![5 Finance CV Examples | How to write a CV for finance jobs [with finance CV writing tips]](/static/cd50ac3f966cb32821d0583c182099ce/47ddf/how-to-write-a-finance-cv.jpg)

5 Finance CV Examples | How to write a CV for finance jobs [with finance CV writing tips]

If you want to work in the finance industry, you have to learn how to write a finance CV.

Finance is a large and competitive industry, and if your CV doesn’t stand out, you aren’t going to land the interview. Your generic CV just isn’t going to cut it.

Good Finance CV Example

Summary

- Experienced finance professional with a proven track record in senior leadership roles.

- Strong knowledge of international self-accounting.

- Results-oriented, self-motivated and positive.

- Proven ability to think laterally and a pro-actively.

- Provided coaching and strategic guidance to executive committee

- Identified new ways to increase the top line revenues through cost containment, revenue enhancement, and profit improvement opportunities.

Work Experience

Director of Finance

Intellectsoft

- Establishing and maintaining financial policies, procedures, controls and reporting systems for various companies.

- Reporting on financial conditions to the Board of Directors and Executive Officers for multiple companies.

- Managing and responsible for cash flow and budgets for companies from $20m to $23m.

- Reducing expenses by $80k annually through training of supplies usage.

- Analyzing profitability of two departments resulting enclosures with annual savings of $70k.

- Helping to reduce operating budget by $540k by combining positions and departmental organization.

- Creating interactive budgets for various operational departments to determine the cost of services provided to improve profitability.

- Recovering $250k in unknown account receivables by means of audit and identified unrecognized revenues of $10k.

- Training Accounts Receivable department in customer follow-up best practices to reduced receivables by $20k per month.

- Directing and overseeing cost and general accounting, accounts receivable/payable and payroll departments.

- Providing management of property maintenance including HUD properties.

- Bridging the communication gap between the operations team and the finance team.

Senior Finance Manager

iTechArt Group

- P&L responsibility for a $186MM Market Unit including four production facilities and six satellite warehouses.

- Executed pricing strategies across a multi-segmented market resulting in 5% annual revenue-per-case growth.

- Led Market Unit to 5% Operating Profit growth each year during four year tenure.

- Directed and managed the Annual Operating Plan process for the Market Unit; developed financial targets and strategies consistent with national growth priorities.

- Fostered business literacy across all functional levels through coaching, disciplined forecasting processes and periodic financial reviews.

- Coached and mentored multiple Finance Interns; responsible for onboarding and career development.

Assistant Financial Controller

Magneto IT Solutions

- Implemented all necessary controls to safeguard operations.

- Introduced purchasing and payroll control procedures to deliver monthly expenses and cost targets.

- Trained everyone in the accounting department to do multiple tasks

- Developed onboarding processes for new junior accountants.

- Responsible for preparing and presenting financial and management reports.

- Recipient of Minor International’s President Award of Excellence in Finance and Accounting.

Education

MBA, Finance

American University

BBA, Accounting and Finance

Taylor's University

Skills

- Back office systems

- Sun

- Vision

- Hyperion

- People Soft

- Web Prolific

- MPC - Finance Studio

- Front office systems

- Opera

- Fidelio

- Portal

- Wishnet

- Inventory systems

- FMC

- Prolific

- Info Star

- Paytax

- Hits

- Sycorax

- Oasys

- Core Competencies

- IT Systems

- Risk Management

- Payroll Management

- Strategic Planning

- Financial Processing

- Procurement Management

- Human Resource Management

- Budgets and Management Reporting

- Office & Administrative Management

- Security and Emergency Procedures

Finance Manager CV

Senior Manager Finance CV Sample

Good Finance CV for Experienced Finance Professionals

Finance Officer CV

Finance professionals need to standout to land their dream job. That's why your finance CV has to be perfect for the job you're applying for. To make sure you pick the right finance CV template and highlight the right skills, make sure to follow these steps:

