Internal Auditor CV Examples

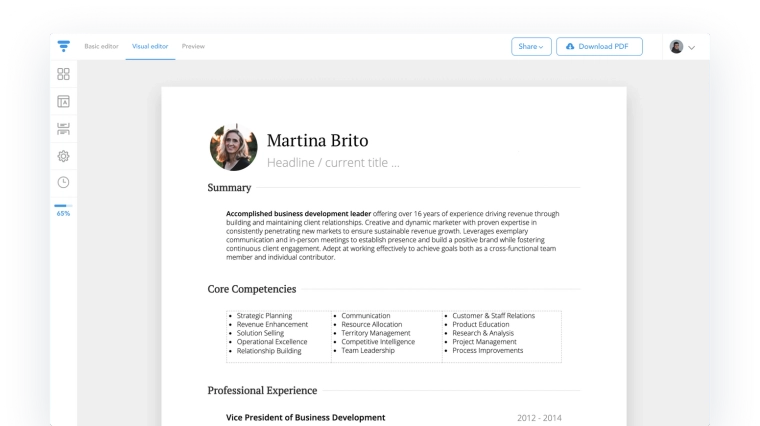

Start creating your CV in minutes by using our 21 customizable templates or view one of our handpicked Internal Auditor examples.

Join over 260,000 professionals using our Internal Auditor examples with VisualCV. Sign up to choose your template, import example content, and customize your content to stand out in your next job search.

How to Write an Internal Auditor CV?

To write an Internal Auditor CV, follow these tips:

- Select a CV template that’s perfect for an Internal Auditor role.

- Hiring managers know what Internal Auditors do on a daily basis, that’s why rather than writing a general CV, make sure you tailor yours to the job that you are applying to.

- At the top of your CV, add a header section that lists your name, current internal auditor role, location and contact details.

- In your CV’s summary, work history, and skills section highlight relevant internal auditing skills that are relevant for the role.

- List whether you are CIA certified and add if you are a member of ACCA, CIMA, etc.

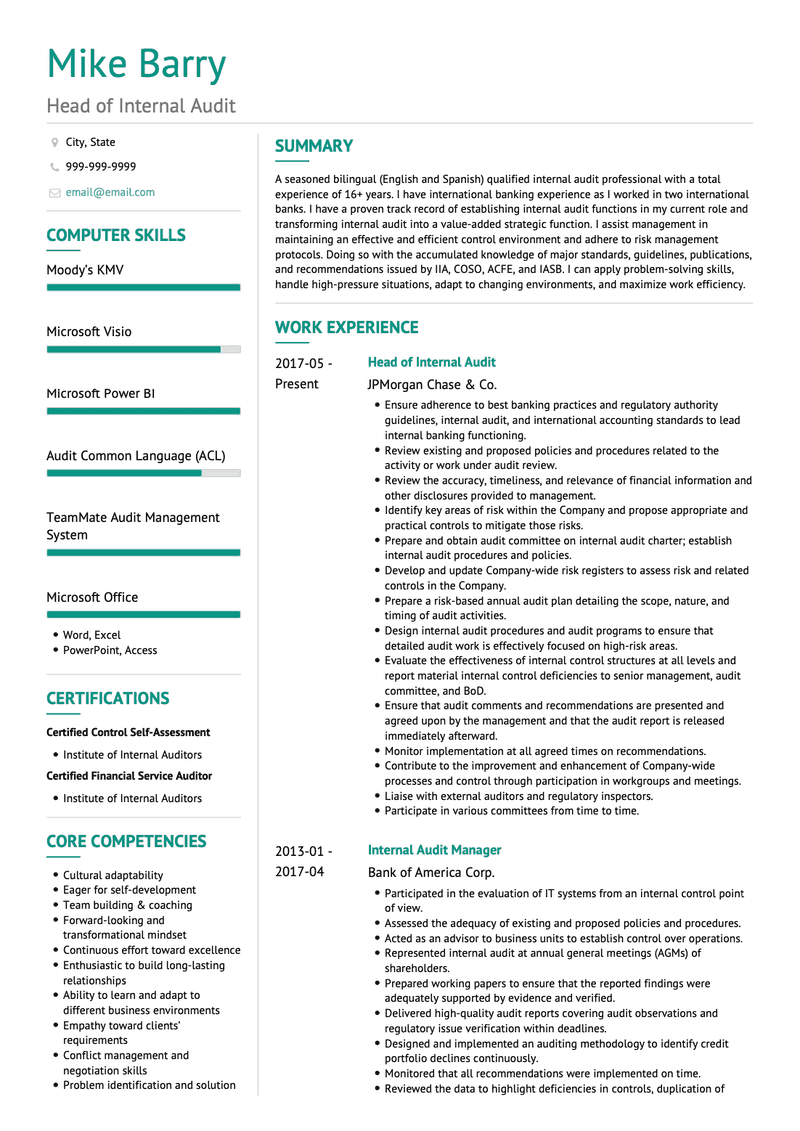

Head of Internal Audit

SUMMARY

A seasoned bilingual (English and Spanish) qualified internal audit professional with a total experience of 16+ years. I have international banking experience as I worked in two international banks. I have a proven track record of establishing internal audit functions in my current role and transforming internal audit into a value-added strategic function. I assist management in maintaining an effective and efficient control environment and adhere to risk management protocols. Doing so with the accumulated knowledge of major standards, guidelines, publications, and recommendations issued by IIA, COSO, ACFE, and IASB. I can apply problem-solving skills, handle high-pressure situations, adapt to changing environments, and maximize work efficiency.

