3+ Claims Representative Resume Examples and Templates

This page provides you with Claims Representative resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Claims Representative resume.

What do Hiring Managers look for in a Claims Representative Resume

- Leadership: Strong leadership skills to guide and motivate the customer service team.

- Customer Focus: Dedication to ensuring exceptional customer satisfaction and resolving complex issues.

- Problem-Solving: Ability to handle escalated customer concerns and find effective solutions.

- Communication: Excellent communication skills for liaising between the team and management.

- Training and Development: Capability to train and mentor team members to enhance their skills and performance.

How to Write a Claims Representative Resume?

To write a professional Claims Representative resume, follow these steps:

- Select the right Claims Representative resume template.

- Write a professional summary at the top explaining your Claims Representative’s experience and achievements.

- Follow the STAR method while writing your Claims Representative resume’s work experience. Show what you were responsible for and what you achieved as a Claims Representative.

- List your top Claims Representative skills in a separate skills section.

How to Write Your Claims Representative Resume Header?

Write the perfect Claims Representative resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Claims Representative position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Claims Representative resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Claims Representative Resume Example - Header Section

Aisha 696 Rock Maple St. South Lyon, MI 48178 Marital Status: Married, email: cooldude2022@gmail.com

Good Claims Representative Resume Example - Header Section

Aisha Oneill, Lyon, MI, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Claims Representative email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Claims Representative Resume Summary?

Use this template to write the best Claims Representative resume summary: Claims Representative with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Claims Representative Resume Experience Section?

Here’s how you can write a job winning Claims Representative resume experience section:

- Write your Claims Representative work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Claims Representative work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Claims Representative).

- Use action verbs in your bullet points.

