Accounts Receivable Manager Resume Examples and Templates

This page provides you with Accounts Receivable Manager resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Accounts Receivable Manager resume.

What Do Hiring Managers Look for in an Accounts Receivable Manager Resume

- Proficient in managing accounts receivable processes, ensuring timely and accurate invoicing, payment processing, and collections.

- Strong knowledge of accounting principles, financial regulations, and credit management.

- Skilled in maintaining accurate customer records, monitoring outstanding balances, and following up on overdue payments.

- Ability to analyze and reconcile accounts receivable transactions, resolving discrepancies and identifying potential issues.

- Proficiency in supervising accounts receivable staff, providing guidance, and ensuring productivity and accuracy.

How to Write an Accounts Receivable Manager Resume?

To write a professional Accounts Receivable Manager resume, follow these steps:

- Select the right Accounts Receivable Manager resume template.

- Write a professional summary at the top explaining your Accounts Receivable Manager’s experience and achievements.

- Follow the STAR method while writing your Accounts Receivable Manager resume’s work experience. Show what you were responsible for and what you achieved as an Accounts Receivable Manager.

- List your top Accounts Receivable Manager skills in a separate skills section.

How to Write Your Accounts Receivable Manager Resume Header?

Write the perfect Accounts Receivable Manager resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Accounts Receivable Manager job title to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Accounts Receivable Manager resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Accounts Receivable Manager Resume Example - Header Section

Alyson 308 E. Homewood Lane Westford, MA 01886 Marital Status: Married, email: cooldude2022@gmail.com

Good Accounts Receivable Manager Resume Example - Header Section

Alyson Schmidt, Westford, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Accounts Receivable Manager email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Accounts Receivable Manager Resume Summary?

Use this template to write the best Accounts Receivable Manager resume summary: Accounts Receivable Manager with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Accounts Receivable Manager Resume Experience Section?

Here’s how you can write a job winning Accounts Receivable Manager resume experience section:

- Write your Accounts Receivable Manager work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Accounts Receivable Manager work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Accounts Receivable Manager).

- Use action verbs in your bullet points.

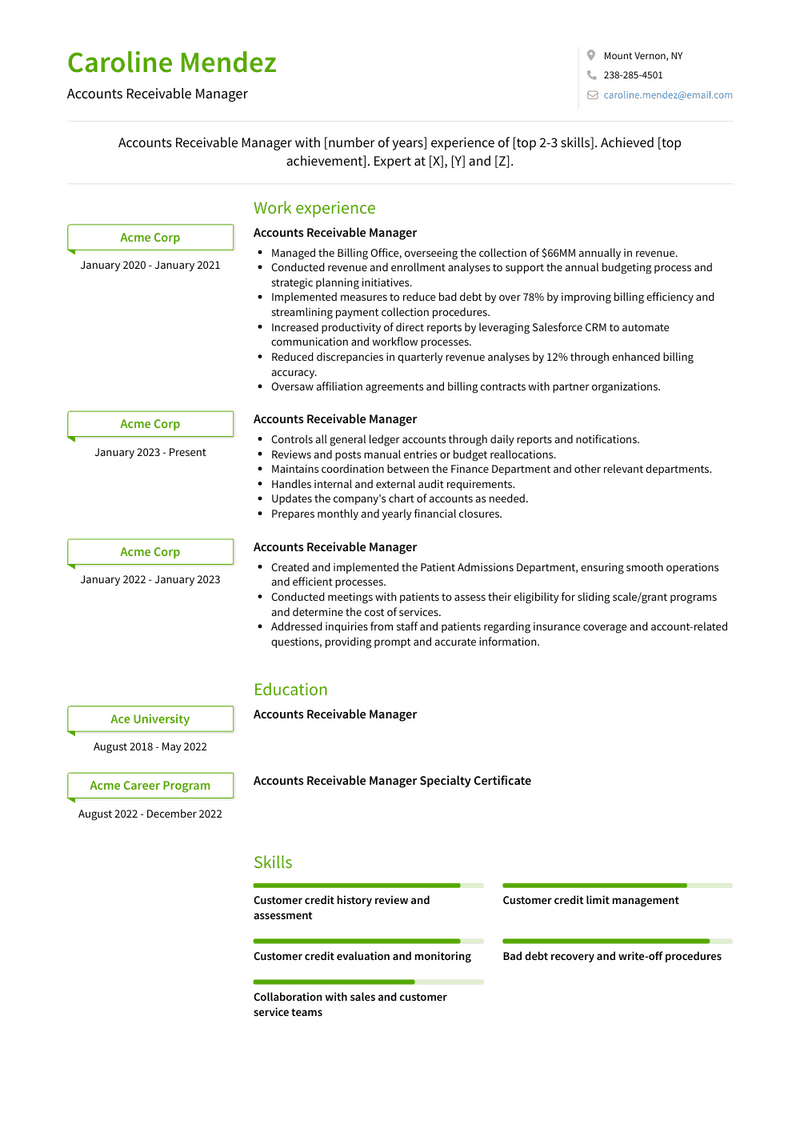

Accounts Receivable Manager Resume Example

Accounts Receivable Manager

- Controls all general ledger accounts through daily reports and notifications.