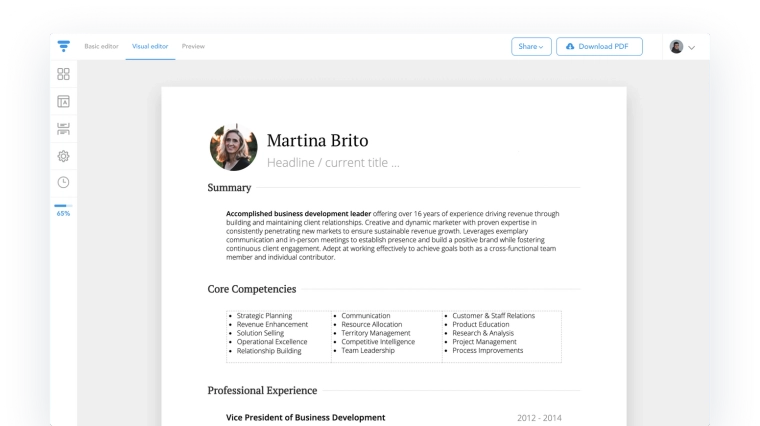

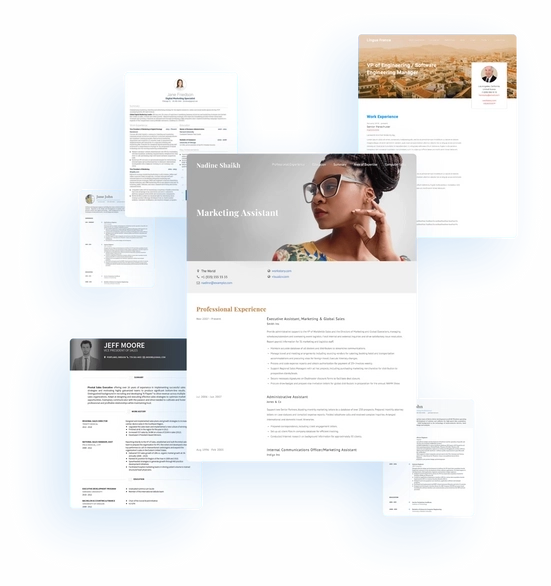

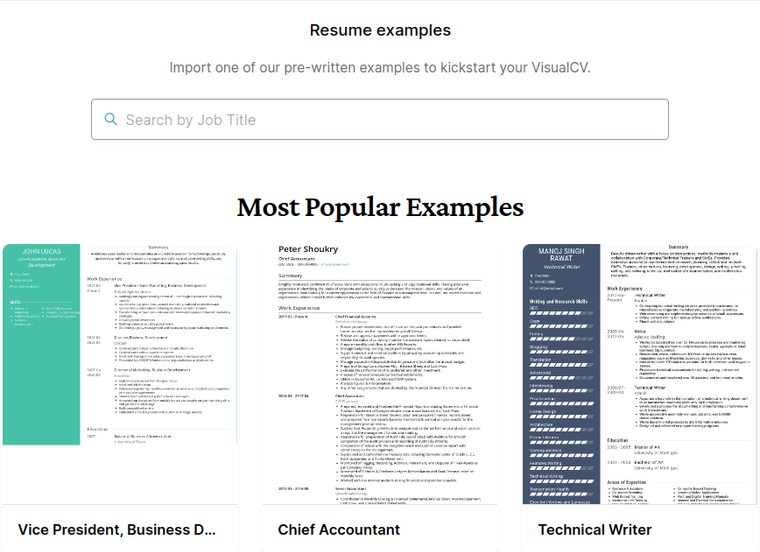

1. Pick a great finance CV template

If you want your application to be successful, pick a great finance CV template.

Your CV’s appearance is just as important as your work experience. If your CV is ugly or confusing, no one will read it, even if your skills are perfect for the job.

Further, your CV template needs to suit the industry. The finance industry tends to be formal, so a traditional CV template is your best choice. This means you should look for a CV template with a readable typeface, clearly defined CV sections, and a subtle colour scheme.

When you pick your finance CV template, use a traditional CV template like ATS, Standard, or Corporate.

2. Write a good finance CV summary

Your CV summary is your elevator pitch to an employer. A CV Summary is a short section right at the top of your CV that sells you as a candidate as efficiently as possible. With only a few sentences or bullet points, a great summary can list your job title, highlight a few key experiences or achievements, and demonstrate your most impressive skills.

