Accounting Manager Resume Examples [+ 3 Samples]

Discover our complete guide and selection of Accounting Manager resume examples to use to create your own resume with our easy-to-use resume builder. Below you'll find our how-to section that will guide you through each section of an Accounting Manager resume.

Accounting Manager Resume Overview

Some people are good with numbers. Others have dazzling people skills. But if you happen to have been graced with both of these traits, a career as an accounting manager just might be the perfect match for you. Of course, you’ll first have to create an accounting manager resume that stands out from the rest. Thankfully, the VisualCV team is here to help you every step of the way!

If you’d like to put your keen eye for detail, sharp math knowledge, and great leadership skills to good use, read on for accounting manager resume examples to land you your dream job in 2022.

What is an Accounting Manager?

People who work in the accounting industry are responsible for keeping and interpreting financial records. Some accountants work for individuals, while others work for larger businesses. Accountants can work as self-employed individuals, or as part of an accounting firm. Day to day, accountants create and keep track of financial records in order to prepare tax statements when the individual or business who employs the accountant needs to file taxes. Accountants can also be in charge of ensuring financial records are up to date and accurate, so anyone interested in pursuing accounting as a career must have a keen eye for detail and meticulously document their daily tasks. Accounting managers are a higher ranking type of accountant than standard accountants, and because of this they often earn more money. Accounting managers are responsible for the daily work of a team of accountants, ensuring that companies are able to reach their financial goals.

Before you can become an accounting manager, you’ll have to start by becoming a certified accountant and working your way up.

How to Write an Accounting Manager Resume

You should seek to prove two main things in your account manager resume. The first is that you have the training and certifications required to work as an accountant in your state or region. The second is that you have the required accounting experience to be a successful accounting manager. Not only are you applying to work as an accountant, you’re also seeking to manage other accountants and larger, more “big picture” tasks for the accounting firm or department.

In general, your accounting manager resume should contain the following:

- A summary

- Your experience

- Your education

- Your skills, including any professional certifications

The Best Format for an Accounting Manager Resume

When choosing your professionally designed accounting manager resume template, think about what you’re most proud of achieving. An accounting manager resume needs to demonstrate that you have the accounting education and certifications required for the job, as well as demonstrate your accounting experience and management skills. Because accounting managers need to have experience across several areas at once, your resume format shouldn’t necessarily prioritize one section over another. Your education, experience, and skills sections are all, in general, equally important. However, if you’re particularly proud of what you’ve achieved at your current job, or if you’re a multitalented accounting manager with many different certifications, you may consider beginning your accounting manager resume with the section that correlates to those achievements.

