Accounts Receivable Analyst Resume Examples and Templates

This page provides you with Accounts Receivable Analyst resume samples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of a Accounts Receivable Analyst resume.

What do Hiring Managers look for in an Accounts Receivable Analyst Resume

- Financial Analysis: Proficiency in financial analysis, specifically related to accounts receivable and collections.

- Attention to Detail: Strong focus on accuracy and precision when managing receivables and financial records.

- Communication Skills: Effective communication and interpersonal abilities for interacting with clients, internal teams, and resolving payment issues.

- Problem-Solving Abilities: Capacity to identify and address accounts receivable challenges, delinquent accounts, and discrepancies.

- Software Proficiency: Familiarity with accounting software and tools for managing accounts receivable processes.

How to Write an Accounts Receivable Analyst Resume?

To write a professional Accounts Receivable Analyst resume, follow these steps:

- Select the right Accounts Receivable Analyst resume template.

- Write a professional summary at the top explaining your Accounts Receivable Analyst’s experience and achievements.

- Follow the STAR method while writing your Accounts Receivable Analyst resume’s work experience. Show what you were responsible for and what you achieved as an Accounts Receivable Analyst.

- List your top Accounts Receivable Analyst skills in a separate skills section.

How to Write Your Accounts Receivable Analyst Resume Header?

Write the perfect Accounts Receivable Analyst resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Accounts Receivable Analyst position to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Accounts Receivable Analyst resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

Bad Accounts Receivable Analyst Resume Example - Header Section

Kevin 90 Foster Ave. Peabody, MA 01960 Marital Status: Married, email: cooldude2022@gmail.com

Good Accounts Receivable Analyst Resume Example - Header Section

Kevin Odom, Peabody, MA, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- firstnamelastname@email.com - johndoe@email.com

- firstname.lastname@email.com - john.doe@email.com

- lastname.firstname@email.com - doe.john@email.com

- f.lastname@email.com - j.doe@email.com

- l.firstname@email.com - d.john@email.com

- firstnamelastname12@email.com - johndoe12@email.com

For a Accounts Receivable Analyst email, we recommend you either go with a custom domain name (john@johndoe.com) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Accounts Receivable Analyst Resume Summary?

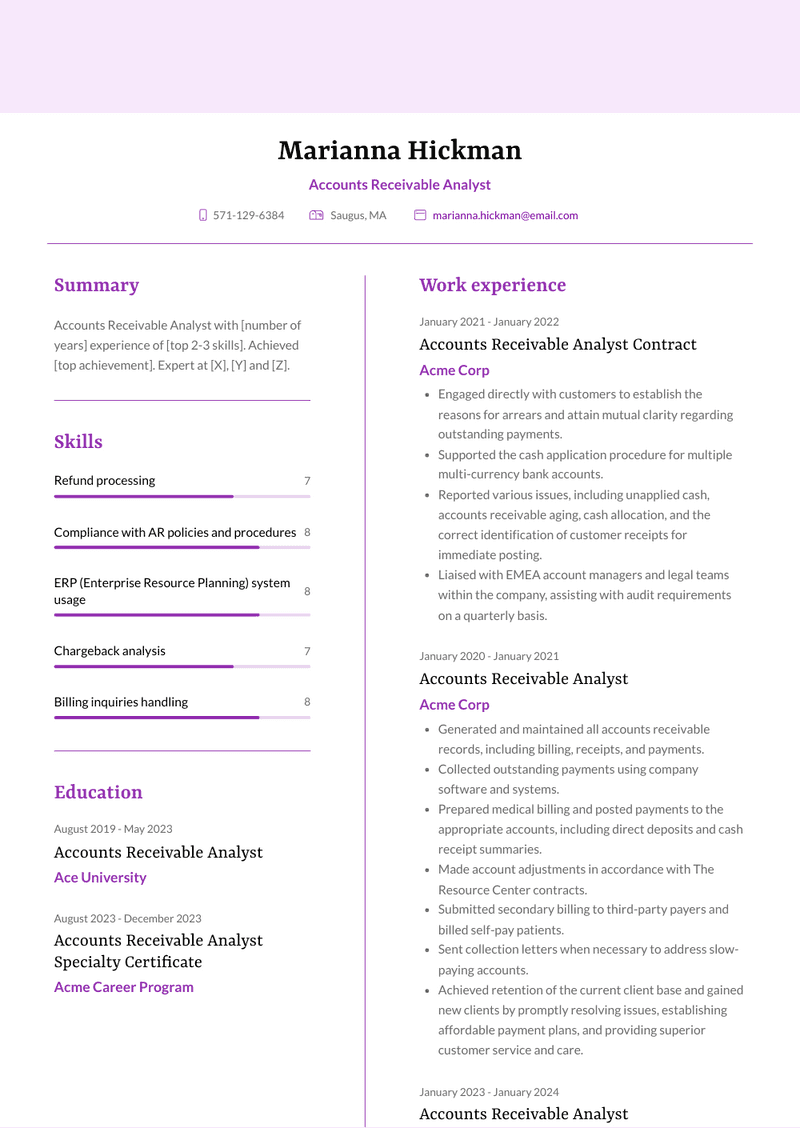

Use this template to write the best Accounts Receivable Analyst resume summary: Accounts Receivable Analyst with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Accounts Receivable Analyst Resume Experience Section?

