity Analyst Resume Example - Header Section

Marques Branch, Rochester, NY, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Equity Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Equity Analyst Resume Summary?

Use this template to write the best Equity Analyst resume summary: Equity Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write an Equity Analyst Resume Experience Section?

Here’s how you can write a job winning Equity Analyst resume experience section:

- Write your Equity Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Equity Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Equity Analyst).

- Use action verbs in your bullet points.

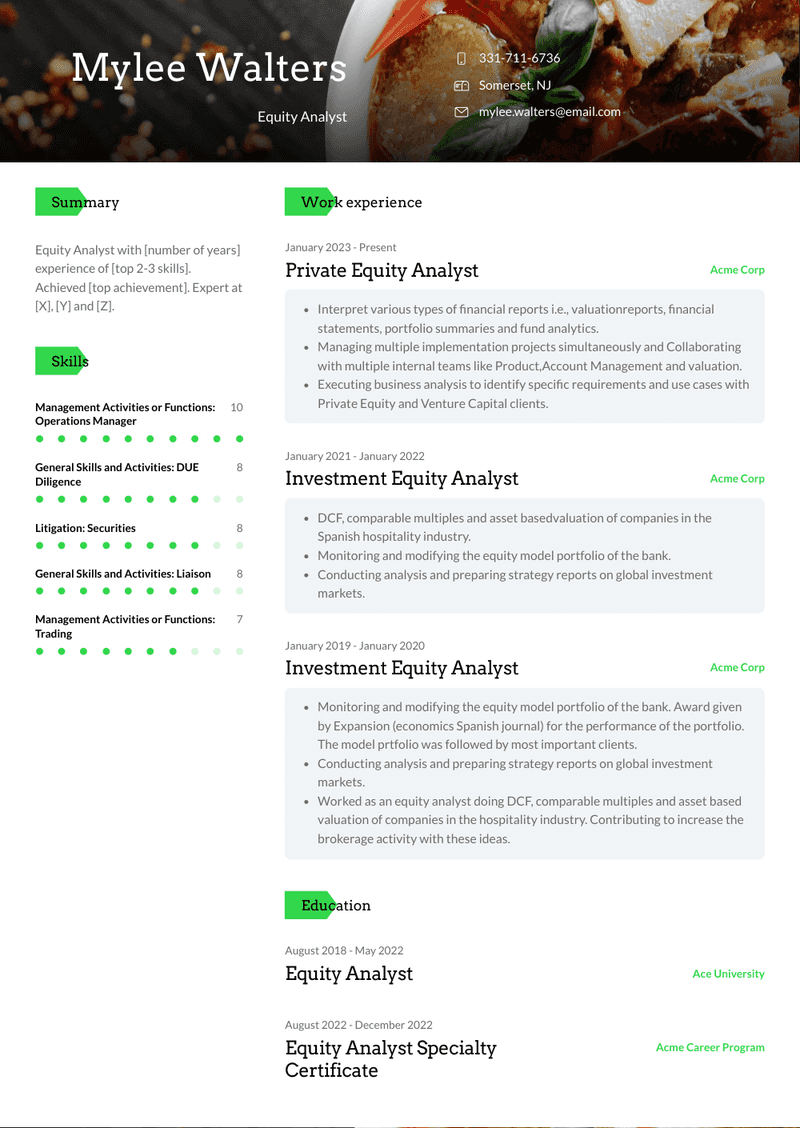

Private Equity Analyst Resume Example

Private Equity Analyst

- Interpret various types of financial reports i.e., valuationreports, financial statements, portfolio summaries and fund analytics.

- Managing multiple implementation projects simultaneously and Collaborating with multiple internal teams like Product,Account Management and valuation.

- Executing business analysis to identify specific requirements and use cases with Private Equity and Venture Capital clients.

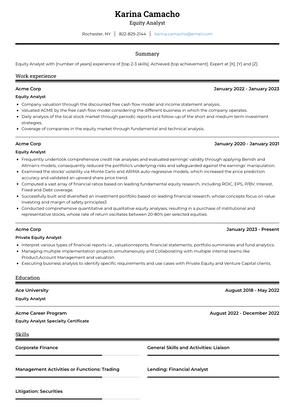

Equity Analyst Resume Example

Equity Analyst

- Company valuation through the discounted free cash flow model and income statement analysis.

- Valuated ACME by the free cash flow model considering the different business in which the company operates.

- Daily analysis of the local stock market through periodic reports and follow-up of the short and medium term investment strategies.

- Coverage of companies in the equity market through fundamental and technical analysis.

Investment Equity Analyst Resume Example

Investment Equity Analyst

- DCF, comparable multiples and asset basedvaluation of companies in the Spanish hospitality industry.

- Monitoring and modifying the equity model portfolio of the bank.

- Conducting analysis and preparing strategy reports on global investment markets.

Equity Analyst Resume Example

Equity Analyst

- Frequently undertook comprehensive credit risk analyses and evaluated earnings' validity through applying Benish and Altman's models, consequently reduced the portfolio's underlying risks and safeguarded against the earnings' manipulation.

- Examined the stocks' volatility via Monte Carlo and ARIMA auto-regressive models, which increased the price prediction accuracy and validated an upward share price trend.

