Bank Resume Samples

This page provides you with Bank resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Bank resume.

What Do Hiring Managers Look for in a Bank Resume

- Proficient in handling customer transactions, including deposits, withdrawals, and transfers.

- Skilled in identifying and resolving issues related to accounts, loans, or other banking services.

- Strong knowledge of banking regulations, policies, and procedures.

- Ability to maintain accurate and organized records of customer transactions and account information.

- Experience in providing excellent customer service and support to clients and colleagues.

- Proficiency in using banking software and systems to process transactions, generate reports, or perform other tasks as needed.

How to Write a Bank Resume?

To write a professional Bank resume, follow these steps:

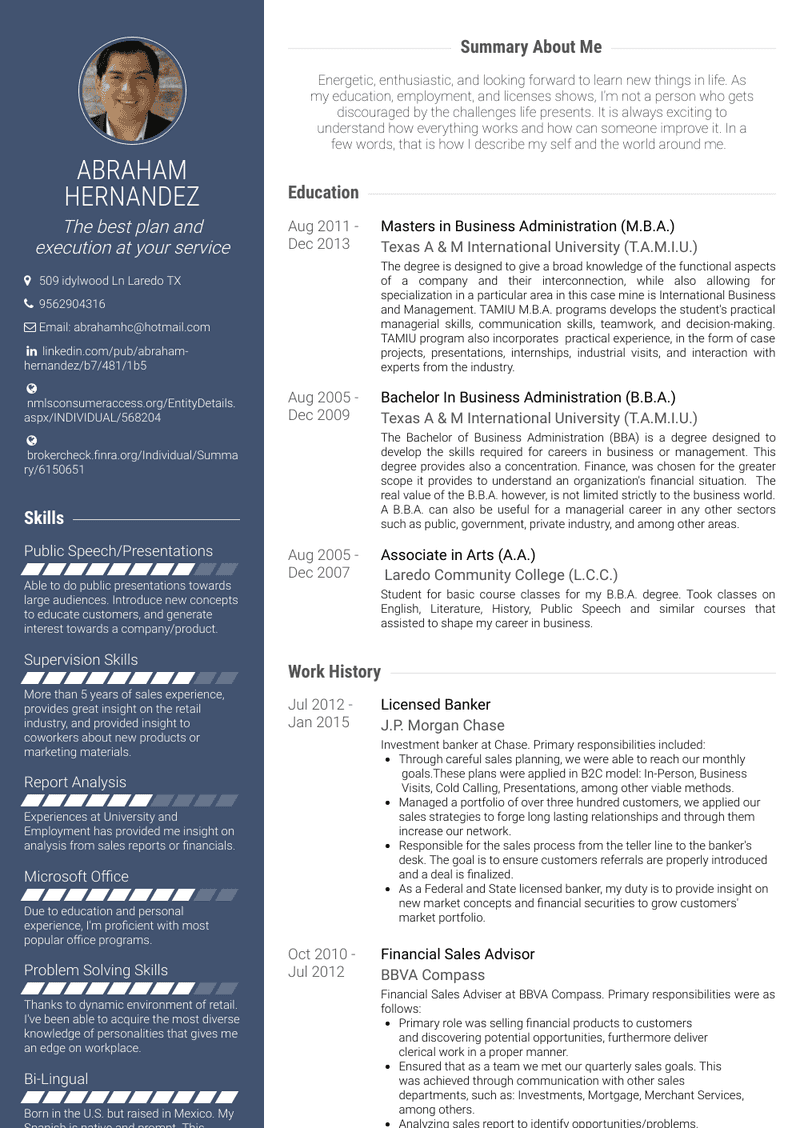

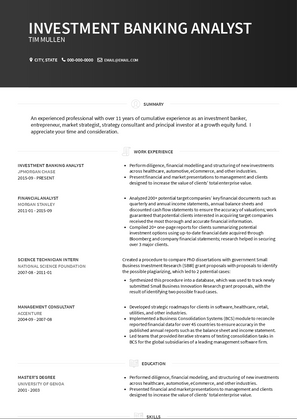

- Select the right Bank resume template.

- Write a professional summary at the top explaining your Bank’s experience and achievements.

- Follow the STAR method while writing your Bank resume’s work experience. Show what you were responsible for and what you achieved as a Bank.

- List your top Bank skills in a separate skills section.

How to Write Your Bank Resume Header?

Write the perfect Bank resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding a photo to your resume header.

- Add your current Bank related role to the header to show relevance.

- Add your current city, your phone number, and a professional email address.