WORK EXPERIENCE

Head of Internal Audit

JPMorgan Chase & Co.

2017-05 - Present

- Ensure adherence to best banking practices and regulatory authority guidelines, internal audit, and international accounting standards to lead internal banking functioning.

- Review existing and proposed policies and procedures related to the activity or work under audit review.

- Review the accuracy, timeliness, and relevance of financial information and other disclosures provided to management.

- Identify key areas of risk within the Company and propose appropriate and practical controls to mitigate those risks.

- Prepare and obtain audit committee on internal audit charter; establish internal audit procedures and policies.

- Develop and update Company-wide risk registers to assess risk and related controls in the Company.

- Prepare a risk-based annual audit plan detailing the scope, nature, and timing of audit activities.

- Design internal audit procedures and audit programs to ensure that detailed audit work is effectively focused on high-risk areas.

- Evaluate the effectiveness of internal control structures at all levels and report material internal control deficiencies to senior management, audit committee, and BoD.

- Ensure that audit comments and recommendations are presented and agreed upon by the management and that the audit report is released immediately afterward.

- Monitor implementation at all agreed times on recommendations.

- Contribute to the improvement and enhancement of Company-wide processes and control through participation in workgroups and meetings.

- Liaise with external auditors and regulatory inspectors.

- Participate in various committees from time to time.

Internal Audit Manager

Bank of America Corp.

2013-01 - 2017-04

- Participated in the evaluation of IT systems from an internal control point of view.

- Assessed the adequacy of existing and proposed policies and procedures.

- Acted as an advisor to business units to establish control over operations.

- Represented internal audit at annual general meetings (AGMs) of shareholders.

- Prepared working papers to ensure that the reported findings were adequately supported by evidence and verified.

- Delivered high-quality audit reports covering audit observations and regulatory issue verification within deadlines.

- Designed and implemented an auditing methodology to identify credit portfolio declines continuously.

- Monitored that all recommendations were implemented on time.

- Reviewed the data to highlight deficiencies in controls, duplication of efforts, fraud, or lack of compliance with laws, government regulations, board policies, and management procedures, and relevant issues.

- Ensured a detailed examination of customer credit files in the credit portfolio and thoroughly reviewed credit-related transactions.

- Reviewed the business process, assessed the associated risks, controls, and prepared a business process matrix.

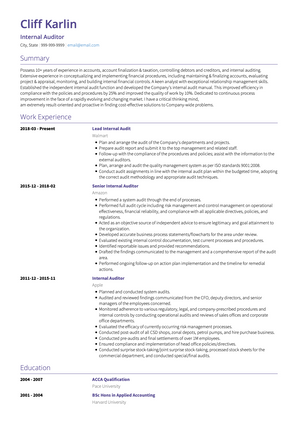

Internal Auditor

Credit Agricole SA

2009-01 - 2012-12

- Performed detailed examination of credit portfolios, customer credit files, and reviewed credit-related transactions.

- Prepared and reviewed reports of findings and recommendations for credit audits, and discuss draft findings with the auditee.

- Developed detailed audit plans and programs for key credit risk areas (i.e. Corporate Credit Group, Risk Management Division, International Banking Group).

- Developed and executed a robust audit plan, by reviewable entity, for assigned businesses following with Internal Audit Manual.

- Prepared comprehensive internal audit reports.

- Evaluated credit policies, procedures, and applications.

- Led fraud investigation and special assignment (as required by management).

EDUCATION

Master of Business Administration

Yale University

2002 - 2004

- Accounting and Finance.

Bachelor's in Accounting

Arizona State University

1998 - 2002

COMPUTER SKILLS

- Moody’s KMV

- Microsoft Visio

- Microsoft Power BI

- Audit Common Language (ACL)

- TeamMate Audit Management System

- Microsoft Office

- Word, Excel

- PowerPoint, Access

CERTIFICATIONS

- Certified Control Self-Assessment

- Institute of Internal Auditors

- Certified Financial Service Auditor

- Institute of Internal Auditors

CORE COMPETENCIES

- Cultural adaptability

- Eager for self-development

- Team building & coaching

- Forward-looking and transformational mindset

- Continuous effort toward excellence

- Enthusiastic to build long-lasting relationships

- Ability to learn and adapt to different business environments

- Empathy toward clients’ requirements

- Conflict management and negotiation skills

- Problem identification and solution formulation

AREAS OF EXPERTISE

- Banking

- Internal auditing

- Data analytics

- Treasury audit

- Financial audit

- Retail credit risk

- Operational risk

- Risk rating models

- Corporate credit risk

- Remedial accounts audit

- Performance management

- Regulatory compliance audit

PERSONAL SKILLS

- Accuracy

- Accountable

- Business-like

- Confidence

- Hardworking

- Very fast & accurate hand typing

- Effective time management

- Job task planning and organizing

- Complete any given tasks before & within the timeline

- Flexibility to work independently and within teamwork

Copyright ©2025 Workstory Inc.