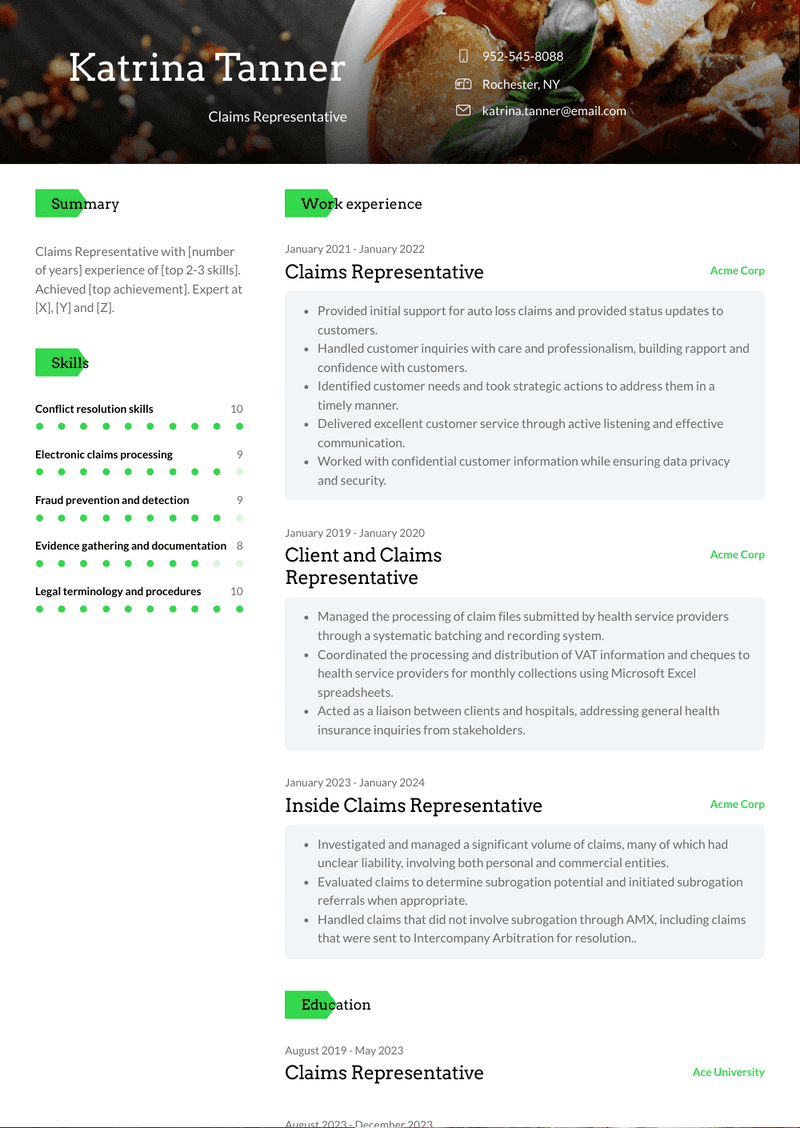

Claims Representative Resume Example

Claims Representative

- Successfully investigated and negotiated auto injury and auto property damage settlements arising from the negligence of insurance members.

- Achieved successful negotiations for homeowner settlements due to homeowner negligence and general liability claims.

- Conducted negotiations directly with injured parties and their legal counsel.

- Recognized as one of nine employees selected for the emerging leaders' program.

- Chosen as one of two claims representatives to participate in the pilot implementation of a new claims system.

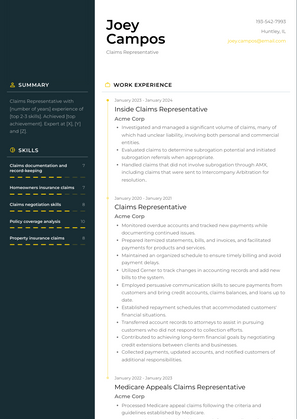

Inside Claims Representative Resume Example

Inside Claims Representative

- Investigated and managed a significant volume of claims, many of which had unclear liability, involving both personal and commercial entities.

- Evaluated claims to determine subrogation potential and initiated subrogation referrals when appropriate.

- Handled claims that did not involve subrogation through AMX, including claims that were sent to Intercompany Arbitration for resolution..

Medicare Appeals Claims Representative Resume Example

Medicare Appeals Claims Representative

- Processed Medicare appeal claims following the criteria and guidelines established by Medicare.

- Generated approval or denial letters to inform appellants about the outcome of their appeals, providing explanations based on Medicare requirements.

- Collaborated with healthcare providers, other departments, and conducted research on patient treatment history and claims records to assist in making appeal decisions.

Claims Representative Resume Example

Claims Representative

- Provided initial support for auto loss claims and provided status updates to customers.

- Handled customer inquiries with care and professionalism, building rapport and confidence with customers.

- Identified customer needs and took strategic actions to address them in a timely manner.

- Delivered excellent customer service through active listening and effective communication.

- Worked with confidential customer information while ensuring data privacy and security.

Claims Representative Resume Example

Claims Representative

- Monitored overdue accounts and tracked new payments while documenting continued issues.

- Prepared itemized statements, bills, and invoices, and facilitated payments for products and services.

- Maintained an organized schedule to ensure timely billing and avoid payment delays.

- Utilized Cerner to track changes in accounting records and add new bills to the system.

- Employed persuasive communication skills to secure payments from customers and bring credit accounts, claims balances, and loans up to date.

- Established repayment schedules that accommodated customers' financial situations.

- Transferred account records to attorneys to assist in pursuing customers who did not respond to collection efforts.

- Contributed to achieving long-term financial goals by negotiating credit extensions between clients and businesses.

- Collected payments, updated accounts, and notified customers of additional responsibilities.

Client and Claims Representative Resume Example

Client and Claims Representative

- Managed the processing of claim files submitted by health service providers through a systematic batching and recording system.

- Coordinated the processing and distribution of VAT information and cheques to health service providers for monthly collections using Microsoft Excel spreadsheets.

- Acted as a liaison between clients and hospitals, addressing general health insurance inquiries from stakeholders.