- Reviews and posts manual entries or budget reallocations.

- Maintains coordination between the Finance Department and other relevant departments.

- Handles internal and external audit requirements.

- Updates the company's chart of accounts as needed.

- Prepares monthly and yearly financial closures.

Accounts Receivable Manager Resume Example

Accounts Receivable Manager

- Created and implemented the Patient Admissions Department, ensuring smooth operations and efficient processes.

- Conducted meetings with patients to assess their eligibility for sliding scale/grant programs and determine the cost of services.

- Addressed inquiries from staff and patients regarding insurance coverage and account-related questions, providing prompt and accurate information.

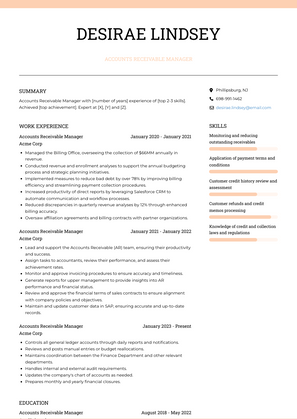

Accounts Receivable Manager Resume Example

Accounts Receivable Manager

- Lead and support the Accounts Receivable (AR) team, ensuring their productivity and success.

- Assign tasks to accountants, review their performance, and assess their achievement rates.

- Monitor and approve invoicing procedures to ensure accuracy and timeliness.

- Generate reports for upper management to provide insights into AR performance and financial status.

- Review and approve the financial terms of sales contracts to ensure alignment with company policies and objectives.

- Maintain and update customer data in SAP, ensuring accurate and up-to-date records.

Accounts Receivable Manager Resume Example

Accounts Receivable Manager

- Managed the Billing Office, overseeing the collection of $66MM annually in revenue.

- Conducted revenue and enrollment analyses to support the annual budgeting process and strategic planning initiatives.

- Implemented measures to reduce bad debt by over 78% by improving billing efficiency and streamlining payment collection procedures.

- Increased productivity of direct reports by leveraging Salesforce CRM to automate communication and workflow processes.

- Reduced discrepancies in quarterly revenue analyses by 12% through enhanced billing accuracy.

- Oversaw affiliation agreements and billing contracts with partner organizations.

Top Accounts Receivable Manager Resume Skills for 2023

- Accounts receivable management and oversight

- Invoicing and billing processes

- Credit and collections management

- Cash application and allocation

- Customer account reconciliation

- Aging report analysis and follow-up

- Credit risk assessment and evaluation

- Collection strategies and techniques

- Dispute resolution and negotiation

- Bad debt recovery and write-off procedures

- Customer payment processing and application

- Billing and collection system proficiency

- Account statement generation and distribution

- Customer credit evaluation and monitoring

- Payment terms and contract review

- Customer credit limit management

- Cash flow forecasting and analysis

- Accounts receivable reporting and analysis

- Knowledge of accounting principles and practices

- DSO (Days Sales Outstanding) management

- Customer relationship management

- Proactive customer communication and follow-up

- Invoice dispute resolution and mediation

- Deduction and chargeback management

- Application of payment terms and conditions

- Monitoring and reducing outstanding receivables

- Collection agency management and coordination

- Customer credit history review and assessment

- Payment plan negotiation and monitoring

- Sales tax compliance and reporting

- Collaboration with sales and customer service teams

- Financial statement analysis and interpretation

- Knowledge of credit and collection laws and regulations

- Collection letter and dunning notice preparation

- Monthly closing and reconciliation of accounts receivable

- Customer credit application review and processing

- Customer payment terms negotiation and management

- Cash flow optimization and working capital management

- Automation and streamlining of accounts receivable processes

- Customer credit scoring and risk assessment

- Invoice coding and classification

- Knowledge of ERP and financial management systems

- Customer credit line adjustment and management

- Aging report trend analysis and forecasting

- Customer refunds and credit memos processing

- Audit support and documentation preparation

- Knowledge of financial controls and internal audit processes

- Collection process improvement and optimization

How Long Should my Accounts Receivable Manager Resume be?

Your Accounts Receivable Manager resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Accounts Receivable Manager, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my accounts receivable experience on an Accounts Receivable Manager resume?