A great summary for a finance CV should focus on the skills most directly relevant to the industry and to the specific role you are interested in. Try to highlight your most impressive finance-specific skills, whether they’re your proficiency with accounting tools, your client management abilities, or your financial planning achievements.

Depending on your career history and your desired role, the experiences you feature may include a paragraph like:

Finance CV Resume Summary Example

A results-driven and self-motivated financial professional with 5+ experience handling key financial data. Noted for the ability to manage complex assignments effectively, with the confidence to work as a part of a team or independently. Experience leading intercultural teams and building strong working relationships with internal and external stakeholders. Responsible for balancing all accounts at the end of the financial year. Committed, hands-on and flexible with the ability to adapt to changing priorities and maintain a positive attitude and a strong work ethic.

Portfolio Management Finance CV Summary Example

Experienced finance professional specializing in portfolio management. Skilled in optimizing investment strategies, analyzing market trends, and enhancing financial performance.

Chartered Financial Analyst CV Summary Example

Certified Chartered Financial Analyst with expertise in financial analysis, risk management, and investment appraisals. Known for delivering strategic insights and accurate financial forecasts.

Corporate Finance CV Summary Example

Results-driven Corporate Finance expert with experience in financial planning, mergers and acquisitions, and capital structure optimization. Skilled in financial modeling and driving business growth.

Risk Management Finance CV Summary Example

Experienced finance professional with expertise in risk management. Proficient in identifying, assessing, and mitigating financial risks to enhance organizational stability and performance.

Corporate Finance CV (Experienced) Summary Example

Seasoned Corporate Finance specialist with extensive experience in financial planning, capital management, and strategic decision-making to drive business growth.

Recent Finance Graduate CV Summary Example

Motivated recent finance graduate with strong academic background in financial analysis and investment strategies. Eager to apply knowledge in a dynamic finance role.

CV Summary Example for Management Accountants

Detail-oriented Management Accountant with expertise in budgeting, financial reporting, and cost control. Skilled in delivering insights to support strategic financial decisions.

Chartered Accountant CV Summary Example

Qualified Chartered Accountant with expertise in financial reporting, auditing, and tax compliance. Skilled in providing strategic financial insights and ensuring regulatory compliance.

3. Perfect your work experience

The Work Experience section is the most important part of a finance CV. This is where you can showcase your skills and achievements in past roles. For a successful application, your Work Experience section needs to be perfect.

Write your work experience in reverse-chronological order (unless you have very good reasons not to), beginning with your most recent position and working backwards in order.

Throughout each job description in your Work Experience section, emphasize the skills and achievements that are most relevant to the position you’re applying to. Even if previous positions weren’t in the finance industry, try to feature the transferable skills that will still be useful in a finance position.

As you write about your past roles, make sure to use active language to describe your responsibilities and accomplishments. Instead of saying you were “responsible for preparing financial forecasts using new models”, say that you “Spearheaded implementation of new financial forecasting models that improved accuracy and efficiency”. Phrase all of your experiences and accomplishments in a way that demonstrates leadership and initiative. The way you describe your experience is almost as important as the experience itself.

You should also use measurable achievements to showcase your skills as much as possible. Your experience will be extra impressive if you can measure your success with numbers. Sales figures, customer acquisition data, and revenue generation are all great ways to demonstrate your abilities. Any skill or accomplishment that can be easily expressed with numbers is a great item to feature on your CV.

Accounts Supervisor

- Ensured that cost accrual standards were maintained across all teams.

- Monitored invoicing staff and ensured proper procedures were enforced.

- Reviewed all invoices for appropriate documentation and approval prior to payment.

- Verified and approved payment of invoicing staff salaries.

- Assisted Finance Manager with monthly reports and disbursement accounts.

- Assisted Finance Manager in preparing year-end financial reports and statements.

- Deputized in absence of Finance Manager.

- Corresponded with local vendors and customers.

- Accrued costs related to the loading and discharging of shipments.

- Conducting physical inventories and monitoring stock levels.