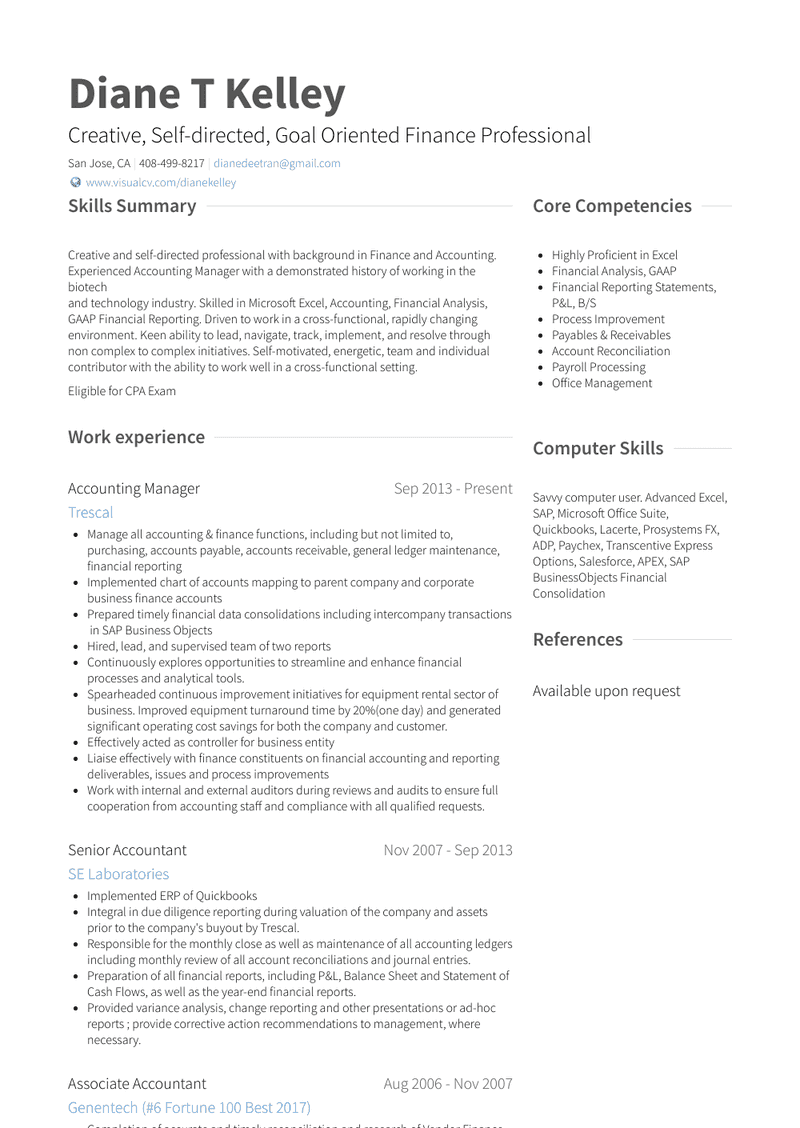

3 Accounting Manager Resume Examples

Your summary should be short and to the point. This is the very first thing a recruiter will see, so make sure you’re putting your absolute best foot forward. Highlight your level of experience if you aren’t applying for entry-level positions, or your recent academic accomplishment if you’re a new graduate. Make sure to read the job description carefully and adjust your resume to fit it -- as long as what you’re saying is true, of course! In order to become an accounting manager, you’ll have to prove one main thing – are you qualified to perform the required tasks of an accounting manager? Accounting managers generally embark on highly specialized education and training, as well as work placements and rigorous exams. Make sure that your accounting manager resume clearly lays out all of your qualifications.

In order to become an accounting manager, you’ll also need to prove your leadership skills. There are many talented and successful accountants that wouldn’t necessarily make good accounting managers because they lack the people skills required to lead a team of accountants. Consider what a hiring manager is looking for in the role – read the job posting carefully and ensure your resume aligns with it.

Many recruiters and companies now use Applicant Tracking Systems to automate and streamline the recruitment process. While this is a great benefit for companies, some applicants have been met with the frustration of their resumes not ever being seen by a real person -- if the resume doesn’t get past the ATS software, it’s usually discarded. Thankfully, VisualCV’s resume templates have been specifically designed to beat applicant tracking systems, making your accounting manager resume much more likely to make it in front of the right person.

The Wrong Way to Write an Accounting Manager Resume Summary

Your summary shouldn’t be too wordy or personal – that’s what your cover letter is for! This first step in your accounting manager resume exists to give hiring managers a brief glimpse into your personality and experience. Not all hiring managers agree that a resume summary is necessary, but if your resume summary is clear, to the point, and hones in on what the job description is asking for, include it!

DON’T Do This

- I never really liked being an accountant because I felt like my skills were better used in a management position. Because of this, I took on extra responsibilities at my previous jobs and worked towards new certifications. Now, I think I’m finally ready to become an accounting manager so I can finally have more fun at my job.

Accounting Manager Resume Summary Sample

Certified Public Accountant with seven years of professional experience. I’ve previously led teams to great success and I’m looking for the opportunity to bring my collaboration, leadership, and organization to a new team!

Professional Summary for an Accounting Manager

Certified Professional Bookkeeper with five years of specialized experience in providing consultant services for start-up and growth stage companies.

Accounting Manager Resume Summary Example

Chartered Accountant with ten years of professional experience working with self-employed individuals, ensuring tax compliance and encouraging best business practices.

Do You Need an Accounting Manager Resume Objective?

Many people think resume objectives are a requirement for each and every accounting manager resume they write. However, accounting manager resume objectives are only recommended for people looking to transition into a new type of role, or for people looking for entry-level positions. Since accounting managers aren’t entry-level positions, if you aren’t sure whether you need a resume objective, it’s safe to leave it off.

Accounting Manager Resume Objective Example

Certified Payroll Manager and newly-certified Chartered Accountant with five years of experience looking to transition from corporate accounting into an accounting manager position for individual tax services.

How to Describe Your Experience On Your Accounting Manager Resume

This is where you can really start bragging. Alison Green, author of Ask a Manager, highlights the single biggest resume mistake she saw in her time as a hiring manager: “Writing a resume that reads like a series of job descriptions.”

“The bullet points they use to describe what they did for each job just list activities and read like a job description for the role might,” she says. “For example, ‘edit documents,’ ‘collect data,’ or ‘manage website.’”

While writing the experience section of your full stack developer resume, focus on what you accomplished at each position.