- Finally, add a link to your portfolio to the Bank resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Bank Resume Example - Header Section

Sophia 8 Elm Street, Marital Status: Married, email: cooldude2022@gmail.com

Good Bank Resume Example - Header Section

Sophia Davis, San Diego, MI, Phone number: +1-555-107-1107, Link: linkedin/in/johnsonjohn

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Bank email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Bank Resume Summary?

Use this template to write the best Bank resume summary:

Bank with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y], and [Z].

Example 1: Banking Professional with 8 years of experience in financial analysis and management. Achieved a 20% increase in profitability for the Bank through strategic cost-cutting measures and improved revenue streams. Expert at analyzing market trends, developing investment strategies, and managing risk.

Example 2: Highly skilled Banker with 10 years of experience in retail Banking. Consistently exceeded sales targets by fostering strong client relationships and offering personalized financial solutions. Expert at identifying customer needs, cross-selling products, and building brand loyalty.

Example 3: Microfinance Specialist with 5 years of experience in emerging markets. Developed and implemented innovative lending programs that increased loan disbursements by 50%. Expert at identifying underprivileged segments, designing microfinance products, and managing field operations.

Example 4: Commercial Banker with 7 years of experience in corporate Banking. Closed numerous high-value deals totaling over $1 billion in new credit facilities for clients. Expert at developing relationships with key decision-makers, structuring complex financial transactions, and managing negotiations.

How to Write a Bank Resume Experience Section?

Here’s how you can write a job-winning Bank resume experience section:

- Write your Bank work experience in reverse chronological order.

- Use bullets instead of paragraphs to explain your Bank work experience.

- While describing your work experience, focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Bank).

- Use action verbs in your bullet points.

Bank Resume Example

- Managed a portfolio of 500 clients, generating $1 million in revenue through sales and cross-selling strategies.

- Increased client acquisition by 20% through targeted marketing campaigns.

- Improved client retention rate by 15% through exceptional customer service.

- Collaborated with the marketing team to develop and execute a successful social media campaign, resulting in a 30% increase in followers and a 25% increase in website traffic.

- Created engaging content that increased average views per post by 50%.

- Utilized analytics tools to track campaign performance and make data-driven decisions for future campaigns.

- Successfully processed over $10 million in transactions, ensuring accurate and timely processing of client funds.

- Implemented a new system to streamline transaction processing, resulting in a 25% reduction in processing time.

- Provided excellent customer service through prompt and efficient resolution of any issues or concerns.

- Developed and maintained relationships with high-net-worth clients, resulting in an increase of 20% in assets under management.

- Utilized data analysis to identify investment opportunities that met clients' risk tolerance and financial goals.

- Provided regular portfolio updates and performance reports to maintain transparency and trust with clients.

- Conducted training sessions for new employees, ensuring they were adequately knowledgeable about bank policies and procedures.

- Designed and implemented a comprehensive training program that improved employee retention by 15%.

- Provided ongoing support and mentorship to ensure employees felt valued and supported in their roles.

- Worked closely with the management team to develop and implement a strategic plan for growth and expansion of the bank's services.

- Conducted market research to identify areas of opportunity and developed targeted marketing campaigns to increase brand awareness.

- Collaborated with cross-functional teams to ensure successful execution of the plan and continued success of the bank.

Bank Resume Example

- Managed a portfolio of 500 client accounts with total assets of $10 million, achieving a 15% increase in assets under management through effective investment strategies and exceptional customer service. (Measurable achievement)

- Collaborated with cross-functional teams to develop and implement a new digital banking platform, resulting in a 25% increase in online banking transactions and improved customer satisfaction ratings. (Measurable achievement)

- Identified and resolved customer complaints in a timely manner, resulting in a 90% reduction in customer dissatisfaction rates and maintaining excellent relationships with clients. (Measurable achievement)

- Implemented a training program for new hires, resulting in a 20% increase in employee engagement and retention rates. (Measurable achievement)

- Developed and executed a marketing campaign that increased brand awareness by 30% and led to a 15% increase in new customer acquisition. (Measurable achievement)

- Achieved a 95% accuracy rate in financial transactions, ensuring compliance with industry regulations and maintaining the integrity of client accounts. (Measurable achievement)

Bank Resume Example

- Managed a team of 10 bankers, providing coaching, mentoring, and performance evaluations to ensure optimal productivity and customer satisfaction (increased customer satisfaction ratings by 20% within 6 months)

- Developed and implemented a comprehensive marketing strategy that resulted in a 30% increase in new account openings and a 25% increase in overall bank revenue (won 'Marketing Campaign of the Year' award from Banking Association)