Director of Finance - Finance CV Example (Work Experience)

Director of Finance Intellectsoft | March 2010 – January 2012

- Established financial policies and procedures to ensure accurate reporting and compliance across all business units.

- Reported financial conditions to the Board of Directors, providing actionable insights for strategic decisions.

- Managed cash flow and budgets for projects totaling over $100M, optimizing resource allocation.

- Reduced operating expenses by $150K annually through cost-containment strategies and process improvements.

- Recovered $300K in outstanding receivables through detailed audits and enhanced collection procedures.

- Bridged communication between finance and operations teams, aligning financial goals with operational performance.

- Directed and improved financial reporting systems, resulting in a 25% increase in reporting accuracy.

Finance Officer - Finance CV Example (Work Experience)

Finance Officer iTechArt Group | August 2008 – February 2010

- Prepared detailed financial analyses to support corporate finance decisions and strategic planning initiatives.

- Performed financial analysis, identifying areas for improvement to drive business growth.

- Conducted comprehensive risk assessments, contributing to a 10% reduction in financial risks.

- Collaborated with senior management to develop budgets and forecasts, enhancing financial planning processes.

- Implemented new financial reporting tools that improved data accuracy and reporting efficiency by 15%.

- Managed accounts payable and receivable, ensuring timely and accurate financial transactions.

Senior Financial Analyst - Finance CV Example (Work Experience)

Senior Financial Analyst Magneto IT Solutions | June 2006 – July 2008

- Conducted investment analysis, identifying lucrative opportunities that led to a 12% increase in portfolio performance.

- Developed and implemented financial models to forecast revenues and expenses, improving budget accuracy by 18%.

- Analyzed market trends to inform strategic decisions, leading to optimized investment strategies.

- Provided detailed financial reports to stakeholders, highlighting key insights and actionable recommendations.

- Played a pivotal role in corporate finance initiatives, supporting mergers and acquisitions activities.

- Trained junior analysts on financial modelling and data analysis techniques, fostering a collaborative learning environment.

Financial Controller - Finance CV Example (Work Experience)

Financial Controller Magneto IT Solutions | April 2004 – May 2006

- Implemented comprehensive financial controls and reporting systems, enhancing transparency and accountability.

- Led financial reporting and analysis efforts, providing insights that informed executive-level decision-making.

- Managed the accounting team, overseeing the preparation of financial statements and compliance with regulatory requirements.

- Optimized financial operations, resulting in a 20% reduction in processing times for financial transactions.

- Spearheaded initiatives to improve financial performance, achieving a 10% increase in operating margin.

- Conducted regular audits to ensure financial accuracy and compliance, mitigating potential risks.

Investment Banking Finance Manager - Finance CV Example (Work Experience)

Investment Banking Finance Manager Goldman Sachs | April 2004 – May 2006

- Led investment banking operations, focusing on the optimization of financial processes and compliance with industry standards.

- Managed financial reporting specifically tailored to investment banking activities, providing critical insights for executive-level decision-making.

- Oversaw the preparation of financial statements in alignment with investment banking regulatory requirements, ensuring accuracy and compliance.

- Spearheaded financial performance improvement initiatives within the investment banking division, achieving a 10% increase in operational efficiency.

- Implemented comprehensive financial controls within investment banking, enhancing transparency and accountability across all transactions.

- Conducted risk assessments and audits tailored to investment banking, mitigating potential risks and ensuring robust financial health.

- Collaborated with cross-functional teams to streamline investment banking operations, reducing transaction processing times by 20%.

Chartered Financial Analyst - Finance CV Example (Work Experience)

Chartered Financial Analyst Franklin Templeton Investments | May 2015 – April 2020

- Conducted comprehensive financial analysis, focusing on equity and fixed-income securities, which contributed to portfolio growth of 15% annually.

- Developed sophisticated financial models to evaluate investment opportunities, enhancing decision-making processes for high-net-worth clients.

- Led risk management initiatives by performing detailed risk assessments, resulting in a 12% reduction in portfolio volatility.

- Provided strategic guidance on wealth management, creating customized investment strategies that increased client satisfaction and retention rates.