Certified Public Accountant, Smith & Johnson Financial Services | 2016-2021

- Filed tax returns for 100 individual clients per year with a 100% accuracy rate

- Tracked financial records for 10 businesses, working across the firm to collaborate with colleagues and provide accurate and up-to-date information for clients

- Audited financial statements for external businesses to ensure accuracy and compliance with tax laws

A hiring manager will be looking for the facts. What did you do at your previous jobs that made you stand out? For which projects did you receive the most praise? Providing tangible facts shows hiring managers that you have the potential to do the same at your next job.

A Bad Accounting Manager Job Description on Resume

Consider the following entry.

Certified Public Accountant, Smith & Johnson Financial Services | 2016-2021

- Filed tax returns

- Kept track of financial records

- Checked accuracy of financial statements

This entry focuses on responsibilities you had at a previous job, but doesn’t describe what you achieved there. Hiring managers will likely already understand the types of tasks you performed at previous jobs. Your goal is to show them how good you are at performing those tasks!

How to List Skills on Your Accounting Manager Resume

What skills should you include on an accounting manager resume? While you should always try and list the skills that the job posting is asking for, there are some skills that come with the territory of being an accounting manager. Looking for more information about adding skills to your resume? Check out our resume skills guide here.

Top Accounting Manager Resume Skills in Demand in 2022

| Hard Skills for Accounting Managers | Soft Skills for Accounting Managers |

|---|---|

| Forecasting Budgets | Time Management |

| Payroll | Organization |

| Generally Accepted Accounting Principles (GAAP) | Communication |

| Tax Law Understanding | Attention to Detail |

| Managing Vendor Accounts | Teamwork |

| Knowledge of Financial Regulations | Management/Mentorship |

| Bookkeeping Software | Active Listening |

| Record Keeping | Efficiency |

Professional Certifications for Accounting Managers

Professional certifications, or additional training and education, are a great way to separate yourself from other applicants when applying for accounting manager positions. Hiring managers will see that you’ve taken an extra step in your career – taking initiative is one way to show a hiring manager you’re prepared for the responsibility of managing others. Take a look at just a few professional certifications you may be interested in achieving.

Certified Professional Bookkeeper

Bookkeepers work for businesses by keeping accurate and up-to-date information about the business’ financial situation. Businesses need to understand exactly how well or poorly they’re operating on a financial level, and a bookkeeper’s job is to provide that information. Bookkeepers often share responsibilities with accountants, such as filing tax returns. This means that becoming a professional accountant with a bookkeeping certification could make you doubly valuable to a company!

Chartered Accountant

Chartered accountants, or CAs, work directly with individuals instead of businesses. Becoming a CA means expanding your knowledge to more than standard accounting practices such as filing tax returns and auditing financial records. CAs are trained to apply the theories of accounting into real-life practice with individual clients. You may, for example, work with clients to create financial strategies as they grow their wealth. This certification is valuable because it allows you to work for clients outside of the standard “busy season” accountants experience when individuals and businesses are filing tax returns.

Certified Payroll Manager

Another managerial certification, becoming a CPM allows an accountant to work for a company’s payroll department. As a CPM, you’re responsible for ensuring employees are paid correctly and on-time. Because working with people’s livelihoods is a heavy responsibility, this certification is highly regulated. To become a CPM, you must have a payroll distribution certificate, work in a company’s payroll department for at least two years, and pass a CPM exam.

Certified Information Technology Professional

If you’ve always had a way with technology, consider adding this certification to your accounting manager resume. Certified Information Technology Professionals are specially trained in the accounting technology that businesses often use to keep track of expenses and taxes. By hiring an accountant who is also a Certified Information Technology Professional, the business is able to utilize technology to the best of its ability, while also retaining the human element of a staff accountant who can answer questions and work as part of the team. In order to become a CITP, accountants must have 1,000 hours of business experience and 75 hours of continued education in information management and technology assurance before they are able to take the CITP exam.

Soft skills for accounting managers

While “hard” or taught skills are often prioritized for accounting jobs, hiring mangers look for soft skills when seeking out accounting managers. Think of the balance between hard and soft skills for accounting manager jobs like a “best of both worlds” situation. Hiring managers are looking for someone with finely tuned accounting skills and years of experience in the field. However, the role of an accounting manager is also to mentor more junior accountants, set goals and lead teams towards them, check the work of others, and much more.

If cultivating these soft skills doesn’t sound appealing to you, you may consider a different path up the ladder as an accountant. However, if you’re the type of person who enjoys cultivating professional relationships with others and helping people become the best that they can be, aspiring to become an accounting manager may be the perfect choice for you. Here are a few of the soft skills hiring managers look for when they seek out accounting managers.