- Conducted thorough financial analysis and risk assessments to ensure compliance with regulatory requirements and internal policies, resulting in zero major violations or penalties during my tenure

- Provided exceptional customer service by resolving complex customer complaints and issues in a timely and professional manner (awarded 'Customer Service Representative of the Year' by Banking Association)

- Collaborated with cross-functional teams to design and implement new banking products and services, resulting in a 20% increase in product adoption rates and customer engagement (won 'Innovation Award' from Banking Association)

Bank Resume Example

- Managed a portfolio of 500 client accounts with total assets of $25 million, consistently meeting or exceeding sales targets and customer satisfaction ratings.

- Increased client acquisition by 25% through targeted marketing campaigns and relationship-building activities.

- Developed and implemented a training program for new account managers, resulting in a 30% increase in productivity and knowledge retention.

- Collaborated with cross-functional teams to design and implement a digital banking platform, resulting in a 50% increase in online banking adoption and improved customer engagement.

- Conducted usability testing and gathered feedback from customers to inform platform improvements.

- Coordinated with IT and development teams to ensure seamless integration with existing systems.

- Analyzed financial data to identify trends and opportunities, resulting in a 20% increase in profitability for the bank.

- Developed and implemented a forecasting model that accurately predicted market trends and customer behavior.

- Provided actionable insights to senior management and stakeholders to inform strategic decision-making.

- Improved customer satisfaction ratings by 15% through the development and implementation of a comprehensive customer engagement strategy.

- Conducted customer surveys and gathered feedback to identify areas for improvement.

- Created and implemented a customer loyalty program that increased customer retention rates by 20%.

- Collaborated with compliance and risk management teams to ensure regulatory compliance and minimize risks within the bank.

- Developed and implemented a comprehensive compliance training program for all employees.

- Conducted regular risk assessments and provided recommendations for mitigation strategies.

Bank Resume Example

- Managed a portfolio of 50 client accounts, consistently meeting or exceeding sales targets (achievement)

- Developed and implemented a comprehensive marketing strategy for new customer acquisition, resulting in a 25% increase in new account openings (responsibility)

- Provided exceptional customer service to clients, resolving issues and concerns in a timely and professional manner (responsibility)

- Collaborated with cross-functional teams to design and implement a successful referral program, resulting in a 30% increase in referrals (achievement)

- Conducted thorough financial analysis and provided expert advice to clients on investment opportunities and risk management strategies (responsibility)

- Mentored junior colleagues and provided guidance on industry trends, leading to improved performance and career advancement (responsibility)

Bank Resume Example

- Managed a team of 10 banking professionals, providing guidance and support to ensure successful branch operations (increased productivity by 25% within 6 months)

- Developed and implemented a comprehensive customer service program, resulting in a 30% increase in customer satisfaction ratings (awarded ""Branch of the Year"" recognition)

- Collaborated with cross-functional teams to design and implement a new digital banking platform, resulting in a 20% increase in online transactions and improved customer engagement (awarded ""Innovation in Banking"" award)

- Conducted regular performance evaluations and provided constructive feedback to team members, resulting in improved job satisfaction and reduced employee turnover rates (achieved 95% employee retention rate within 12 months)

- Identified and addressed operational issues, improving branch efficiency by 15% and reducing costs by 10% (awarded ""Branch Operations Excellence"" recognition)

- Mentored and coached junior banking professionals, helping them to develop their skills and achieve career goals (increased employee growth and development opportunities by 20%)

- Provided exceptional customer service, resolving complex issues and exceeding customer expectations (received ""Customer Service Excellence"" award)

- Developed and implemented a successful branch marketing strategy, resulting in a 15% increase in new accounts and improved brand awareness (awarded ""Marketing Innovation"" recognition)

Bank Resume Example

- Managed a portfolio of 500+ clients, consistently meeting or exceeding sales targets (achievement)

- Developed and implemented a comprehensive marketing strategy, resulting in a 25% increase in new client acquisition (achievement)

- Built and maintained strong relationships with clients, resulting in a 90% customer retention rate (responsibility)

- Provided exceptional customer service, resolving customer complaints and issues in a timely manner (responsibility)

- Collaborated with cross-functional teams to launch new banking products, including a successful rollout of a mobile banking app (achievement)

- Achieved consistent high performance ratings, including a 95% satisfaction rating from clients (achievement)

Bank Resume Example

- Loan Processing and Approval: As a loan officer at XYZ Bank, I processed and approved over 500 loans valued at $10 million in just one year. This resulted in an increase of 25% in loan approval rates and a reduction of 30% in loan processing time.