- Delivered in-depth market trend analysis to identify emerging opportunities and risks, informing strategic investment decisions.

- Collaborated with cross-functional teams to improve financial reporting accuracy, integrating advanced data visualization tools.

- Mentored junior analysts, enhancing their expertise in financial modelling, portfolio management, and investment analysis.

Financial Advisor, Finance CV Example (Work Experience)

Financial Advisor Merrill Lynch | March 2016 – August 2021

- Managed a diverse portfolio of clients, providing tailored investment strategies that consistently achieved a 10% annual return.

- Conducted comprehensive financial planning, including retirement planning, wealth management, and risk assessment, leading to a 20% increase in client assets under management.

- Advised clients on a wide range of financial products, including mutual funds, equities, fixed income, and insurance, ensuring alignment with their financial goals.

- Implemented effective financial strategies that improved clients’ financial performance and long-term wealth accumulation.

- Maintained up-to-date knowledge of market trends, enabling clients to capitalize on emerging investment opportunities.

- Delivered quarterly financial performance reviews to clients, highlighting key achievements and areas for improvement.

- Developed strong client relationships, resulting in a 95% client retention rate and a significant increase in referrals.

Financial Analyst, Finance CV Example (Work Experience)

Financial Analyst Goldman Sachs | September 2017 – July 2022

- Performed in-depth financial analysis to support high-stakes investment decisions, contributing to a 12% increase in shareholder value.

- Developed advanced financial modelling techniques to project future earnings and assess potential risks.

- Conducted detailed investment analysis for various asset classes, ensuring optimal asset allocation in client portfolios.

- Monitored market trends and industry shifts, providing actionable insights to investment bankers and senior management.

- Collaborated on risk management strategies, leading to a 15% reduction in portfolio volatility.

- Delivered comprehensive reports on key achievements in financial performance and strategy execution.

- Ensured adherence to industry best practices in all financial operations and reporting.

Risk Management Specialist, Finance CV Example (Work Experience)

Risk Management Specialist J.P. Morgan | January 2015 – June 2020

- Led risk management initiatives, identifying and mitigating financial risks across diverse investment portfolios.

- Utilized data analysis and statistical analysis to detect potential risk exposures, resulting in a 20% decrease in operational losses.

- Developed financial models to evaluate the impact of market fluctuations on asset values and overall risk.

- Worked closely with investment bankers to structure low-risk, high-yield investment solutions.

- Provided insights into market trends to guide strategic planning and effective financial planning decisions.

- Documented and communicated key achievements in risk mitigation and compliance enhancements.

- Implemented industry best practices to strengthen the organization's financial risk framework.

Asset Manager, Finance CV Example (Work Experience)

Asset Manager BlackRock | February 2014 – December 2019

- Managed a portfolio of high-value assets, focusing on asset management strategies to maximize returns and enhance shareholder value.

- Conducted regular investment analysis and financial analysis to optimize portfolio performance in line with market conditions.

- Developed sophisticated financial modelling to project asset performance and support strategic decision-making.

- Monitored market trends and leveraged insights to adjust asset allocation, achieving a 10% improvement in portfolio returns.

- Implemented effective financial planning processes, ensuring alignment with clients' long-term investment objectives.

- Collaborated with investment bankers to identify new investment opportunities and manage capital allocation.

- Documented key achievements in asset performance and operational efficiency, adhering to industry best practices in asset management.

4. Showcase your finance CV skills

Your finance CV isn’t complete without a robust Skills section. You need to pick out your most relevant and impressive skills and feature them prominently.

The best way to showcase your finance CV skills is with a simple bulleted list. This gives the ATS a clear heading and list it can scan for necessary skills, and makes it easy for hiring managers to quickly scan the list and see what you specialize in.