Organization

As an accounting manager, you’ll have to stay on top of the ins and outs of your clients’ financial details, as well as the duties and responsibilities of the accountants you manage. Being able to stay organized is a crucial part of being a successful accountant, because you’ll often need to find individual documents or records months or years after they’ve been filed. This becomes even more amplified when you work as an accounting manager, because you’ll have to keep track of your staff and all of their clients, too.

Detail-Oriented

Are you the kind of person who can find the one small error in a large stack of documents? Being a detail-oriented person can help you go far as an accountant! Demonstrate to hiring managers that you’ll be able to spend hours pouring over tax returns, payroll, and other financial documents without ever missing anything by sharing examples of situations during which you paid close attention to detail.

Leadership

Key in any management position, leadership skills are extremely important if you’d like to become an accounting manager. You don’t have to have management experience to display leadership – maybe you’ve been in charge of a committee or team before, or you’ve planned networking events for your co-workers? You should always find ways to demonstrate your leadership skills on your accounting manager resume.

Related Resumes

Something about this job catch your eye, but you aren’t quite sure if it’s a match? Check out these related resumes and discover where your next career move could take you.

Accountant Resume Examples Project Manager Resume Examples Account Assistant Resume Examples Project Administrator Resume Examples Office Manager Resume Examples

Accounting Manager Salaries

Accounting is seen by many to be a stable, reliable career that can lead to a good income. But exactly how much money can you expect to make by the time you become an accounting manager?

According to Glassdoor, accounting managers in the USA make an average of $85,000 per year. However, keep in mind that salaries will vary depending on your experience, certifications, and location. If you live in a very high cost of living area, for example, it may appear as though you make significantly more than that average salary, but you’ll have to spend much more of it on things like food, housing, and entertainment.

If you’re interested in increasing your salary even more as an accounting manager, consider taking the time to obtain new certifications in your field. While these certifications usually come with an initial investment, you may be able to quickly recoup it with a raise or new, higher-paying job.

How to Become an Accounting Manager

Accounting managers already have several years of experience in the accounting field before they’re promoted to the position of accounting manager. If you’re at the beginning of your career journey, but you already know you’d like to become an accounting manager in the future, you first need to become an accountant. Once you’ve successfully proven to your field that you’re an excellent accountant, you can begin to ask for promotions or apply to accounting manager positions.

What should you study to become an accounting manager?

In general, people interested in becoming accountants attend university and study either accounting or finance through a four-year undergraduate program. You should consider your future goals when selecting your undergraduate degree, as there are pros and cons to both programs. Many people who select finance over accounting do so because they appreciate having the option to work in the financial sector as well as in accounting. This way, if one career doesn’t work out, or isn’t what they expected, they can more easily switch to the other one.

An accounting degree will teach you about statistics, financial record keeping, accounting ethics, taxes, auditing, and more. Finance degrees will usually teach you about the financial industry more broadly, and you’ll learn about investing, financial planning, and budgeting.

Choosing your accounting specialty

Accountants can work over several disciplines. Choosing the one that suits your skills and career goals best can lead to more rewarding opportunities throughout your career. In general, accountants will either select a specialty during their education, or work towards qualifying as a Certified Public Accountant, or CPA. If you’d like to specialize, you’ll likely choose a path in one of eight accounting specialties.

Financial Accounting

Financial accountants are employed by businesses to keep track of financial transactions and determine tax obligations. As a financial accountant, your tasks will include preparing and filing tax returns on behalf of businesses. You’ll also be responsible for creating financial documents, such as balance sheets and income statements, for businesses. In general, you’ll receive a company’s historical financial information from previous months, and your job as a financial accountant will be to take that information and use it to guide you in creating your financial documents.

Cost Accounting

Cost accounting is frequently used in the manufacturing industry, where companies have a variety of fixed and variable costs. A cost accountant works closely with a business, analyzing fixed costs, such as the company’s rent and office expenses, and variable costs, such as the cost of supplies ordered from third parties. They then determine whether these costs can be better managed by the company.

Auditing

Auditors ensure that businesses avoid fraud and are in line with government regulations surrounding paying taxes. If you’d like to become an auditor, you’ll usually specialize further by becoming either an internal or external auditor. Internal auditors work with companies to outline accounting procedures, to protect companies from fraud and to make sure everyone within the company is working effectively. External auditors work for government agencies or other governing boards. They investigate a company’s financial records in order to determine whether fraud or other illegal financial activities have occured.