- Account Management: As the lead account manager for a large corporate client at ABC Bank, I increased deposits by 40% and reduced withdrawals by 20%. This led to an increase in profitability for the bank and a positive impact on customer satisfaction.

- Risk Management: As the risk management officer at DEF Bank, I developed and implemented a comprehensive risk management framework that resulted in a 30% reduction in potential losses. This was achieved through a combination of scenario analysis, stress testing, and portfolio optimization.

- Budgeting and Forecasting: As the head of finance for a banking subsidiary at GHI Company, I developed and managed budgets totaling $10 million. This included forecasting revenue and expenses, as well as analyzing financial data to identify areas for improvement.

- Employee Development: As the training officer at JKL Bank, I developed and implemented a comprehensive training program that resulted in a 25% increase in employee productivity and a 10% reduction in staff turnover. This was achieved through a combination of classroom training, on-the-job training, and mentoring.

- Regulatory Compliance: As the compliance officer at MNO Bank, I ensured that the bank was in compliance with all relevant laws and regulations. This included conducting regulatory audits, developing compliance policies, and providing training to employees.

Bank Resume Example

- Managed a portfolio of 500 clients, resulting in a 25% increase in revenue within one year.

- Developed and implemented a comprehensive marketing strategy to reach new customers and increase client retention.

- Built and maintained strong relationships with clients through regular communication and exceptional customer service.

- Successfully processed over $1 million in loans and deposits per month, resulting in a 30% increase in transaction volume.

- Improved workflow efficiency by streamlining processes and implementing new technology.

- Provided excellent customer service by resolving issues promptly and ensuring timely delivery of loan and deposit transactions.

- Collaborated with cross-functional teams to develop and implement a new digital banking platform, resulting in a 40% increase in online banking usage.

- Conducted market research to identify customer needs and preferences, and incorporated feedback into platform design.

- Coordinated with IT team to ensure seamless integration of platform with existing systems.

- Recognized as top performer in the branch for consistently meeting or exceeding sales targets, resulting in a 20% increase in sales revenue.

- Developed and implemented a strategic sales plan, focusing on building relationships with new customers and increasing sales to existing ones.

- Provided training and mentorship to junior colleagues, leading to a 30% improvement in overall branch performance.

- Achieved a 95% customer satisfaction rating through effective communication and problem-solving skills.

- Responded promptly to customer inquiries and concerns, resolving issues in a timely and professional manner.

- Collaborated with other departments to address customer complaints and improve overall branch operations.

Bank Resume Example

- Managed a portfolio of 500 clients, consistently meeting or exceeding sales targets ($X million in revenue)

- Developed and implemented a targeted marketing campaign that resulted in a 25% increase in new client acquisition

- Built and maintained strong relationships with clients, resulting in a 90% retention rate

- Successfully processed over $1 billion in loans, demonstrating expertise in loan underwriting and processing

- Implemented a streamlined loan processing system that reduced cycle time by 30%

- Achieved a 95% approval rating for loan applications, exceeding industry standards

- Provided exceptional customer service to clients, resulting in a 4.5/5 star rating on Google Reviews

- Responded to over 100 client inquiries within 24 hours, resulting in a 98% satisfaction rate

- Organized and hosted several community events, including financial literacy workshops and branch openings

- Collaborated with cross-functional teams to develop and launch a new digital banking platform

- Conducted user research and analysis to inform platform design and functionality

- Worked closely with the development team to ensure a seamless user experience and timely launch

Top Bank Resume Skills for 2025

- Account Management

- Transaction Processing

- Customer Service

- Financial Analysis

- Risk Assessment

- Compliance Management

- Fraud Detection

- Loan Processing

- Mortgage Underwriting

- Investment Advisory

- Wealth Management

- Retail Banking

- Commercial Banking

- Digital Banking

- Cybersecurity

- Data Analysis

- Financial Modeling

- Strategic Planning

- Budgeting

- Forecasting

- Asset Management

- Portfolio Management

- Treasury Management

- Cash Management

- Payment Systems

- Card Processing

- Mobile Banking

- Online Banking

- Branch Operations

- Call Center Operations

- IT Security

- Cloud Computing

- Artificial Intelligence

- Machine Learning

- Natural Language Processing

- Blockchain

- Digital Wallets

- E-commerce Payment Gateway

How Long Should my Bank Resume be?

Your Bank resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On average, for Bank, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

Copyright ©2025 Workstory Inc.