Top Claims Representative Resume Skills for 2023

- Insurance claims processing

- Knowledge of insurance policies and regulations

- Claims investigation and evaluation

- Policy coverage analysis

- Claims documentation and record-keeping

- Claims adjustment and settlement

- Claims fraud detection

- Insurance claims software proficiency

- Medical billing and coding

- Injury assessment and evaluation

- Accident scene investigation

- Liability determination

- Property damage assessment

- Policy interpretation and analysis

- Subrogation and recovery process

- Claims negotiation skills

- Mediation and arbitration techniques

- Claims resolution strategies

- Customer service and communication

- Conflict resolution skills

- Legal terminology and procedures

- Court case management

- Insurance claim analytics tools

- Insurance claims auditing

- Regulatory compliance (e.g., HIPAA)

- Auto insurance claims handling

- Homeowners insurance claims

- Health insurance claims

- Worker's compensation claims

- Property insurance claims

- Claims denial management

- Claims appeals process

- Third-party claims management

- Electronic claims processing

- Damage assessment tools (e.g., estimating software)

- Claims reporting and notification

- Evidence gathering and documentation

- Claims liability assessment

- Coverage dispute resolution

- Customer advocacy and support

- Claims file management

- Claims status tracking and reporting

- Insurance claim data analysis

- Knowledge of state insurance laws

- Claims database management

- Fraud prevention and detection

- Policyholder education and guidance

- Settlement negotiation and documentation

- Claims handling in a digital environment

- Claims process improvement

How Long Should my Claims Representative Resume be?

Your Claims Representative resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Claims Representative, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Frequently Asked Questions (FAQs) for Claims Representative Resume

-

What does a Claims Representative do?

- A Claims Representative evaluates insurance claims, such as health, auto, property, or liability claims, submitted by policyholders. They investigate claims, gather documentation, assess coverage, determine liability, and negotiate settlements with claimants or third-party representatives.

-

What qualifications are important for a Claims Representative position?

- Qualifications typically include a high school diploma or equivalent, with relevant experience in customer service, insurance, or a related field. Strong communication, negotiation, analytical, and problem-solving skills, as well as knowledge of insurance policies and regulations, are essential.

-

What kind of experience should a Claims Representative highlight on their resume?

- Experience in handling insurance claims, conducting investigations, reviewing policy coverage, and communicating with claimants, policyholders, and third-party vendors is crucial for a Claims Representative. Highlighting proficiency in claims processing systems and software, documentation management, and adherence to regulatory requirements is important.

-

How important is it for a Claims Representative to demonstrate customer service skills on their resume?

- Customer service skills are vital for a Claims Representative as they interact with policyholders and claimants to provide assistance and resolve issues related to claims. Highlighting experience in addressing customer inquiries, managing complaints, and maintaining professionalism in customer interactions can demonstrate strong customer service abilities.

-

Should a Claims Representative include their experience with claim investigation on their resume?

- Yes, mentioning experience with claim investigation techniques, such as interviewing witnesses, gathering evidence, reviewing documents, and assessing damages, can demonstrate the Representative's ability to accurately evaluate claims and determine coverage.

-

What soft skills are important for a Claims Representative to highlight on their resume?

- Soft skills such as communication, empathy, attention to detail, organization, time management, adaptability, and conflict resolution are crucial for a Claims Representative. These skills contribute to effectively managing claims processes, addressing customer needs, and resolving disputes.

-

Is it necessary for a Claims Representative to mention their knowledge of insurance regulations on their resume?

- Yes, mentioning knowledge of insurance regulations, including state-specific laws, policy provisions, and claims handling guidelines, can demonstrate the Representative's understanding of legal and compliance requirements in claims management.

-

How should a Claims Representative tailor their resume for different types of insurance claims?

- A Claims Representative should highlight experience and skills relevant to the specific types of insurance claims they have handled, whether it's auto, property, health, liability, or workers' compensation claims. Emphasizing familiarity with industry-specific terminology, claims processes, and documentation requirements can be beneficial.

-

Should a Claims Representative include their educational background on their resume?

- Yes, including educational background such as degrees, certifications, or relevant coursework in insurance, business, or related fields is important. This provides credibility and demonstrates the foundational knowledge necessary for the role.

-

How can a Claims Representative make their resume visually appealing and easy to read?

- Utilizing clear headings, bullet points to highlight key skills and experiences, and a professional layout are important aspects of resume formatting. Additionally, including specific examples of successful claims settlements, customer satisfaction ratings, or any relevant achievements or recognitions can enhance the overall presentation of the resume.

Copyright ©2025 Workstory Inc.