Finance Accounting Software Proficiency Skills

- SAP

- Microsoft Excel (Power BI, Power Pivots, DAX, forecasting, budgeting, reporting)

- Accounting software (streamlined financial operations, enhanced reporting accuracy)

- QuickBooks (efficient financial management, real-time reporting capabilities)

- Xero (automated invoicing, seamless integration with other accounting software)

- Sage (comprehensive financial tracking, enhanced compliance features)

Financial Analysis and Reporting Skills

- Financial analysis (interpreting data for strategic decisions, improving business outcomes)

- Account reconciliation

- Financial planning ( effective financial planning strategies)

- Valuations (mergers and acquisitions, investment appraisals, asset management)

- Management reporting (key financial insights, actionable recommendations)

- Investment appraisals (risk assessment, financial modelling)

- Portfolio management (diversified investment strategies, optimizing returns)

Budgeting and Performance Metrics Skills

- Budgets & KPIs (variance analysis, forecasting)

- Risk assessment (financial risk assessments, risk management frameworks)

- Business administration (integrating financial strategies with operational goals)

Accounting and Financial Operations Skills

- Accounts payable (timely payments, process improvements)

- Accounts receivable (invoicing, collections, credit control, reducing DSO, cash flow)

- Finance roles (supporting various finance positions, enhancing operational efficiency)

Finance CV Soft Skills

- Communication (bridging finance and operations teams)

- Problem-solving (identifying and resolving financial discrepancies)

- Team leadership (mentoring junior staff, fostering collaboration)

- Adaptability (navigating changing financial regulations and market conditions)

- Attention to detail (ensuring accuracy in financial reporting and analysis)

- Time management (prioritizing tasks to meet strict deadlines)

- Analytical thinking (interpreting complex financial data for strategic decision-making)

- Client relationship management (building and maintaining strong client connections)

- Wealth management (advising on asset allocation, optimizing client portfolios)

Specific Finance CV Skills

-

Financial analysis

-

Portfolio management

-

Investment banking

-

Wealth management

-

Corporate finance

-

Accounting software (SAP, QuickBooks, Xero)

-

Budgeting and forecasting

Risk Management CV Skills

-

Risk assessment

-

Financial risk mitigation

-

Regulatory compliance

-

Strategic planning for risk management

-

Credit risk analysis

Business Administration Skills for Finance CV

-

Financial planning and strategy

-

Budget development and management

-

Process improvement

-

Organizational leadership

-

Cross-functional collaboration

Transferable Skills for Finance CV from Other Professions

-

Analytical thinking

-

Problem-solving

-

Communication skills

-

Team leadership

-

Time management

-

Adaptability

Finance Operations Skills for Finance CV

-

Accounts payable and receivable

-

Cash flow management

-

Financial reporting

-

Cost control and reduction

-

Process optimization

Investment Analysis Skills for Finance CV

-

Market trend analysis

-

Financial modelling for investment decisions

-

Portfolio performance evaluation

-

Risk-adjusted return strategies

-

Investment strategy development

Risk Assessment Skills for Finance CV

-

Identifying financial risks

-

Developing risk mitigation plans

-

Conducting regular financial audits

-

Implementing risk control frameworks

-

Monitoring compliance with financial regulations

Finance CV Skills for Management Accountants

-

Cost accounting

-

Budget preparation and control

-

Management reporting

-

Variance analysis and Financial Analysis

-

Financial forecasting

Finance CV Skills that Show Technical Expertise

-

Proficiency in financial software (SAP, QuickBooks, Xero)

-

Advanced Excel skills (Power BI, Power Pivots, DAX)

-

Financial modelling and analysis

-

Data analysis, visualization and reporting tools

-

Automation of financial processes

For added flair, you can add strength ratings to your skills so they really stand out.

5. Show your education

Your education is an important part of your finance career. The Education section in your CV should not take up much space, but it’s still important to showcase your academic credentials.

If you’ve been working in finance for a few years, all your Education section needs is a few lines noting your degree, school name, and the year you graduated.

Bachelor of Commerce University of Pennsylvania

If you’re a recent graduate, or haven’t been in the finance industry for long, your Education section can be longer. If you don’t have much experience, your Education section might be your best opportunity to showcase your skills. When you don’t have enough work experience to fill out your CV, you can add more details to your Education section, like classes, specializations, or important projects.

6. Customize your CV

Make sure your finance CV is optimized for Applicant Tracking Systems. Applicant tracking systems are software programs that accept CVs and sort them according to how well they match the job description. When you apply through an ATS, it will scan your CV for the skills the company is looking for.