To highlight your experience, focus on your ability to manage accounts receivable processes, oversee invoicing and collections, and ensure accurate financial reporting. Include examples of how you’ve improved collection efficiency, reduced outstanding receivables, and maintained strong relationships with clients. Mention your role in leading accounts receivable teams and implementing strategies to improve cash flow.

What are the key skills to feature on an Accounts Receivable Manager resume?

Key skills to feature include accounts receivable management, collections, invoicing, financial reporting, and team leadership. Additionally, highlight your ability to manage aging reports, resolve billing disputes, and work with accounting software such as QuickBooks, SAP, or Oracle. Emphasize your attention to detail, communication skills, and ability to implement process improvements.

How do I demonstrate my ability to manage the accounts receivable process on my resume?

Demonstrate your ability to manage the accounts receivable process by providing examples of how you’ve monitored aging reports, reduced days sales outstanding (DSO), and ensured timely collections. Mention your experience in managing the invoicing process, reconciling accounts, and maintaining accurate financial records. Highlight how you’ve improved cash flow by optimizing collections or resolving payment delays.

Should I include metrics on my Accounts Receivable Manager resume? If so, what kind?

Yes, including metrics is important to quantify your impact. For example, you could mention the percentage reduction in overdue accounts, the improvement in DSO, or the number of clients you managed. Metrics such as decreased delinquency rates, increased collections efficiency, or successful dispute resolutions provide tangible evidence of your effectiveness as an Accounts Receivable Manager.

How can I showcase my experience with collections on my resume?

You can showcase your experience by detailing the strategies you’ve used to collect outstanding payments, negotiate payment terms, and resolve disputes. Mention any experience in improving collection processes, working with third-party collection agencies, or reducing bad debt. Highlight your communication skills and ability to maintain positive client relationships while ensuring timely payments.

What kind of achievements should I highlight as an Accounts Receivable Manager?

Highlight achievements such as reducing outstanding receivables, improving the collections process, or implementing new systems to streamline invoicing and payments. You could also mention any recognition you’ve received for successfully managing large accounts, reducing write-offs, or improving cash flow for the company. Achievements that demonstrate your ability to manage receivables efficiently and drive positive financial outcomes are particularly valuable.

How do I address a lack of management experience on an Accounts Receivable Manager resume?

If you lack formal management experience, focus on transferable skills such as leadership, communication, and problem-solving. Mention any experience you have in training or mentoring junior staff, leading smaller projects, or taking ownership of specific accounts receivable processes. Highlight your ability to take initiative, improve processes, and contribute to team success.

How important is experience with financial software for an Accounts Receivable Manager role?

Experience with financial software is highly important, as it ensures you can efficiently manage invoicing, collections, and reporting. Highlight your proficiency with tools such as QuickBooks, SAP, Oracle, or Microsoft Dynamics. Mention how you’ve used these tools to automate processes, track accounts, generate reports, and improve collections accuracy.

How do I demonstrate my ability to resolve billing disputes on my resume?

Demonstrate your ability to resolve billing disputes by describing how you’ve worked with clients to investigate discrepancies, negotiate payment solutions, and maintain positive relationships. Mention your role in ensuring accurate invoicing, correcting errors, and communicating clearly with clients to prevent future issues. Highlight your problem-solving skills and your ability to balance customer service with financial accuracy.

Should I include certifications on my Accounts Receivable Manager resume?

Yes, including certifications can enhance your resume by demonstrating your qualifications and commitment to professional development. Certifications such as Certified Credit Executive (CCE), Certified Accounts Receivable Specialist (CARS), or training in financial management software can add significant value to your resume and make you stand out to potential employers.

-

What Do Hiring Managers Look for in an Accounts Receivable Manager Resume

-

How to Write Your Accounts Receivable Manager Resume Header?

-

How to Write a Professional Accounts Receivable Manager Resume Summary?

-

How to Write a Accounts Receivable Manager Resume Experience Section?

-

How can I highlight my accounts receivable experience on an Accounts Receivable Manager resume?

-

What are the key skills to feature on an Accounts Receivable Manager resume?

-

How do I demonstrate my ability to manage the accounts receivable process on my resume?

-

Should I include metrics on my Accounts Receivable Manager resume? If so, what kind?

-

How can I showcase my experience with collections on my resume?

-

What kind of achievements should I highlight as an Accounts Receivable Manager?

-

How do I address a lack of management experience on an Accounts Receivable Manager resume?

-

How important is experience with financial software for an Accounts Receivable Manager role?

-

How do I demonstrate my ability to resolve billing disputes on my resume?

-

Should I include certifications on my Accounts Receivable Manager resume?

Copyright ©2025 Workstory Inc.