Managerial Accounting

If you enjoy strategy and financial planning, managerial accounting may be the direction you’d like to take your career. Managerial accounting focuses on providing information to a company’s financial decision-makers in order to guide the company towards the best financial decisions. As a managerial accountant, you’ll budget and forecast, analyze finances and costs, and review business decisions the company has made in the past.

Tax Accounting

Tax accountants may be what the general public first thinks of when they think of accountants. This specialization focuses on preparing individuals or businesses for filing their tax returns. If you’re a tax accountant for a business, you’ll be responsible for keeping them in line with IRS or other government regulations. Individuals also often hire tax accountants for their personal tax returns, meaning you’ll have to be up to date on all regulations surrounding tax returns, and be able to provide tax advice to clients to ensure they file as effectively as possible.

Forensic Accounting

Not many people consider accounting to be a “trendy” career, but forensic accounting is certainly a specialization that’s rising in popularity among accountants and non-accountants alike! Forensic accountants focus on legal issues, such as fraud, claims and disputes, and other criminal activity. In these cases, financial records are often incomplete, written in code, or otherwise purposefully confusing. A forensic accountant’s job is to work on a case-by-case basis to determine the financial goings-on that surround a legal matter.

Fiduciary Accounting

Fiduciary accountants focus on accounting related to the ownership of property. You may work with individuals or businesses as a fiduciary accountant. Fiduciary accountants often work with legal estates, especially if a person has died or a company is closed and financial assets are to be distributed as a result.

Accounting Manager Career Path

If being an accounting manager is just one of the steps on your way to the top, you’ll need to know what else is in store! Maybe you’re dreaming of becoming a partner at a major accounting firm, or the CFO of a large company. Either way, understanding your potential career path is the first step in climbing that corporate ladder.

Staff Accountant

Staff accountants are usually the most junior accountants on a team, whether you’re working in the public or private sectors. These entry-level positions are the first step in a lifelong career as an accountant, and many staff accountants spend extra time obtaining new certifications as they begin to try and shape their careers. Junior or staff accountants are often responsible for assisting the accounting department with administrative tasks such as populating balance sheets.

Senior Accountant

After proving yourself for a few years as a staff accountant, a promotion might be in order! Senior accountants generally perform the same duties as junior or staff accountants. However, senior accountants are responsible solely for their own work, and generally do not have to assist the accounting team. If you’re working for a large accounting firm, you’ll likely become more responsible for your own clients at this stage in your career. Building these relationships is crucial as you move forward, so don’t take your new responsibilities lightly!

Accounting Manager

If you’re looking for accounting manager resume examples, there’s a good chance that you’ve already reached this stage of your career! Accountants begin to take on more responsibility at this stage – becoming an accounting manager means expanding your job description to not only perform your accounting duties, but to also lead, mentor, and shape the accounting team. After several years in an accounting manager role, you may decide your dreams are even higher. At that point, you’ll generally have to decide whether you’d like to become an accounting partner, or a CFO. This decision usually depends on the sector in which you work – if you’re a public accountant, accounting partner is usually the top of the career ladder. Private accountants, however, often strive to become chief financial officers.

Accounting Partner

Accounting partners are very senior accountants, usually employed by major consulting or accounting firms. In this role, you’ll be responsible for accounting duties as well as management and “big picture” tasks. You’ll need to maintain and cultivate client relationships, as well as advising them on the best financial practices for their businesses. Your goal as an accounting partner is to contribute to the overall growth, development, and success of your firm.

Chief Financial Officer (CFO)

Becoming a CFO means reaching the very top of the accounting corporate ladder. While this position is very difficult to achieve, CFOs are extremely well-compensated and find a great deal of pleasure in their work. As a CFO, you’ll be responsible for a company’s overall financial situation. You’ll track cashflow and plan for the company’s financial future. You’ll need to constantly analyze the company’s financial situation, determining the financial strategy and proposing different ways for the company to reach their financial goals.

Final Thoughts

If you’ve always had a “math brain,” but also delight in making personal connections with people and helping others, you might find that being an accounting manger is the perfect fit for you. Whether your goal is to become the best accounting manager you can be, or you have your sights set on the lofty goal of becoming a CFO, you’ll need the best accounting manger resume to help you land the perfect accounting manager job.

A professionally designed resume is one way to make your application stand out from the crowd. Whether you choose to use eye-catching color, a unique format, or simply a clean and polished template with your skills and achievements on display, a VisualCV Pro membership could be the thing that takes your career to the next level.

Copyright ©2025 Workstory Inc.