Here’s how you can write a job winning Accounts Receivable Analyst resume experience section:

- Write your Accounts Receivable Analyst work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Accounts Receivable Analyst work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Accounts Receivable Analyst).

- Use action verbs in your bullet points.

Accounts Receivable Analyst Resume Example

Accounts Receivable Analyst

- Performed monthly reconciliations of accounts and generated reports.

- Monitored and supervised the collection process.

- Acted as a Competence focal point, providing consultancy and support to other departments.

- Resolved customer complaints related to payment issues through interactions with third parties.

- Ensured the refund process was executed correctly, minimizing the probability of double payments to clients.

- Managed the billing process every month.

- Conducted accounts equalizations.

- Supported the accounts receivable team in the EU.

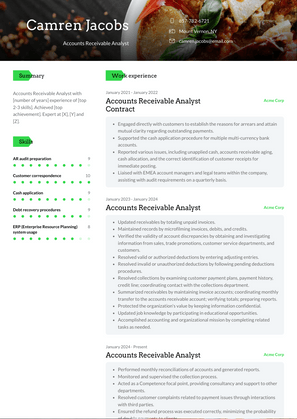

Accounts Receivable Analyst Resume Example

Accounts Receivable Analyst

- Updated receivables by totaling unpaid invoices.

- Maintained records by microfilming invoices, debits, and credits.

- Verified the validity of account discrepancies by obtaining and investigating information from sales, trade promotions, customer service departments, and customers.

- Resolved valid or authorized deductions by entering adjusting entries.

- Resolved invalid or unauthorized deductions by following pending deductions procedures.

- Resolved collections by examining customer payment plans, payment history, credit line; coordinating contact with the collections department.

- Summarized receivables by maintaining invoice accounts; coordinating monthly transfer to the accounts receivable account; verifying totals; preparing reports.

- Protected the organization's value by keeping information confidential.

- Updated job knowledge by participating in educational opportunities.

- Accomplished accounting and organizational mission by completing related tasks as needed.

Accounts Receivable Analyst Resume Example

Accounts Receivable Analyst

- Reviewed ordering documents to confirm ordering details are correctly entered in our financial tools.

- Ensured all invoices are accurate and generated in a timely manner.

- Delivered invoices through electronic procure-to-pay platforms such as Coupa, Ariba, Tungsten, and Catalyst.

- Reported and resolved payment issues, disputing payments, and reconciling issues with both internal stakeholders and external vendors.

- Monitored and responded to incoming customer billing queries.

- Supported month-end closing activities, including revenue booking and assisting with various monthly tracking reports.

- Worked late nights and on weekends during month-end closing.

- Conducted ad-hoc activities, such as preparing credit memo requests and sending out annual invoices for contractual renewals.

Accounts Receivable Analyst Contract Resume Example

Accounts Receivable Analyst Contract

- Engaged directly with customers to establish the reasons for arrears and attain mutual clarity regarding outstanding payments.

- Supported the cash application procedure for multiple multi-currency bank accounts.

- Reported various issues, including unapplied cash, accounts receivable aging, cash allocation, and the correct identification of customer receipts for immediate posting.

- Liaised with EMEA account managers and legal teams within the company, assisting with audit requirements on a quarterly basis.

Accounts Receivable Analyst Resume Example

Accounts Receivable Analyst

- Generated and maintained all accounts receivable records, including billing, receipts, and payments.

- Collected outstanding payments using company software and systems.

- Prepared medical billing and posted payments to the appropriate accounts, including direct deposits and cash receipt summaries.

- Made account adjustments in accordance with The Resource Center contracts.

- Submitted secondary billing to third-party payers and billed self-pay patients.

- Sent collection letters when necessary to address slow-paying accounts.

- Achieved retention of the current client base and gained new clients by promptly resolving issues, establishing affordable payment plans, and providing superior customer service and care.