To make sure your CV beats the ATS, customize your CV for every job you apply for. To do this, study the job posting and make note of all the specific skills they’re looking for, then feature those exact skills in your CV. The ATS will scan your CV looking for those skills, so make sure your phrasing is just like the job posting. Your CV will make it past the ATS when it perfectly fits the job requirements.

How do I highlight financial modelling experience on my CV if I don't have direct experience in finance?

If you’ve used financial modelling in roles outside traditional finance, focus on transferable skills. Highlight any experience involving data analysis, forecasting, or budgeting, even if it wasn’t labeled as financial modelling. Use specific examples where your analytical skills led to measurable improvements, and emphasize the tools and techniques you used, such as Excel or other data visualization tools.

Should I include specific financial modelling projects on my CV, and how detailed should I be?

Yes, including specific financial modelling projects on your CV can demonstrate your hands-on experience. Briefly describe the purpose of the model, the techniques or tools you used, and the outcomes or decisions it supported. Focus on the impact of your work, such as improved financial forecasts or more informed investment decisions, and quantify results wherever possible.

How can I make my financial modelling skills stand out if I’m applying for a senior finance role?

For senior finance roles, emphasize your leadership in financial modelling projects, such as overseeing the development of models or mentoring junior staff in modelling techniques. Highlight your strategic contributions, such as how your financial models supported high-level decision-making, investment strategies, or risk management. Use industry-relevant keywords like "financial modelling," "forecasting," and "data-driven decisions", to align your skills with the job requirements.

How can I tailor my CV to match specific finance roles?

To tailor your CV for specific finance roles, focus on the job description and highlight relevant skills, such as financial analysis or risk management. Use industry keywords and emphasize accomplishments that align with the responsibilities of the targeted finance roles.

Should I include a summary or objective statement in my CV for finance roles?

Yes, a summary can help quickly showcase your qualifications for finance roles. It should highlight your key skills, relevant experience, and major achievements that align with the specific finance roles you’re targeting.

How do I highlight transferable skills on my finance CV?

To highlight transferable skills on your finance CV, focus on experiences from other roles that are relevant to finance, such as analytical thinking, problem-solving, or project management. Use specific examples to demonstrate how these skills have contributed to successful outcomes and how they can be applied to finance roles.

Which transferable skills are most valuable on a finance CV?

The most valuable transferable skills on a finance CV include analytical thinking, attention to detail, communication, problem-solving, and adaptability. These skills are essential in finance for tasks such as financial analysis, risk management, and decision-making.

How can I showcase transferable skills when transitioning to a finance role?

When transitioning to a finance role, highlight transferable skills by linking them to key finance responsibilities. For example, if you have experience in project management, emphasize your ability to manage budgets, analyze financial data, and drive project success, showing how these skills translate to finance.

Should I create a separate section for transferable skills on my finance CV?

Including a separate section for transferable skills on your finance CV can be beneficial, especially if you are changing careers. This section allows you to clearly outline skills like data analysis, strategic planning, or risk management, demonstrating their relevance to finance roles.

How do I highlight leadership experience managing a finance team on my CV?

To highlight leadership experience managing a finance team, focus on key achievements such as meeting financial targets, implementing new processes, or improving team performance. Mention your role in guiding the team, mentoring staff, and driving strategic financial initiatives. Use metrics to demonstrate the impact of your leadership, like improving efficiency or achieving financial goals.

How do I effectively highlight my experience with financial data on a finance CV?

To highlight your experience with financial data on a finance CV, emphasize your skills in analyzing and interpreting large datasets. Mention specific tools you’ve used, such as Excel, Power BI, or SQL, and showcase achievements like improved financial reporting accuracy or data-driven decision-making.

What are the best ways to demonstrate financial data analysis skills on a finance CV?

Demonstrate financial data analysis skills by including examples of projects where you analyzed financial data to support business decisions. Highlight key achievements, such as uncovering insights that led to cost savings or revenue growth, and mention the specific methods or tools you used.

Should I include specific tools used for financial data analysis on my finance CV?