- Computed a vast array of financial ratios based on leading fundamental equity research, including ROIC, EPS, P/BV, Interest, Fixed and Debt coverage.

- Successfully built and diversified an investment portfolio based on leading financial research, whose concepts focus on value investing and margin of safety principles3

- Conducted comprehensive quantitative and qualitative equity analyses, resulting in a purchase of institutional and representative stocks, whose rate of return oscillates between 20-80% per selected equities.

Investment Equity Analyst Resume Example

Investment Equity Analyst

- Monitoring and modifying the equity model portfolio of the bank. Award given by Expansion (economics Spanish journal) for the performance of the portfolio. The model prtfolio was followed by most important clients.

- Conducting analysis and preparing strategy reports on global investment markets.

- Worked as an equity analyst doing DCF, comparable multiples and asset based valuation of companies in the hospitality industry. Contributing to increase the brokerage activity with these ideas.

Top Equity Analyst Resume Skills for 2023

- Financial statement analysis

- Equity valuation techniques

- Discounted cash flow (DCF) analysis

- Comparable company analysis (CCA)

- Precedent transaction analysis

- Relative valuation methods

- Earnings per share (EPS) analysis

- Price-to-earnings (P/E) ratio analysis

- Price-to-book (P/B) ratio analysis

- Enterprise value (EV) analysis

- Return on equity (ROE) analysis

- Return on invested capital (ROIC) analysis

- Free cash flow (FCF) analysis

- Dividend discount model (DDM)

- Dividend yield analysis

- Dividend growth rate analysis

- Capital asset pricing model (CAPM)

- Beta analysis

- Risk-adjusted return analysis

- Portfolio management techniques

- Asset allocation strategies

- Investment research methods

- Equity market research

- Industry analysis

- Company analysis

- Fundamental analysis

- Technical analysis

- Market trend analysis

- Market timing strategies

- Trading strategies

- Sector rotation strategies

- Risk management techniques

- Portfolio diversification strategies

- Portfolio optimization techniques

- Portfolio rebalancing

- Performance attribution analysis

- Scenario analysis

- Sensitivity analysis

- Monte Carlo simulation

- Financial modeling

- Forecasting techniques

- Quantitative analysis methods

- Data visualization

- Statistical analysis software (e.g., R, Python)

- Financial data sources utilization (e.g., Bloomberg, FactSet)

- Equity research report writing

- Presentation skills

- Communication skills (written and verbal)

- Teamwork and collaboration

How Long Should my Equity Analyst Resume be?

Your Equity Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Equity Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Equity Analyst Resume

-

What does an Equity Analyst do?

- An Equity Analyst is responsible for conducting research and analysis on stocks or equities to provide investment recommendations to clients or investment firms. They evaluate financial data, company performance, industry trends, and market conditions to assess the value and potential of investments.

-

What qualifications are important for an Equity Analyst position?

- Qualifications typically include a bachelor's degree in finance, accounting, economics, or a related field. Additional certifications such as Chartered Financial Analyst (CFA) or Chartered Financial Analyst (CFA) Level I can be advantageous. Strong analytical skills, financial modeling expertise, and knowledge of investment analysis techniques are essential.

-

What kind of experience should an Equity Analyst highlight on their resume?

- Experience in financial analysis, equity research, or investment analysis is crucial for an Equity Analyst. Highlighting proficiency in financial modeling, valuation techniques, and equity research methodologies can demonstrate relevant experience.

-

How important is it for an Equity Analyst to demonstrate knowledge of financial modeling on their resume?

- Knowledge of financial modeling, including building financial models to analyze company performance, forecast future earnings, and estimate the value of investments, is important for an Equity Analyst. Highlighting experience in using financial modeling techniques to support investment recommendations can demonstrate the Analyst's quantitative skills.

-

Should an Equity Analyst include their experience with industry research on their resume?

- Yes, mentioning experience with industry research, including analyzing industry trends, competitive dynamics, and macroeconomic factors that may impact investments, is important for an Equity Analyst. This demonstrates the Analyst's ability to assess broader market conditions and identify investment opportunities.

-

What soft skills are important for an Equity Analyst to highlight on their resume?

- Soft skills such as critical thinking, attention to detail, problem-solving, communication, and time management are crucial for an Equity Analyst. These skills contribute to effectively analyzing financial data, communicating investment recommendations, and managing multiple research projects.

-

Is it necessary for an Equity Analyst to mention their experience with investment analysis software on their resume?

- Yes, mentioning experience with investment analysis software, such as Bloomberg Terminal, FactSet, or Capital IQ, is important for an Equity Analyst. This demonstrates the Analyst's proficiency in using industry-standard tools to conduct research and analysis.

-

How should an Equity Analyst tailor their resume for different sectors or industries (e.g., technology, healthcare, finance)?

- An Equity Analyst should highlight experience and skills relevant to the specific sectors or industries they have analyzed, whether it's technology, healthcare, finance, or others. Emphasizing familiarity with industry-specific metrics, regulations, and market dynamics can be beneficial.

-

Should an Equity Analyst include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework related to finance, economics, or investment analysis is important for an Equity Analyst. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can an Equity Analyst make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful investment recommendations, any relevant certifications or awards, or extracurricular involvement can enhance the overall presentation of the resume.

Copyright ©2025 Workstory Inc.