Top Accounts Receivable Analyst Resume Skills for 2023

- Accounts receivable analysis

- Invoice processing

- Payment processing

- Accounts receivable reconciliation

- Payment application

- Customer account management

- Billing inquiries handling

- Payment posting

- Invoice disputes resolution

- Aging reports analysis

- Credit memo processing

- Cash application

- Accounts receivable reporting

- Collection analysis

- Customer credit assessment

- Credit limit management

- Bad debt analysis

- Dunning letters preparation

- Payment plan negotiations

- Debt recovery procedures

- Credit terms management

- Account statement generation

- Payment terms verification

- Account aging analysis

- Account reconciliation software usage

- ERP (Enterprise Resource Planning) system usage

- Excel proficiency (e.g., PivotTables, VLOOKUP)

- Data entry accuracy

- Customer correspondence

- Billing system operation

- Payment processing software

- AR audit preparation

- Compliance with AR policies and procedures

- Bank reconciliation

- Account adjustments

- Payment posting software

- Refund processing

- Chargeback analysis

- Tax compliance for AR

- Account receivable documentation

- AR data analysis

- AR metrics and KPIs

- Customer account history review

- Billing accuracy verification

- Payment disputes escalation

- Customer account aging review

- Customer credit scoring

- Cash flow analysis

- Collection agency coordination

How Long Should my Accounts Receivable Analyst Resume be?

Your Accounts Receivable Analyst resume length should be less than one or two pages maximum. Unless you have more than 25 years of experience, any resume that’s more than two pages would appear to be too long and risk getting rejected.

On an average, for Accounts Receivable Analyst, we see most resumes have a length of 2. And, that’s why we advise you to keep the resume length appropriate to not get rejected.

How can I highlight my experience as an Accounts Receivable Analyst on my resume?

Focus on your expertise in managing invoices, processing payments, and ensuring timely collections. Highlight your role in analyzing outstanding receivables, resolving billing discrepancies, and maintaining accurate financial records.

What are the key skills to feature on an Accounts Receivable Analyst's resume?

Emphasize skills in accounts receivable management, invoicing, payment processing, reconciliation, and financial analysis. Highlight your proficiency with accounting software like QuickBooks, SAP, or Oracle, and your ability to manage large volumes of transactions.

How do I demonstrate my ability to manage accounts receivables on my resume?

Provide examples of how you’ve reduced outstanding receivables, improved collections, or streamlined the invoicing process. Highlight your role in maintaining accurate records, generating aging reports, and collaborating with clients to resolve payment issues.

Should I include metrics on my Accounts Receivable Analyst resume? If so, what kind?

Yes, include metrics such as reductions in days sales outstanding (DSO), improvements in collection rates, or the value of receivables you managed. These metrics help quantify your contributions to improving cash flow and reducing overdue accounts.

How can I showcase my experience with reconciliation on my resume?

Detail your experience in reconciling accounts receivable records with general ledger balances, ensuring accuracy in financial statements. Highlight your role in identifying discrepancies, investigating variances, and resolving accounting issues.

What kind of achievements should I highlight as an Accounts Receivable Analyst?

Highlight achievements such as reducing overdue receivables, improving cash flow, or being recognized for your accuracy and efficiency in managing accounts receivable processes. Mention any recognition for contributing to financial reporting accuracy or improving collection procedures.

How do I address a lack of experience in a specific area of accounts receivable on my resume?

Emphasize your core accounting skills, attention to detail, and problem-solving abilities. Highlight relevant coursework, certifications, or projects that demonstrate your readiness to manage various aspects of accounts receivable.

How important is communication for an Accounts Receivable Analyst role?

Communication is crucial for resolving payment issues and maintaining good relationships with clients. Highlight your experience in communicating with clients, resolving disputes, and ensuring timely payments while maintaining professionalism.

How do I demonstrate my ability to manage billing and collections on my resume?

Mention specific examples where you’ve improved billing accuracy, reduced payment delays, or worked closely with clients to resolve payment discrepancies. Highlight your ability to manage both high-volume invoicing and customer relationships.

Should I include certifications on my Accounts Receivable Analyst resume?

Yes, include relevant certifications such as Certified Accounts Receivable Professional (CARP), Certified Credit & Risk Analyst (CCRA), or accounting-related certifications. These demonstrate your expertise in managing receivables and commitment to professional development.

-

What do Hiring Managers look for in an Accounts Receivable Analyst Resume

-

How to Write Your Accounts Receivable Analyst Resume Header?

-

How to Write a Professional Accounts Receivable Analyst Resume Summary?

-

How to Write a Accounts Receivable Analyst Resume Experience Section?

-

How can I highlight my experience as an Accounts Receivable Analyst on my resume?

-

What are the key skills to feature on an Accounts Receivable Analyst's resume?

-

How do I demonstrate my ability to manage accounts receivables on my resume?

-

Should I include metrics on my Accounts Receivable Analyst resume? If so, what kind?

-

How can I showcase my experience with reconciliation on my resume?

-

What kind of achievements should I highlight as an Accounts Receivable Analyst?

-

How do I address a lack of experience in a specific area of accounts receivable on my resume?

-

How important is communication for an Accounts Receivable Analyst role?

-

How do I demonstrate my ability to manage billing and collections on my resume?

-

Should I include certifications on my Accounts Receivable Analyst resume?

Copyright ©2025 Workstory Inc.