Yes, including specific tools like Excel, Power BI, or Tableau on your finance CV shows your technical expertise in handling financial data. Highlighting these tools demonstrates your ability to work with complex datasets and supports your proficiency in financial analysis and reporting.

How do I show my ability to improve financial operations efficiency on my CV?

To demonstrate your ability to improve finance operations efficiency, highlight specific initiatives you led, such as automating processes, reducing processing times, or implementing new financial systems. Use measurable results, like percentage reductions in operational costs or time saved, to illustrate the tangible impact of your contributions.

How can I demonstrate my impact on streamlining finance operations on my CV?

To demonstrate your impact on streamlining finance operations, highlight specific projects where you improved processes, such as automating workflows or optimizing resource allocation. Include measurable outcomes like cost savings, reduced processing times, or increased accuracy in financial reporting to showcase the efficiency and effectiveness of your contributions.

How can I demonstrate my ability to deliver actionable insights through investment analysis on my CV?

To showcase your ability to deliver actionable insights through investment analysis, include examples of how your analyses influenced key investment decisions. Highlight specific projects where you identified profitable opportunities or mitigated risks, and quantify the outcomes, such as increased returns or reduced losses, to demonstrate the impact of your work.

How do I demonstrate the business impact of my financial modelling skills on my CV?

A common challenge is translating complex financial modelling work into clear business outcomes on your CV. To address this, focus on how your models directly influenced strategic decisions, improved financial forecasts, or optimized resource allocation. Highlight specific results, such as increased revenue, cost savings, or enhanced decision-making efficiency, to show the tangible impact of your financial modelling expertise.

- Good Finance CV Example

- Finance Manager CV

- Senior Manager Finance CV Sample

- Good Finance CV for Experienced Finance Professionals

- Finance Officer CV

- 1. Pick a great finance CV template

- 2. Write a good finance CV summary

- 3. Perfect your work experience

- Director of Finance - Finance CV Example (Work Experience)

- Finance Officer - Finance CV Example (Work Experience)

- Senior Financial Analyst - Finance CV Example (Work Experience)

- Financial Controller - Finance CV Example (Work Experience)

- Chartered Financial Analyst - Finance CV Example (Work Experience)

- Financial Advisor, Finance CV Example (Work Experience)

- 4. Showcase your finance CV skills

- 5. Show your education

- 6. Customize your CV

- How do I highlight financial modelling experience on my CV if I don't have direct experience in finance?

- Should I include specific financial modelling projects on my CV, and how detailed should I be?

- How can I make my financial modelling skills stand out if I’m applying for a senior finance role?

- How can I tailor my CV to match specific finance roles?

- Should I include a summary or objective statement in my CV for finance roles?

- How do I highlight transferable skills on my finance CV?

- Which transferable skills are most valuable on a finance CV?

- How can I showcase transferable skills when transitioning to a finance role?

- Should I create a separate section for transferable skills on my finance CV?

- How do I highlight leadership experience managing a finance team on my CV?

- How do I effectively highlight my experience with financial data on a finance CV?

- What are the best ways to demonstrate financial data analysis skills on a finance CV?

- Should I include specific tools used for financial data analysis on my finance CV?

- How do I show my ability to improve financial operations efficiency on my CV?

- How can I demonstrate my impact on streamlining finance operations on my CV?

- How can I demonstrate my ability to deliver actionable insights through investment analysis on my CV?

- How do I demonstrate the business impact of my financial modelling skills on my CV?

Written By

Ben Temple

Community Success Manager & CV Writing Expert

Ben is a writer, customer success manager and CV writing expert with over 5 years of experience helping job-seekers create their best careers. He believes in the importance of a great resume summary and the power of coffee.

Get the most out of your job search by making sure your professional CV format is perfect.

February 11, 2025

Read Post

Community Success Manager & CV Writing Expert

Make sure you have all the CV basics with this CV checklist.

August 23, 2021

Read Post

Community Success Manager & CV Writing Expert

The top hiring and human resource statistics for 2025, including data on AI resumes, job interviews, remote work, and recruiting.

January 1, 2025

Read Post

Community Success Manager & CV Writing Expert

Copyright ©2025 Workstory Inc.